[ad_1]

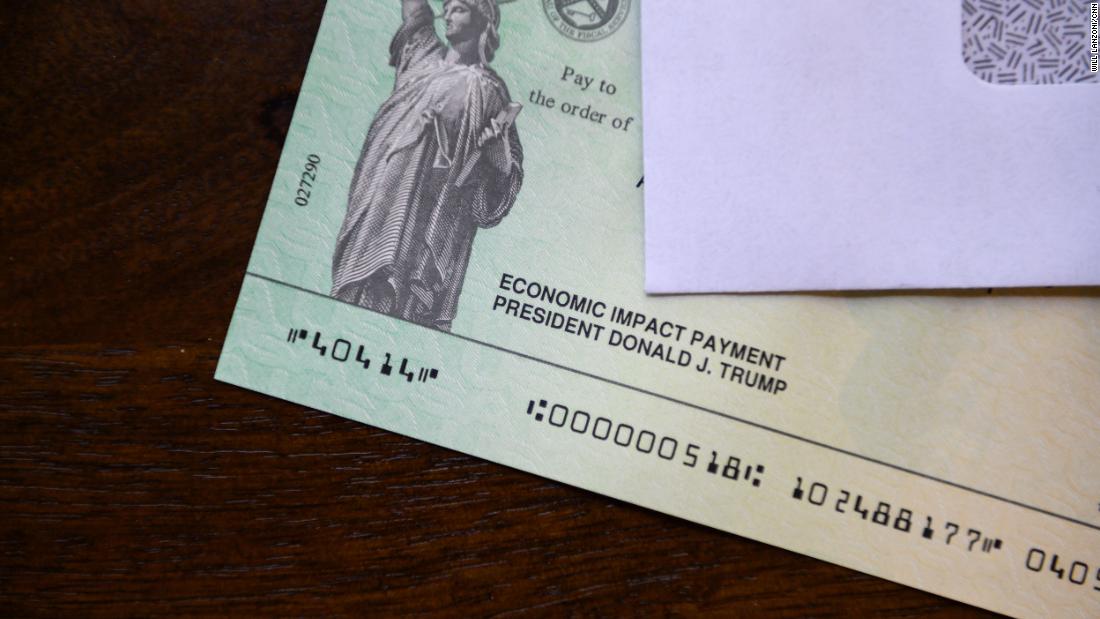

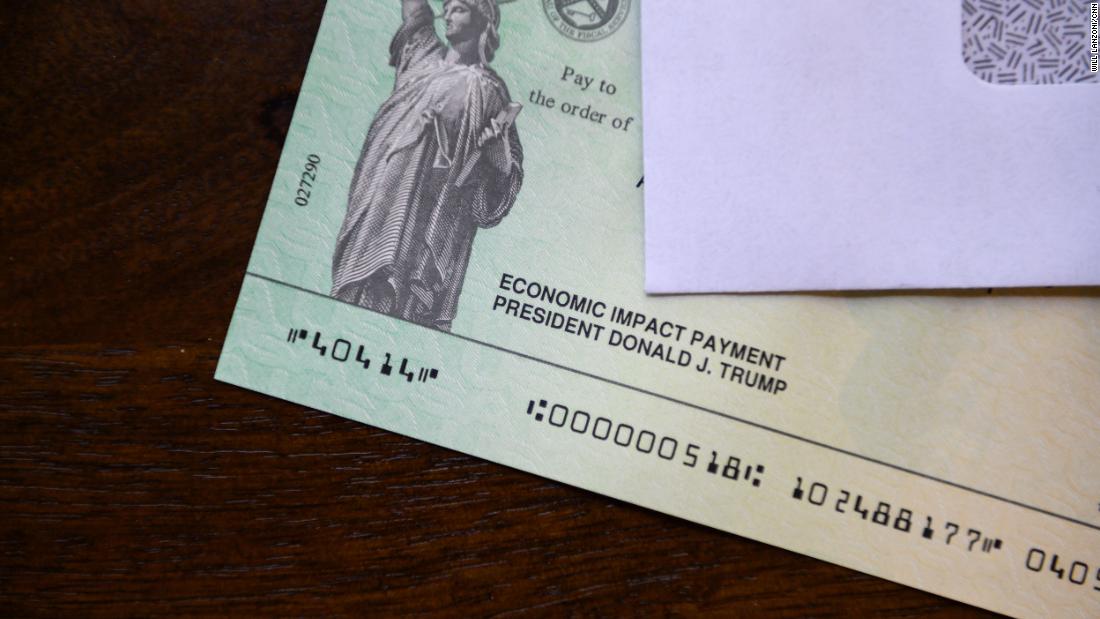

The Internal Revenue Service is rushing to reach these latest recipients before the Nov. 21 deadline, sending nine million letters in September to people who may have potentially missed the $ 1,200 payments authorized by Congress earlier this year.

While most eligible Americans received the money automatically in the spring and summer, those with very low incomes who do not normally file a tax return should register online so the Internal Revenue Service knows how to file them. join.

About 12 million people fell into this category and it is not known how many of them still have not received their money. More than eight million people had registered online by October, but the Internal Revenue Service declined to say how many payments have been made to non-filers or how many more have registered since it began. heightened its awareness.

Volunteers across the country have stepped up their attempts to reach homeless people who may be eligible for the $ 1,200 payment, but who may not be aware of or have a computer or smartphone they can. use to register.

In Broward County, Fla., Volunteer Richard Campillo led efforts that helped 220 homeless people register online by setting up a computer lab at a food court. But only about 30% of those actually received the money, he said.

There are several reasons for this, but the government’s online tool usually does not explain why a payment is pending. It could take a phone call to the Internal Revenue Service hotline to find out why and even then, Campillo said, the agency still couldn’t verify a person’s identity.

“I think the IRS did a really good job. But now they have to finish the fight,” he said.

Some people are simply not eligible under the law, such as those who have been declared dependents on a family member’s tax return. Undocumented immigrants who do not have a Social Security number but pay Uncle Sam using a taxpayer identification number are also excluded from payments, as are their spouses.

Some bumps in previous payments

The agency sent money to over 160 million people quickly, but the process has not been smooth along the way. Some deceased people received payments in error before living people who were still waiting. Social Security recipients who have to pay extra money for a dependent had to take action before receiving the correct amount. And after the Internal Revenue Service sent some people debit cards loaded with their payment, there were reports of people unknowingly throwing them in the trash because they expected a paper check.

“It is clear that the IRS was not equipped to respond at this time,” Democratic Representative Carolyn Maloney said during a House watch hearing last month.

She said some of her constituents were still waiting for the money the government owed them and blamed Republicans in Congress for slashing the agency’s budget over the years.

The stimulus checks coincided with the peak of the tax filing season, adding to the agency’s already heavy workload. In the meantime, it has had to close some of its in-person tax assistance centers due to the pandemic and the huge backlog of paper returns it has built up as many of its employees work from home.

Still, a government watch report found that the Internal Revenue Service correctly calculated 98% of the payments it made through June.

One more chance in the tax season

Those who miss the Nov.21 deadline can still get their stimulus money next year after filing their 2020 tax return – but that would be a whole year after Congress established the program.

Lawmakers on both sides of the aisle have expressed support for sending a second round of stimulus payments, but have been unable to agree on a comprehensive economic package despite months of negotiations . It will likely be next year if and when Congress passes another stimulus package.

If a new stimulus bill includes a second round of payments, lawmakers have the option of changing the program. According to the Center on Budget and Policy Priorities, state governments have information on about 75% of those who are at risk of missing the first round of payments because they participate in SNAP or Medicaid. But Congress did not say that data from these programs could be used the first time.

[ad_2]

Source link