[ad_1]

Zurich negotiates with major Spanish banks Latin American business – Part in the basement – President Sauter: A secret plan?

Daniel Sauter is required on all fronts. Out of love, father fresh, and now in the center of the storm on Julius Baer.

The magnitude of the crisis is illustrated by news from Citywire, a media outlet. According to a story, the first private bank Zurich should negotiate with the Spanish company Santander.

The element: part of the Latin American business of the bear. The reach: especially the rich Venezuelan customers. The price: always open.

Bär stresses that their business in Latin America is "not for sale". It is parts of the company.

"By focusing on key markets such as Brazil, where we completed an acquisition in 2018, Mexico and Argentina, we will withdraw from certain markets, such as Venezuela," said a spokeswoman. this morning.

It is only a transfer of activity to the Spanish bank, but you remain certainly active in the region.

"Julius Baer continues its growth strategy focused on key markets defined in Asia, Europe and Latin America."

Media news highlights that Julius Baer is beaten. Under her former boss Boris Collardi, she has always bought only to be expensive.

Collardi's successor, Bernhard Hodler, has now backtracked. After the many scandals – from Fifa to Petro – he had nothing left.

Bär recently closed Panama, Venezuela, separated from the bosses responsible in Zurich.

In addition, the bad luck threatens America. Matthias Krull, longtime bear counselor, is at the heart of the Venezuelan thriller. He could charge the statement bank.

What to do? Nothing like it here. In other words, we close the doors of "hot" Latino customers. Now, right now.

This is the beginning of the great deconstruction. Bär is in too many scandals around the world to continue to accelerate as before.

The renovation leads to skid marks. Senior consultants with a long career and lucrative clients jump to the competition or become independent.

The bear stock is diving. There is still a little more than 40 francs. After Bernhard Hodler had assumed Collardi's tax as a Member of Parliament a year ago, the title had initially reached more than 60 francs.

This year, we descended more and more steep. The total market value of Bear fell well below the $ 10 billion mark. The bank threatens to become the target of takeover bids.

Many of their major shareholders, including Anglo-Saxon hedge funds and foreign sovereign funds, have left their shares bearish. They realized their profits.

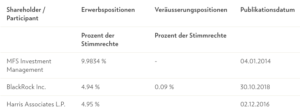

The other three major shareholders together hold 20%. What do you want with the bear?

The CS would like to buy. But it lacks strength and money for that. UBS is hardly interested because the number of important customers in both banks is too large. Asset exits would be heavy.

A JP Morgan could grab the bear bank before breakfast. For Zurich, but would have cleared the inheritance.

They do it now. With the release of parts of Latin America – under Collardi, an absolute essential market for bears – the Gesundschrumpfen has begun.

President Sauter could then review the sale of the entire bank; depending on what the major shareholders give him as an order.

Jumping could also rearrange in advance in advance. CEO Bernhard Hodler is beaten. It is considered part of Collardi-Klüngel.

The young Yves Robert-Charrue is considered an imminent man. The new Chief Risk Officer, Oliver Bartholet, is also well placed in Bär-Spitze.

Precious, nice: too good? Robert-Charrue (photo: bear)

Both are unknown leaders. A Jürg Zeltner from UBS would be of another caliber. His wife's escapades stand in his way.

The captain of the Sauter bear could not ignore it when needed. It is the survival of the bear as an independent Swiss bank. If the renovation fails, the days of the bear can be numbered.

Source link