[ad_1]

the

The Financial Times (FT) is one of the world's media. Your financial journalist

YBS criticized yesterday for its quarterly figures. Almost all

The media, except maybe the look, did it.

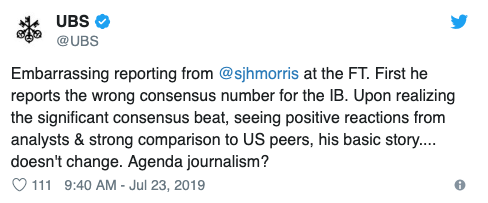

But UBS misunderstood FT's story. She attacked the newspaper head-on. "Uncomfortable reporting," writes the UBS press service on Twitter, and names the publisher.

UBS learns that the head of the communication department of FT journalists has asked for a correction. UBS investment bank had met expectations, not to be missed.

Because he did not feel taken seriously, the big bank communicator intervened with the boss of the FT reporter. The FT then added its story to indicate that "the UBS investment bank has exceeded analysts' expectations".

The UBS press shot went against him. Marketwatch.com, a financial website, has dedicated a great history to the intervention of the headquarters of the Swiss financial multinational.

Important voices have been voiced that do not leave beautiful hair in UBS communications. "Massive corporate / institutional account at personal account – this is not really a good idea of criticism," wrote the public relations officer of the ECB on Twitter.

What he meant: When it comes to a personal account, then it could be yes. But having a global organization like UBS on a single journalist is not a good idea.

Jan Willmroth from the Süddeutsche Zeitung has chosen even clearer words. "Embarrassing public denunciation of a conscientious colleague by your communication department," tweeted the reporter.

UBS points out in its interviews that behind the attack, it is not the CEO Sergio Ermotti, but the public relations department of the bank. Their boss enters and leaves the CEO Ermotti.

In today's communication, we must take swift and massive measures: if we feel misunderstood, a man from UBS yesterday held a conversation against the FT.

A few months later, the following results show that you are right and that the critics have been wrong. Do not help anymore these days.

So, the argument in favor of Twitter reprimand by UBS against FT reporters In support of his point of view, the UBS press service sends interested parties an article from Frankfurter Allgemeine.

This is an external investigation, which can be done by the chief financial officer. These are mainly critical articles against the German payment company Wirecard. The company is pursuing the FT.

Under the leadership of his boss, Sergio Ermotti, UBS repeatedly opposes unpleasant media and reports. She uses expensive lawyers for this.

At the beginning of the year, it was the turn of the German magazine of managers. The story revolved around the relationship between General Manager Ermotti and UBS President Axel Weber.

It is not UBS that has been the first to protest. But Sergio Ermotti himself: "There is no truth in this story today @ manager_magazine," wrote the CEO of the big bank on Twitter.

There, Ermotti had just started from scratch. To follow today in the 2 & 500 peopleUBS did not stop there. Through lawyers, she opposed a notification to the magazine Manager.

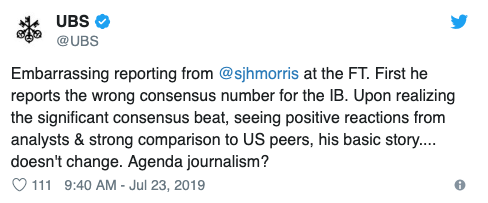

A story in this medium also had Ermotti in the wrong neck. This was the issue of UBS shares sales in Ticino. The UBS press service did not want to say anything in advance, but criticized it all the more violently.

For the bank, the article is not only "100% wrong", it also shows "impressively the total lack of credibility of this portal". Ermotti then mandated his lawyer. The thing is waiting.

Conversely, Ermotti praises journalists who kindly ask him questions, like the president of CH Media, the new network of NZZ Regional with the Aargauer Mediengruppe.

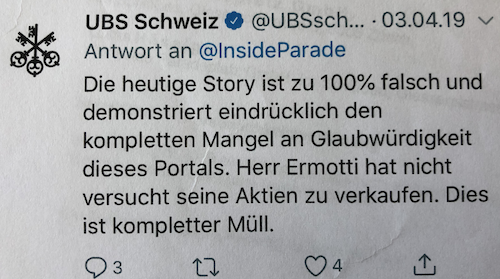

Under Ermotti, the value of UBS shares has decreased relatively.

On November 15, 2011, when Ermotti became the bank's managing director after a brief interim phase, and last night, UBS shares rose 14%.

The CS title was significantly worse at 42%. The SMI is high massively.

UBS currently has a market value of 44 billion francs. Before the financial crisis, it was about 150 billion.

The compensation of the summit remained high. The largest increase reached 100 million, of which 14 million was attributed to CEO Ermotti.

Similar posts

[ad_2]

Source link