[ad_1]

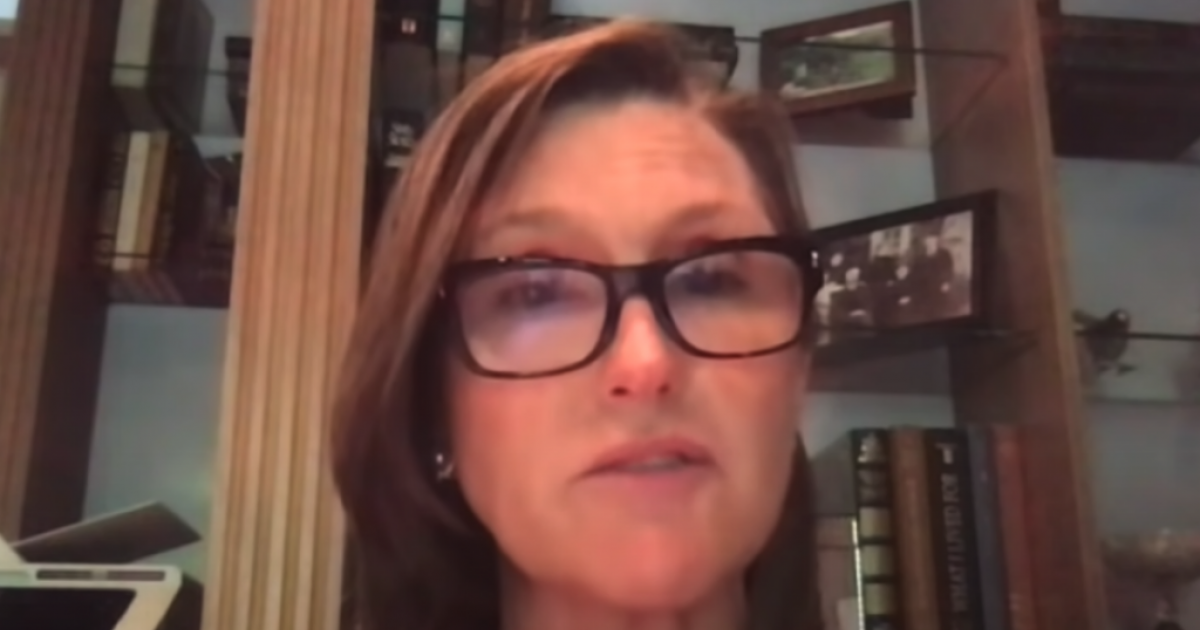

Ark Funds CEO and Co-Founder Cathie Wood joined Benzinga for the “Raz Report” interview earlier this month. At that time, Wood had promised that a new price target would arrive on Ark’s Tesla.

Friday it arrived.

Ark Fund on Tesla: Ark Funds has updated its target price for the shares of Tesla Inc (NASDAQ: TSLA) to $ 3,000 in 2025.

Last year, Ark Funds posted a split adjusted price target on Tesla shares of $ 1,400 by 2024.

Ark Funds uses a Monte Carlo model, based on a series of simulations to determine the probability of different outcomes with random variables. A total of 34 inputs and over 40,000 possible simulations were used to create the new price target.

Ark Funds ‘bearish case is that Tesla shares will hit $ 1,500 in 2025. Ark Funds’ new bullish case is that Tesla shares will hit $ 4,000 in 2025.

The Ark Funds price target does not include energy storage or Tesla’s solar activity in the models. The impact of the price of Bitcoin is also not included in the Ark Funds model.

See also: How to invest in Tesla stock

Future growth: Ark Funds said Tesla could sell between 5 million and 10 million vehicles in 2025 after new technology and production improvements. Tesla sold more than 500,000 vehicles in 2020.

The average selling price of Tesla’s electric vehicles was $ 50,000 in 2020. Ark calls for this figure to be between $ 36,000 and $ 45,000 in the new target price model.

For the first time, Ark Funds is integrating insurance opportunities into its forecasting model.

“Ark believes Tesla could achieve above-average insurance margins from the very detailed driving data it collects from customers’ vehicles,” Ark says in the report.

Tesla launched its insurance product in 2019. It is currently only available in California. Ark believes that in the next few years, Tesla could roll out insurance in other states, purchasing its own policies.

Ark Funds has updated its pricing model for Tesla to include assumptions about fully autonomous driving. Ark estimates the probability of providing fully autonomous driving by 2025 at 50%. Ark had previously listed a 30% chance by 2024.

Related Link: Auto Companies That Fulfilled Shareholder Needs Instead of Future Growth Will Be Sorry: Cathie Wood

Ark Funds and Tesla: Wood has been a remarkable Tesla bull for years. She gave an adjusted price target of $ 800 which was criticized by many on Wall Street. His prediction came just earlier this year.

Tesla is the largest holding company in ETF Ark Innovation (NYSE: ARKK) with over 3.7 million shares valued at $ 2.4 billion.

Tesla is also the largest holding company in Internet Ark Next Generation ETF (NYSE: ARKW) with 1.1 million shares held worth $ 752.5 million.

Tesla represents 10.5% of the assets in both ARKK and ARKW.

Price action: Tesla shares closed at $ 654.87 on Friday. Tesla shares have traded between $ 82.10 and $ 900.40 over the past fifty-two weeks.

Watch the full interview with Cathie Wood and Benzinga here.

Final ratings for TSLA

| Dated | Solidify | action | Of | AT |

|---|---|---|---|---|

| March 2021 | Mizuho | Throw the blanket on | Buy | |

| March 2021 | New street | Upgrades | Neutral | Buy |

| Feb 2021 | Morgan stanley | Maintains | Overweight |

View more analyst notes for TSLA

See the latest analysts’ notes

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[ad_2]

Source link