[ad_1]

Tesla (TSLA) hits a new, near-record high for investors buying big in the stock after announcing its addition to the S & P500.

Even Warren Buffett would have bought Tesla.

In the past two days, since it was confirmed that Tesla will be added to the S & P500, the stock has risen.

It rose 8% yesterday, and it is extending its gains today by now trading 10% higher intraday.

The result is that Tesla has now added around $ 80 billion in valuation to its two-day stock.

In addition to the announcement of the inclusion of the S & P500, Tesla’s stock was also helped by an increase in Morgan Stanley’s price target.

However, it is difficult to justify such a massive increase in valuation from this new information.

An interesting theory is that some large investors are now investing heavily in Tesla, and a particularly interesting theory is that famous investor Warren Buffet could invest big.

Frank Peelen found that around 50 million Tesla shares (TSLA) have gone missing in the hands of currently unknown investors based on the 13F filings, which reveal large properties:

This is particularly interesting in the context of Berkshire Hathaway, Warren Buffett’s investment firm, asking for a confidential investment in a new company that she did not want to disclose so as not to affect the market too much.

The new investment could be worth around $ 11 billion.

An investment of this size would very likely result in a stake of more than 5% in most companies.

Unless they manage to get an exception from the SEC, the company must be large enough for an investment of this size that does not meet the 5% ownership threshold for disclosure:

There are only 25 companies listed on the US stock exchanges big enough not to hit the threshold, and Berkshire Hathaway owns nine and is one of them.

Tesla is said to be one of the few companies large enough for the investment to make sense.

Peelen argues that Tesla’s missing shares and this mysterious Berkshire Hathaway investment is an interesting theory that Buffett could have acquired a stake in Tesla.

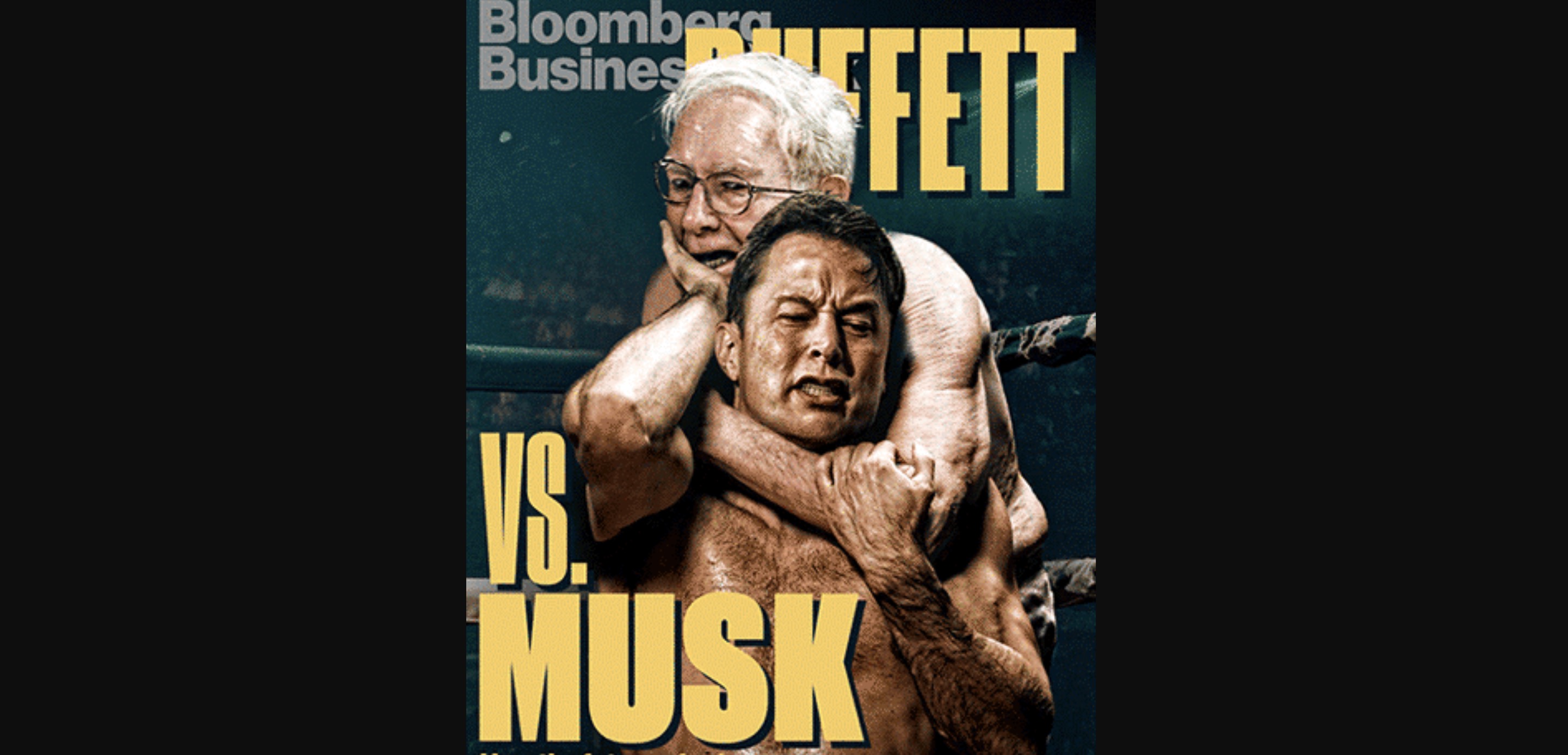

Buffett and Elon Musk have had butt before.

The former invested in BYD, a Chinese electric vehicle maker, and Musk previously didn’t care what vehicles they produced.

Buffett also owns numerous car dealerships in the United States, which have lobbied against Tesla’s direct-sales model.

Additionally, Buffett has lobbied against solar initiatives in Nevada, where he owns the largest electric utility.

Taking Electrek

I’m sure a group of massive investors are now buying Tesla, resulting in this massive push.

Buffett would actually be one of the last investors I would have thought of buying in Tesla.

It usually invests in fundamentals and you don’t invest in Tesla based on fundamentals.

However, is he nearing the end of his career and slowly letting go of the reins of Berkshire Hathaway, and perhaps other company executives like Tesla?

Either way, it’s speculation at this point.

What do you think? Let us know in the comment section below.

FTC: We use automatic income generating affiliate links. More.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

[ad_2]

Source link