[ad_1]

Tesla (NASDAQ: TSLA) has been trading at massive volumes since automaker EV announced it would be included in the S & P500 index on December 21. try to buy enough stock before the automaker EV’s official inclusion in the S&P 500.

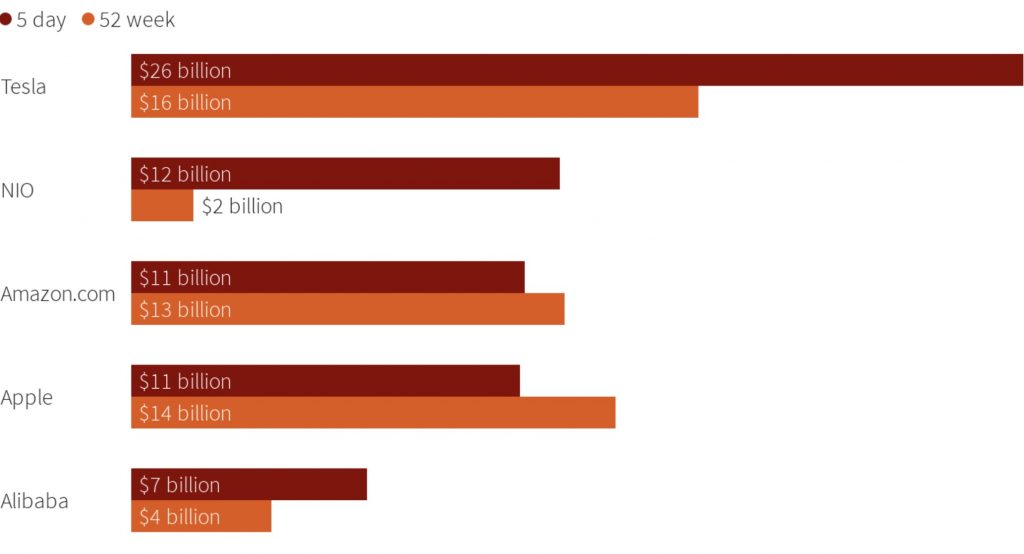

According to Refinitiv, traders have bought and sold TSLA shares at an average of around $ 26 billion per session since the company announced its impending inclusion in the S&P 500 last Tuesday. Massive Tesla stock trading volumes accounted for 8% of all U.S. stock exchanges over the past week. Reuters calculated that Tesla’s transaction value exceeded that of Amazon and Apple combined during the same period.

Tesla now has a market cap of $ 544 billion, helping Elon Musk outperform Bill Gates in net worth. On Wednesday TSLA rose 3% and closed at $ 574. Tesla stock has risen 40% since November 16, when it was revealed the company would join the S & P500.

“It was crazy. Since Tesla’s (announced) inclusion in the S&P, you’ve had a lot of managers who didn’t have enough and needed to buy more, ”said managing director of trading at Wedbush Securities in Los Angeles, Sahak Manuelian. He also said retail investors significantly contribute to Tesla’s massive trading volume through apps like Robinhood.

At the rate that TSLA stock has soared, it could be the sixth most valuable company in the S&P 500 once it joins the index. Tesla’s entry into the S&P 500 was preceded by the company’s five consecutive profitable quarters. Tesla stock has so far risen by more than 400% in 2020, making it the world’s largest automaker by market capitalization.

Disclosure: I have been TSLA for a long time.

[ad_2]

Source link