[ad_1]

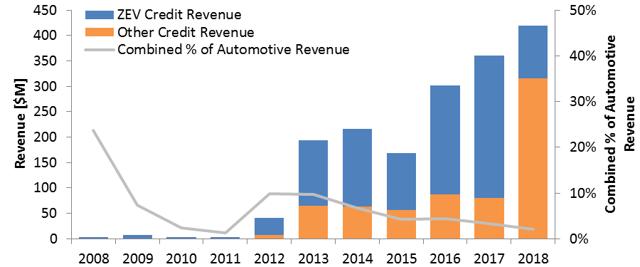

My previous article asked that we further deepen Tesla's revenue from other credits, mainly generated by sales of greenhouse gas (GHG) emissions credits. Unlike the zero emission vehicle policy (ZEV) that is applied by only a fraction of states, GHG legislation is a federal requirement established by the Environmental Protection Agency (EPA) and the United States. National Highway Traffic Safety Administration (NHTSA). The EPA released its 2018 report a few weeks ago summarizing the market activity for the 2017 model year.

The greenhouse gas emissions legislation is relatively technologically neutral, allowing manufacturers to implement any available powertrain, provided they reduce emissions from their fleet. Electric vehicles (EVs) and fuel cell electric vehicles (FCEVs) are extremely favorable because they are supposed to emit zero g / mi exhaust emissions; therefore considerably to the benefit of the average emissions of a fleet. Car manufacturers that do not have a fleet to compensate can generate a significant number of credits for sale to less conforming manufacturers.

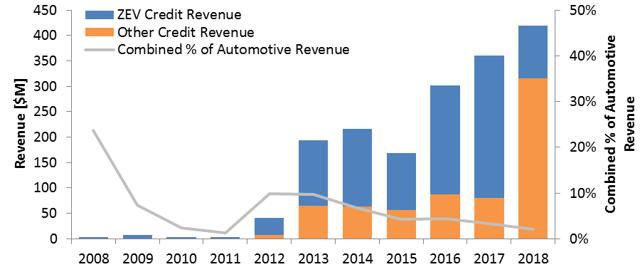

Tesla almost immediately sold every GHG credit generated for each model year. Unlike ZEV credits, where Tesla sold them to most automakers, their GHG credits were only bought by Mercedes and FCA.

Source: GHG reports (2018 estimated on the basis of US production volume)

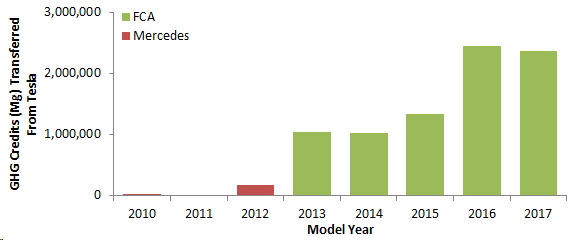

The amount of credits generated by Tesla per vehicle has decreased slightly compared to the model years due to the increasing difficulty of their fleet. Similar to their ZEV credits, the amount of GHG credits per vehicle has also decreased since its inception, but it appears to have stabilized at around $ 1,600 to $ 1,700 per vehicle (it is difficult to estimate for 2017 -2018 due to the low frequency and confusion of calculation times (data from Tesla and EPA). These two declines were offset in 2018 by the significant increase in Tesle Tesla volume compared to Model 3, which caused the huge increase in revenues they achieved.

Source: Tesla 10-K forms and greenhouse gas emissions reports (2018 estimate)

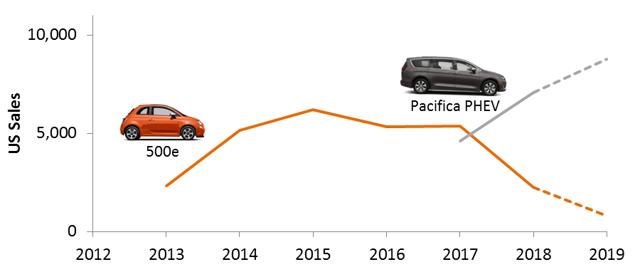

It is difficult to predict whether FCA will continue to buy credits from Tesla. In the 2014-2018 FCA Business Plan Update, they specifically stated, "US GHG compliance by optimizing the combination of technologies and technologies. purchased credits"However, they have moved away from this comment in their latest updates, focusing instead on their future portfolio of electrified products. Although they may become self-sufficient in the early 2020s with the launch of their electrified wallet, the coming years remain promising as they currently sell some highly electrified vehicles.

Source: InternalEVs plug-in sales score card (2019 estimated)

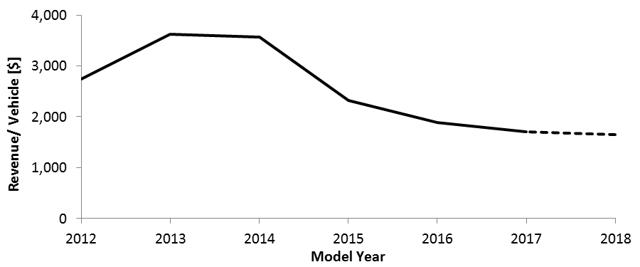

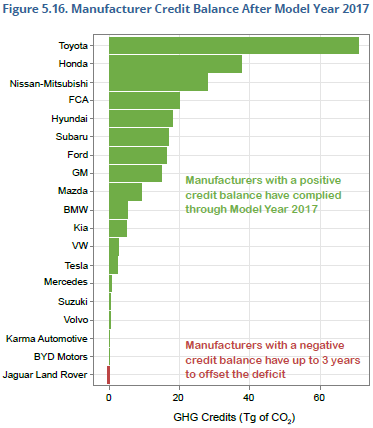

Outside the FCA, many other manufacturers still need credit. Overall, the balance of the sector's GHG credits is positive, but their performance over the past two years has failed to meet the obligation and has deteriorated this collective balance. Most of the credit balance is saved by only a few manufacturers, which creates opportunities with those whose balance is negligible, such as JLR, Volvo, Mercedes and VW. If Tesla respects its sales forecast for 2019 and is able to extract similar GHG and ZEV credits by selling them to FCA or other automakers, they will likely exceed the $ 418.6 million generated in 2018 from sales on credit.

Source: 2018 GHG report

Disclosure: I am / we are long TSLA. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link