[ad_1]

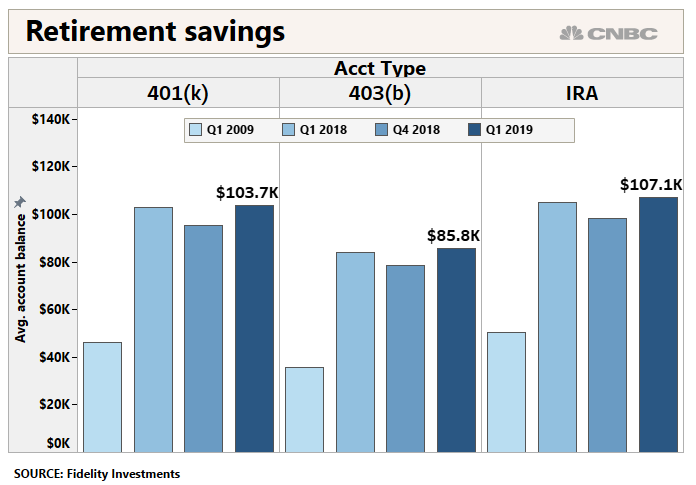

With 401 (k) balances close to all-time highs, retirement savers are probably feeling pretty good lately.

The first part of this year was marked by record contributions, thanks in part to the strength of the stock market, according to Fidelity, the largest provider of 401 (k) type plans in the United States.

Finally, savers will have to take distributions from these accounts.

And it is at that moment that they can realize that their nest egg is less colorful than they previously thought.

More Invest in You:

3 steps to determine if you have earned the right to invest

Take this step if you want to become rich one day

Here's what it takes to become a millionaire 401 (k)

Since contributions to 401 (k) regular accounts are made with pre-tax dollars, they will at some point have to pay the piper (in this case, the federal government and perhaps the state in which they live).

Retirement money is taxed at the rate of your regular income, which is currently 37% for the highest tax bracket, plus marginal state tax rates. (If your retirement income is lower than what it was before, you will probably end up in a lower tax bracket, but you still have to pay taxes – at your new rate, of course – on any withdrawal from retirement savings.)

"People are forgetting the tax impact," said Alicia Munnell, director of the Boston College Retirement Research Center. "It's going to be a shock to them, to discover that the government could get a third."

To reduce the tax burden, financial professionals recommend some key tips:

For starters, when you are building a nest egg, consider an individual Roth 401 (k) or Roth retirement account in addition to a traditional 401 (k) account, said Howard Hook, Certified Financial Planner and CPA of the management company. Heritage EKS Associates in Princeton, New Jersey.

It's a better bet if you end up in a higher or identical tax bracket, he said. Contributions to a Roth are immediately taxed, and withdrawals are tax free in retirement.

A caveat: contributions to a Roth IRA have income limits, although the threshold is high. Alternatively, there is no income limit on who can participate in a Roth 401 (k) – and the maximum annual contribution for workers under 50 is more than three times higher.

You can contribute $ 6,000 to a Roth IRA with an additional $ 1,000 catch-up contribution if you are 50 years old or older. Similarly, you can save up to $ 19,000 a year with a Roth 401 (k) and an additional $ 6,000 if you are over 50 years old.

Once you retire, manage distributions of all your tax-deferred, tax-deferred and Roth accounts to keep you in the lowest tax bracket possible, Hook said. First, tap accounts that allow for tax-free withdrawals, such as Roth accounts and brokerage accounts, that are taxable only when you sell appreciated assets to distribute cash. .

It may be better to delay withdrawal of retirement accounts and withdraw money from more tax-efficient locations.

"It may be better to delay withdrawing retirement accounts and to take money in more tax-efficient locations," said Hook.

Nevertheless, the IRS asks you to start withdrawing withdrawals from your 401 (k) or traditional IRA at the age of 70 and a half. A Roth IRA is not subject to this requirement while the account holder is alive.

Depending on your situation, one way to avoid the minimum distribution tax required is to donate money directly to a charity through a qualified charity, added Chris Schaefer Senior Investment Advisor at MV Financial in Bethesda, Maryland.

The money you give – up to $ 100,000 a year – is excluded from your taxable income.

Of course, not everyone can afford to give their DMRs and that's where proper preparation comes in.

Understand that what you have in your 401 (k) will be taxed and plan accordingly, said Munnell. "You have to save more than you think you need."

Check-out Do not fall for these 5 myths about money via Grow with Glands + CNBC.

Disclosure: NBCUniversal and Comcast Ventures Invest in acorns.

[ad_2]

Source link