[ad_1]

Risk and reward often go hand in hand, making the stock market both lucrative and dangerous. Some of the best examples of this axiom are penny stocks, those stocks priced at $ 5 or less. With that low price comes the potential for extreme gains, as even a smaller and smaller price increase will result in a high percentage gain.

Eduardo Lecubarri, Head of Small and Mid Cap Equity Strategy at JPMorgan, sees both the opportunities and the dangers in the current market environment – and the great potential of small cap stocks that have room for maneuver.

“The first quarter can be difficult as a result of the strong gains since November and the fact that valuations are at all-time highs. However, the outlook for the year is encouraging with much stronger fundamental tailwinds. Such a positive backdrop will likely cause investors to pursue the few stocks that still offer a strong upside rally as they appear to have started doing YTD. It is for this reason that we encourage investors to build their portfolios now and to see things through in the event of a phase of consolidation that could occur in the first quarter, ”wrote Lecubarri.

With the risk in mind, we used TipRanks’ database to find compelling penny stocks with great price tags. The platform directed us to two tickers with “Strong Buy” consensus ratings from the analyst community. Not to mention a substantial upside potential on the table. We’re talking about returns of at least 300% over the next 12 months, analysts said.

AcelRx Pharmaceuticals (ACRX)

Opioids have grabbed the headlines in recent years, and for all the wrong reasons. These powerful pain relievers are also dangerous addictive – a factor that led to the opioid epidemic in the United States. AcelRx is a pharmaceutical company dedicated to creating safer treatments for acute pain, developing synthetic opioids for sublingual (under the tongue) dosing.

The company’s main product, Sufentanil, was approved by the FDA as Dsuvia in 2018 and by the EU as Dzuveo in the same year. A second Sufentanil sublingual system, by the name Zalviso, has also been approved for use by the EU, and is in trial phase 3 in the US.

In its latest revenue report, the company posted $ 1.4 million on the top line, thanks to $ 1.3 million in product sales. Revenue increased 433% sequentially and total revenue increased 133% year over year.

In this context, several members of the street think that ACRX’s stock price at $ 1.40 looks like a good deal.

Cantor analyst Brandon Folkes is optimistic about Dsuvia’s prospects as an alternative to current opioid treatments, and he believes that potential will increase the company’s shares.

“With the launch of Dsuvia, we believe that investors can now focus on the launch of measures and the maximum sales potential of the product. As ACRX launches a real alternative to IV opioids, we expect investors to begin to appreciate the value of the product. We believe that Dsuvia offers a breakthrough in providing adequate pain treatment by eliminating the need for an invasive and time-consuming IV set-up in the emergency room, as well as outpatient or post-surgery. While hospital launches take time, we predict that adopting Dsuvia will lead to higher revenues beyond current street estimates which, in turn, could cause the stock to rise above levels. current, ”Follked said.

In line with its bullish stance, Folkes is pricing ACRX a Buy, and its price target of $ 9 portends an impressive upside potential of 552% over the next 12 months. (To look at Folkes’ record, click here)

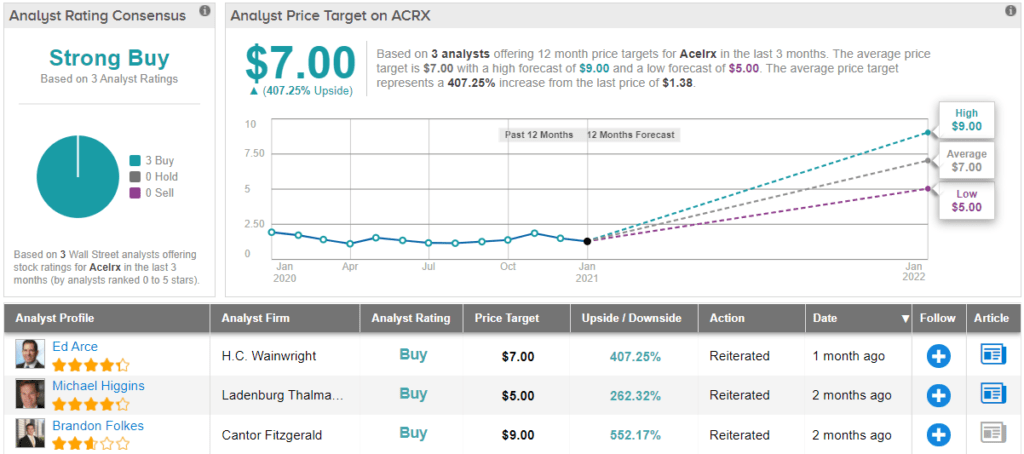

Turning now to the rest of the street, 3 buys and no holds or sells have been posted in the past three months. Therefore, ACRX has a Strong Buy consensus rating. Based on the average price target of $ 7, stocks could climb 407% next year. (See the analysis of ACRX share on TipRanks)

NuCana (NCNA)

NuCana is a biopharmaceutical company specializing in new cancer treatments. The company’s goal is to provide effective treatments for biliary, breast, colorectal, ovarian and pancreatic cancers – while avoiding the complications and side effects of current chemotherapy treatments. NuCana is using a phosphoramidate chemistry technology called ProTide to create a class of drugs that will overcome the limitations of existing nucleotide analogues behind many chemotherapy drugs. NuCana’s ProTides have already been used in Gilead’s antiviral Sovaldi.

In May of last year, NuCana announced the restart of its Phase III trial of acelarin, the furthest drug candidate in the company’s pipeline, as a treatment for bile duct cancers. The study encompasses more than 800 patients in 6 countries and is currently ongoing. In November, the company published data it qualified as “encouraging” from the phase Ib study of the same drug.

While Acelarin is the flagship drug in the pipeline, NuCana has two other prospects in development. NUC-3373 is in a Phase I trial as a treatment for solid tumors and colorectal cancers, and NUC-7738 is a second pathway under investigation for advanced solid tumor applications. Of these three, the colorectal study is the most advanced.

Written by Truist, 5-star analyst Robyn Karnauskas sees the pipeline as key to NuCana’s investor potential.

“We believe investors have overlooked the fact that NCNA is a platform company that we believe to be validated as defined by the production of clinical products. We appreciate the fact that she brought 3 products to the clinic, including a new drug and two improved chemotherapy drugs. Data suggests that the platform works and may produce better chemotherapy drugs […] While investors primarily focus on Acelarin, we believe investors should also focus on NUC-3373, another core of our platform-based thesis that has data expected in 1H2021, ”noted Karnauskas.

To that end, Karnauskas puts a price target of $ 22 on NCNA, suggesting the stock has 384% growth margin ahead of it, with a buy rating. (To look at Karnauskas’ record, click here)

Overall, NCNA’s Strong Buy consensus rating is unanimous and based on 4 recent reviews. The shares have an average price target of $ 17.33, which suggests a 270% year-over-year increase from the current price of $ 4.69. (See NCNA stock market analysis on TipRanks)

To find great ideas for trading penny stocks at attractive valuations, visit Best Stocks to Buy from TipRanks, a newly launched tool that brings together all the information about TipRanks stocks.

Warning: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

[ad_2]

Source link