[ad_1]

Our goal here at Credible Operations, Inc., NMLS number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we promote the products of our partner lenders who pay us for our services, all opinions are ours.

View mortgage refinance rates for October 5, 2021, which are largely unchanged from yesterday. (iStock)

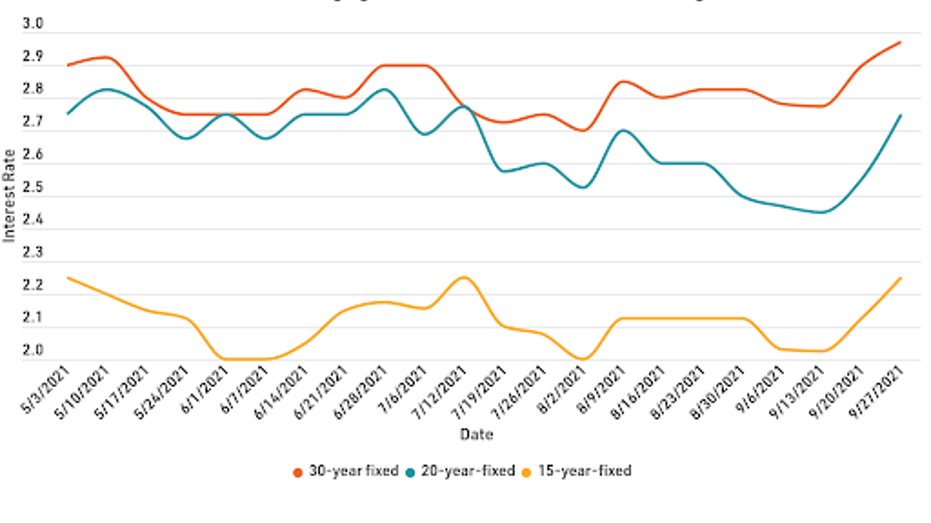

Based on data compiled by Credible, current mortgage refinance rates were largely unchanged from yesterday, with the exception of 30-year rates, which edged up.

- Refinancing at a fixed rate over 30 years: 2.940%, vs. 2.875%, +0.065

- Refinancing at a fixed rate over 20 years: 2.625%, unchanged

- Refinancing at a fixed rate over 15 years: 2.125%, unchanged

- Refinancing at a fixed rate over 10 years: 2.125%, unchanged

Rates last updated on October 5, 2021. These rates are based on the assumptions presented here. Actual rates may vary.

Rates for a 30-year mortgage refinance have climbed to 2.940% today. While 30-year refinance rates remain a bargain for homeowners looking to lower their interest costs, rates for this current term may not stay below 3% for much longer. Experts predicted rate hikes towards the end of the year. For homeowners who want to save even more on interest and can handle a higher monthly payment, the rates for the 15 and 10 year terms remain a bargain at just 2.125%.

If you are thinking about refinancing your mortgage, consider using Credible. Whether you want to save money on your monthly mortgage payments or consider refinancing with cash, Credible’s free online tool will allow you to compare rates from multiple mortgage lenders. You can see prequalified fares in as little as three minutes.

Current fixed refinancing rates over 30 years

The current rate for a 30 year fixed rate refinance is 2.940%. It’s since yesterday. Refinancing a 30-year mortgage into a new 30-year mortgage might lower your interest rate, but might not have much of an effect on your total interest charges or monthly payments. Refinancing a short-term mortgage to a 30-year refinance could result in a lower monthly payment, but higher total interest charges.

Current 20-year fixed refinancing rates

The current rate for a 20 year fixed rate refinance is 2.625%. It’s the same as yesterday. By refinancing a 30-year loan to a 20-year refinance, you could earn a lower interest rate and lower total interest charges over the life of your mortgage. But you can get a higher monthly payment.

Current fixed refinancing rates over 15 years

The current rate for a 15 year fixed rate refinance is 2.125%. It’s the same as yesterday. A 15-year refinance might be a good choice for homeowners looking to strike a balance between lowering interest charges and maintaining a reasonable monthly payment.

Current fixed refinancing rates over 10 years

The current rate for a 10 year fixed rate refinance is 2.125%. It’s the same as yesterday. 10-year refinancing will help you pay off your mortgage sooner and maximize your interest savings. But you could also end up with a larger monthly mortgage payment.

You can explore your mortgage refinancing options in minutes by visiting Credible to compare rates and lenders. Discover Credible and get prequalified today.

Rates last updated on October 5, 2021. These rates are based on the assumptions presented here. Actual rates may vary.

These rates are based on the assumptions presented here. Actual rates may vary.

If you think refinancing is the right decision, consider using Credible. You can use Credible’s free online tool to easily compare multiple mortgage refinance lenders and see prequalified rates in as little as three minutes.

Rates last updated on October 5, 2021. These rates are based on the assumptions presented here. Actual rates may vary.

What is the average cost of refinancing?

Refinancing a mortgage can generate significant interest savings over the life of a loan. But not all of these savings are free. Typically, you’ll encounter costs – $ 5,000 on average, according to Freddie Mac – when refinancing your mortgage.

Your exact refinancing costs will depend on several factors, including your loan amount and where you live. Typical refinancing costs include:

- The cost of registering your new mortgage

- Assessment fees

- Lawyer fees

- Lender fees, such as origination or underwriting

- Title service fee

- Credit file fees

- Mortgage points

- Prepaid interest charges

Keep in mind that no-cost refinancing does not exist. Lenders who market “no-fee loans” typically charge a higher interest rate and build the costs into the loan, which means you’ll pay more interest over the life of the loan.

How To Get Your Lowest Mortgage Refinance Rate

If you want to refinance your mortgage, improve your credit rating, and pay off any other debt could guarantee you a lower rate. It’s also a good idea to compare the rates of different lenders if you are hoping to refinance to find the best rate for your situation.

Borrowers can save $ 1,500 on average over the life of their loan by purchasing a single additional rate quote, and on average $ 3,000 by comparing five rate quotes, according to research by Freddie Mac.

Be sure to shop around and compare the rates of several mortgage lenders if you decide to refinance your mortgage. You can do this easily with Credible’s free online tool and see your prequalified rates in just three minutes.

How does Credible calculate the refinance rates?

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the development of mortgage refinancing rates. Credible’s average mortgage refinance rates are calculated based on information provided by partner lenders who compensate Credible.

The rates assume that a borrower has a credit score of 740 and borrows a conventional loan for a single family home that will be their primary residence. Rates also assume zero (or very low) discount points and a 20% deposit.

Credible mortgage refinancing rates will only give you an idea of current average rates. The rate you receive may vary depending on a number of factors.

How to find the best refinance rate

There are some factors that affect the refinancing rate you will get that are beyond your control. But there are several things you can do to make sure you’re getting the best refinance rate available. Here are a few to consider.

Save for closing costs

You may know that it’s a good idea to save for a down payment when buying a home for the first time. Even though you can get a loan with little or no down payment, a down payment of at least 20% offers many benefits, including being able to avoid PMI.

But it’s also a good idea to save for closing costs, which Freddie Mac says can run up to $ 5,000 on average.

Polish your credit

Just like when you bought your home, your credit rating and history affect your refinance rate, so it’s a good idea to make sure your credit is in the best possible shape.

Check your credit report for any errors, such as incorrect duplicate account information. Pay off as much other debt as possible to improve your debt-to-debt ratio. And pay off your credit card balances to reduce your credit usage.

Comparison shop

Just as you would compare quotes from multiple vendors for an expensive home repair, you should look at loans and mortgage interest rates from multiple lenders. Each lender has their own methods of setting interest rates, so shopping around could help you find the lowest rate available.

In fact, getting five rate quotes could save you $ 3,000 over the life of your mortgage, according to a Freddie Mac survey.

Credible is also a partner of a home insurance broker. If you are looking for a better home insurance rate and are considering switching providers, consider using an online broker. You can compare quotes from top rated insurance companies in your area – it’s quick, easy, and the whole process can be done entirely online.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at [email protected] and your question could be answered by Credible in our Money Expert column.

As a credible authority on mortgages and personal finance, Chris Jennings has covered topics such as mortgages, mortgage refinancing, and more. He was an editor and editorial assistant in the online personal finance field for four years. His work has been featured by MSN, AOL, Yahoo Finance, etc.

[ad_2]

Source link