[ad_1]

Photographer: Carla Gottgens / Bloomberg

Photographer: Carla Gottgens / Bloomberg

Treasury Wine Estates Ltd. unveiled a contingency plan to find new markets for its best-known labels after China imposed crippling 169% anti-dumping duties on its wine over the weekend.

In a statement on Monday, the Melbourne-based Treasury said demand in China would be “extremely limited” as long as the taxes are in place. In total, the company must find a new home for a quarter of its annual worldwide Penfolds volume. The plan to diversify away from the world’s largest buyer of Australian wine will take years to bear fruit.

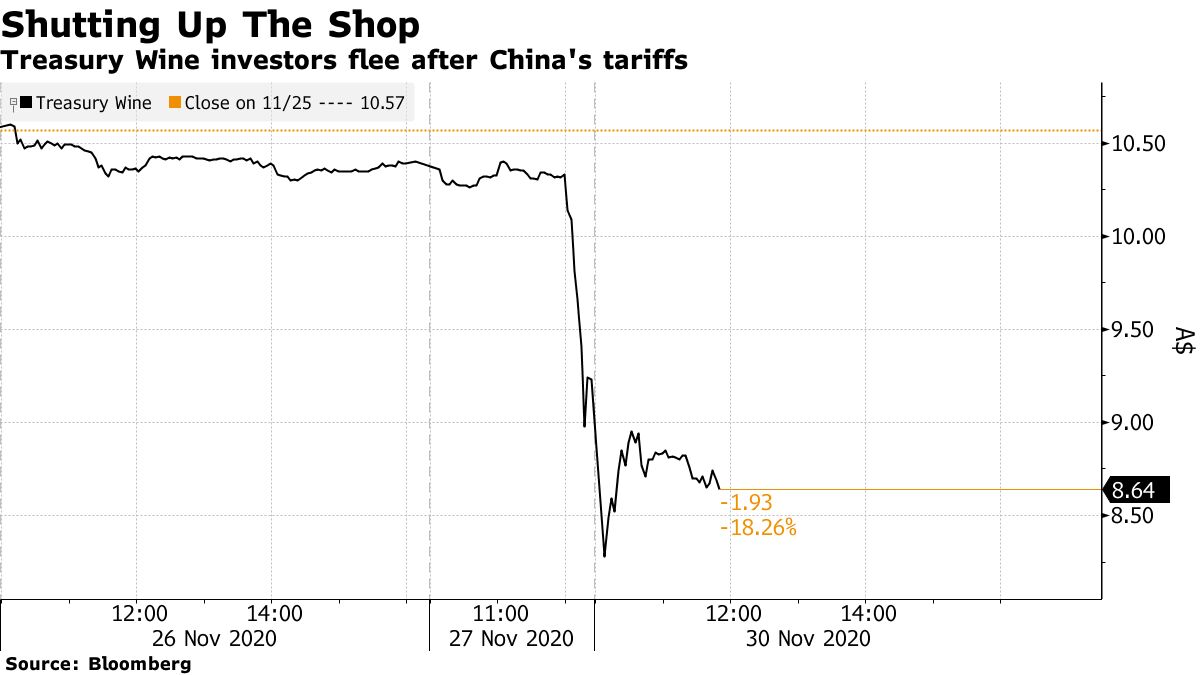

Treasury shares fell 12% in Sydney as investors digested the scale of the reorganization facing the wine producer, the latest company to fall victim to a growing political conflict between Australia and China. The duties follow a series of other measures targeting Australian commodities, from coal and copper to barley this year.

Prime Minister Scott Morrison’s government vigorously rejects claims Australia is dumping wine in China and says it is becoming increasingly clear that Beijing is using trade as a diplomatic club. Canberra plans to bring China into the World Trade Organization and says its “aggressive” actions are undermining confidence in the global economic recovery.

Australia’s largest listed winemaker had made China a central focus of its growth strategy by distributing a suite of luxury brands, led by Penfolds, to the wealthy and emerging middle class. The country accounted for around 30% of its total revenue in the previous fiscal year.

Today, the company is repurposing the Penfolds Bin and Icon labels to other luxury markets, including Australia, the United States and Europe. CEO Tim Ford has said he is also accelerating a campaign to produce more wine in other countries such as France, and potentially China, to avoid Australian manufacturing rights.

The benefits of the Treasury’s rapid response are likely to be limited in the fiscal year ending June 2021 and deliver maximum results over a period of two to three years, he said.

The stock was down 5.7% as of 11:32 a.m. local time, reducing the company’s market value to A $ 6.3 billion ($ 4.7 billion). Its shares fell 11% on Friday as China’s measures, which can remain in place until August next year, were announced.

Learn more about Treasury Wine’s response to Chinese tariffs

One of the Treasury’s challenges is to redirect wines to China without over-saturating other markets and without sacrificing profit margins. In recent years, the company has focused on high-end brands and relied less on mass brands, a strategy that generated record profits and a stock price surge under Ford’s predecessor. , Michael Clarke. The company said on Monday it would keep the wine on its books for future publication in order to balance demand and supply.

During a call with investors on Monday, Ford said the Treasury is also expected to address its cost base in China in light of the expected slump in demand. He said Chinese demand for Penfolds would persist at a certain level and the Treasury has a “long-term commitment” to the market.

China targets Australian wine, says ties have gained the upper hand

“We are extremely disappointed to find our company, our partner operations and the Australian wine industry in this position,” said Ford. China is Australia’s biggest buyer of wine, importing A $ 1.2 billion a year through September, according to government marketing agency Wine Australia.

“The uncertainty has been quantified,” said Jun Bei Liu, portfolio manager at Tribeca Investment Partners in Sydney. “Bad news is reflected in the stock price.” She said the Treasury-wide Chinese wine redirection is “very doable,” in part because the company has been selling wine in other markets for years, although it now needs to hire more. of salespeople to get the job done.

Australia is the most China-dependent developed economy in the world and finalized a free trade agreement with Beijing in 2015. But relations have been strained since 2018, when Canberra blocked Huawei Technologies Co. from building its network. 5G. They went into free fall earlier this year when Morrison’s government called for an investigation into the origins of the coronavirus outbreak, a move that shattered pride in China and sparked a torrent of criticism that the Australia is a puppet of the United States.

Australia has accused China of “economic coercion” and insists it will not be intimidated by trade measures that impact a range of commodities, including timber, cotton and lobster. More than 50 ships carrying at least $ 500 million worth of Australian coal are stranded near Chinese ports.

China claims Australia has poisoned bilateral relations by interfering in its affairs.

Agriculture Minister David Littleproud said on Monday that China’s actions risked undermining global confidence in the nation as a trading partner. “When countries abuse the rules and are unable to clearly explain why they have taken action,” it “poses a risk to any nation that trades with them,” he said.

– With the help of Jackie Edwards

(Updates with the context of the dispute in the fourth paragraph)

[ad_2]

Source link