[ad_1]

President Donald Trump hailed Germany's ability to sell interest-free bonds Wednesday, but did not mention that Germany had not sold more than half of what it was worth. She had put up for auction.

The German government sold for the first time, for the first time in its history, 869 million euros in 30-year bonds with a negative return, adding to the growth of debt global $ 15 trillion.

The bund, which is expected to mature in 2050, has a zero coupon, which means it pays no interest. Germany offered 2 billion euros of bunds at 30 years and investors were willing to buy less than half with a yield of minus 0.11%.

Trump said that Germany was able to convince investors to pay for its debt, while the United States is a "larger credit" but must pay interest. "WHERE IS THE FEDERAL RESERVE?" Trump asked in the tweet, in his latest review of the Fed and Fed Chairman Jerome Powell.

"It remains to be seen if this is the beginning of an investor reaction to this craziness of negative rates. We have to see it for the moment," said Peter Boockvar, chief investment strategist at Bleakley. Advisory Group. "People said" I can not buy that ", that 's why they sold less than half of what they hoped for … They were hoping to sell 2 billion euros. That's why we call this a failed auction. "

Boockvar said that Mr Trump should take a closer look at Europe, where the European Central Bank should soon lower its rates to even more negative levels and use other forms of stimulating buying d & # 39; assets.

"He should look at their banking stocks." Wanting to emulate the European banking system, which has curbed negative rates, is not well thought out, "he said.

Ian Lyngen, head of US rates at BMO, said the German government had been forced to buy itself the remaining bonds on Wednesday, a common trend in Berlin. "It was technically an uncovered auction, which means that the German government had to buy a reasonable part of it," Lyngen said.

Andy Brenner of National Alliance said that Germany had held unsuccessful auctions in the past, but that it was the worst.

"This is the most important thing I've seen in terms of 30 years of failure – an unprecedented 60% for the Bundesbank – there was no demand for 30-year paper with a negative interest rate. about 40%, and a real investor can not pay an annuity based on negative interest rates, "he said.

It is negative returns and extremely low rates elsewhere in the world that have pushed investors into the US bond market to hunt for safe investments with a return. As a result, US Treasury yields, which have evolved at opposite prices, have fallen sharply, making loans cheaper for US businesses and consumers, including for mortgages.

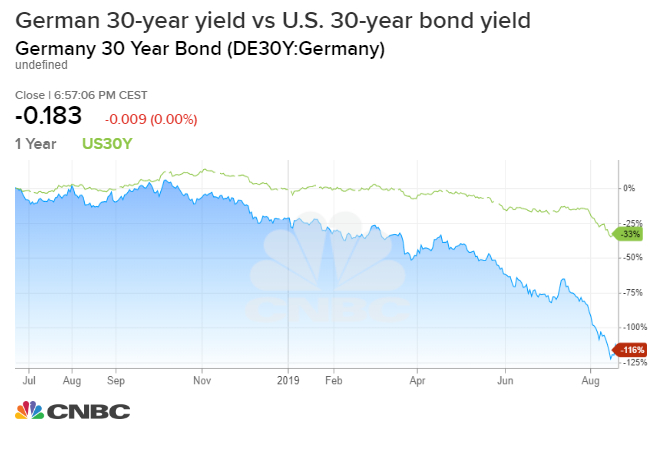

The German auction comes in a month in which rates fell sharply and German yields sank further into negative territory. US yields also fell in record territory, with the 30-year-old reaching a record low of 1.91% last week.

About a third of the world's tradable bonds now have negative returns.

"Modestly negative policy rates may have had a positive overall impact initially, but keeping rates in very negative territory for long periods of time, or navigating to even deeper negative territory, could have more unintended consequences than the lack of interest." 39 "advantages," wrote JP Morgan's strategists this week.

The US Treasury will rely on investors' appetite for US debt, as the government issues more and more bonds to pay its deficit. Germany, meanwhile, recorded a record budget surplus of 58 billion euros last year, its fifth record surplus in a row, although it is considering a program. expenditure.

"The Treasury's last 30-year auction lost 1.1 basis points, but non-dealer allocations amounted to 74.9% versus an average of 69.6% – investable alternatives." said Lyngen.

Torsten Slok, chief economist at Deutsche Bank Securities, accounts for 50% of the Investment Grade universe, up from 40% 10 years ago.

"With negative interest rates in Europe and Japan, European real money managers and Japanese banks are forced to seek returns to achieve stable returns.For regulatory reasons, they are mainly allowed to buy sovereign bonds of good quality and corporate bonds of good quality, "writes Slok. , in a note.

It is unclear to what extent the global bond market will be disrupted when investors change their minds about the need for extremely low or negative rates.

"Unfortunately, it may take a banking crisis in Japan and Europe for them to realize the poison that negative rates are for their banks," Boockvar said.

Trump also criticized the European Central Bank for its easy policy, which gives it a weaker currency and an advantage over the United States.

But J. P. Morgan's economists point out that the ECB's negative interest rate policy has not helped much.

"The initial evidence on the creation of credit in the euro area was at best mixed … net credit creation in the euro area fell sharply during the eurozone crisis and remained weak even when the ECB pushed credit deposit rate to -20bp in 2014, "they said. it's noted. "It then resumed, although its growth rates have remained relatively low by historical standards, and the fact of placing deposit rates in negative territory at meetings on December 15 and 16 does not appear to have stimulated further growth. the growth rates of loans. "

[ad_2]

Source link