[ad_1]

The AMD Fantasy Running (AMD) has ended with the Intel Supplies Update Letter (INTC). The letter has raised doubts as to how far AMD will reach with its Ryzen range, and AMD has dropped.

Ryzen will be one of the key drivers of third quarter performance, and Market believes that if Intel reaches its revenue forecast, AMD will not perform as well as expected. This would be true in a zero sum game. This is not it.

How does Intel do it?

Intel has problems producing enough 14nm and 10nm chips, while 7nm chips are nowhere else. So, how can he still be on track to reach his income prospects for the year?

To mitigate its problems, Intel has increased the capital investment of $ 1 billion for its 14-nm manufacturing sites, prioritized the production of Intel Xeon processors and Intel Core ™ and increased their prices for 8th generation processors.

The 8th generation price increase will reduce the demand for its processors, easing the pressure of manufacturing, while increasing the profit margin.

That said, the supply is undoubtedly limited, especially at the entrance of the personal computer market. We continue to believe that we will have at least enough supply to meet our forecast for the year we announced in July, which is $ 4.5 billion higher than our January forecast. "

–Bob Swan, Chief Financial Officer of Intel and Interim CEO

The extra $ 1 billion in capital spending is a small sacrifice to pay to protect their market share of 14-nm chips and to increase the supply on the market.

This is undoubtedly a good strategy. The increase in prices would undoubtedly reduce demand, which would ease the manufacturing process while maintaining the necessary revenues for Intel. However, Intel sells fewer processors than it could, and AMD will benefit.

German figures

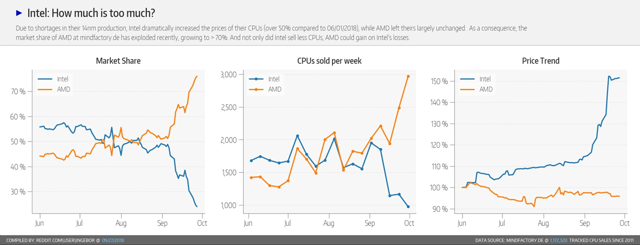

A recent article (from the Italian version of Tom's material) shows the evolution of Mind Factory's sales in recent quarters. Although German market trends may not reflect the world's trends perfectly, it's interesting to see the numbers.

Source: Tom's Hardware

The picture shows how AMD has taken over Intel's market share and, while the beginning of the third quarter is a tight fight, September is the big winner of AMD. If we look at the price trend by brand, we see an average price increase of Intel processors of nearly 50%, which shows how much the price increases went and why Intel will probably maintain its forecasts of revenue while selling fewer processors.

As AMD's market share increases with the quarter, if this trend continues, fourth-quarter sales could offer a much better surprise than the third quarter.

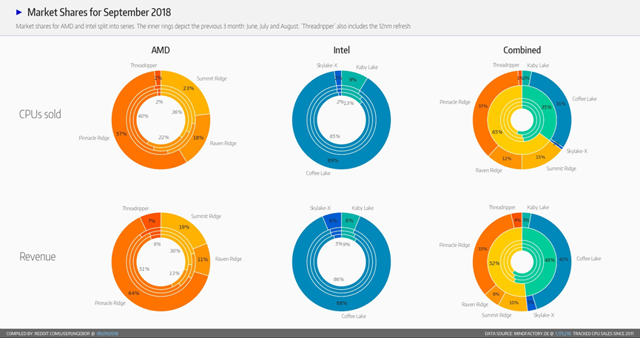

Source: Tom's Hardware

A closer look at the distribution of processor and revenue market shares illustrates this point. While AMD represents 65% of the processors sold in September, its revenues represent only 52% of the total.

AMD 5 nm

While Intel is struggling with 14nm chips and hopes to be able to produce 10nm chips in April of next year, AMD is preparing for 5nm chips, or at least TSMCs ( NYSE: TSM).

TSMC is expected to start production at 5nm as early as April of next year, which would bring mass production back to the third quarter of 2020, while the production of the second generation at 7nm has already begun.

TSMC currently uses Deep Ultra Violet (DUV) lithography for the production of 7 nm chips. To produce 5 nm chips, they should instead use Extreme Ultra Violet (EUV) lithography. TSMC is starting to produce a second generation of 7nm chips that will use the EUV in four non-critical layers to accelerate the learning and production of 5nm chips.

The company recorded the first chip using EUV earlier this month, just as the price of AMD was plummeting for fear that Intel would increase its chip output by 10nm.

The second generation of 7nm will bring some improvements to the processors, but the increase in performance and size reduction are minimal compared to the possibility of 5nm output.

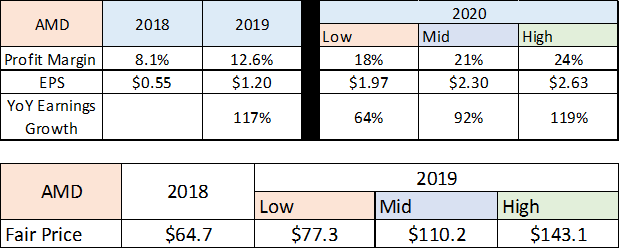

Evaluation

For the moment, I remain with the assessment that I have made in the previous article. However, if the third quarter results prove that the market behaves like the customers of the German factory Mind Factory, the fourth quarter will surely be a favorable quarter. Third quarter revenues will tell a lot about the market behavior and scalability of the mental plant information. After the third quarter results, there will be enough information to refine the outlook for 2020 and the fair value for 2019.

Source: Author's tables

This information will be essential to obtain a better fourth-quarter revenue model and measure the market share of AMD. In April, we will see how far Intel has improved its 10nm output and whether TSMC has successfully started the 5nm risky production.

conclusions

My last article on AMD indicated that before the first quarter results, when AMD traded at a single digit, fear masked AMD's real progress. Now, history repeats itself. AMD dropped because fear darkens market judgment. The next six months will prove AMD's technical superiority and pave the way for a fair valuation of the stock.

Mind Factory figures may not reflect market trends, which presents a risk. Given the range of products and the price differential between AMD and Intel, the risk that market behavior will be significantly diverted from one of the German customers is low.

Although Intel can increase production by 10nm, it has already lost a market share and a technological advantage. Resuming AMD's market share will be a difficult task that may prove impossible if AMD can beat them again in the 5nm race.

Warren Buffett said it best.

Source: Commercial Education

If there is anything in this article with which you agree or disagree or would like me to develop further; I would sincerely appreciate that you leave a comment. I will answer it as soon as possible. I am long AMD (stocks and options), so I will continue to write about it. If you like this article, subscribe!

Disclosure: I am / we have been for a long time.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link