[ad_1]

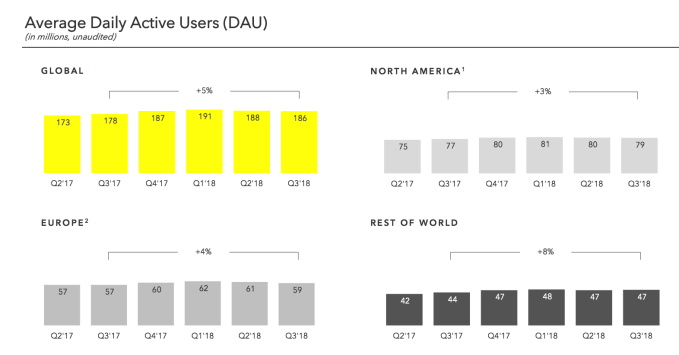

Snapchat continued to contract in the third quarter of 2018, but its business continues to improve. The number of daily active users of Snapchat has further decreased, this time from 1% to 186 million, against 188 million euros and a negative growth rate of 1.5% in the second quarter. The number of users is still up 5% over the previous year. Snapchat achieved $ 298 million in revenue with a $ 0.12 EPS loss, exceeding Wall Street's expectations of $ 283 million in revenue and a $ 0.14 EPS loss plus loss of half a million users.

Snap posted a profit of $ 6.99, close to its low of $ 6.46 and down from its opening price of the initial public offering at $ 24. Snap lost $ 325 million this quarter, up from $ 353 million in the second quarter. The reduction in costs has therefore increased. This briefly encouraged Wall Street, which pushed the stock price up 8.3% to about $ 7.57 just after the announcement of the results.

But Snap's share price collapsed to -2% or $ 6.85. Investors have been so penetrated by the stock market that he needed only modest growth for his stocks to recover, but the fear that Snap will be reduced to nothing will tire investors.

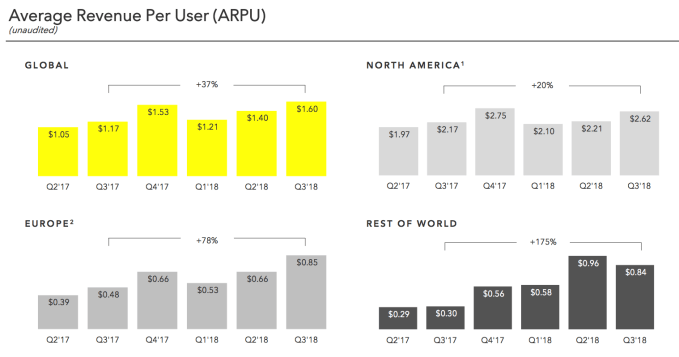

Unfortunately, Snapchat's average revenue per user dropped by 12.5% in developing countries this quarter. However, significant gains in the US and European markets have increased the global ARPU by 14%. Snap expects fourth-quarter vacation revenues of $ 355 to $ 380 million, according to analysts' estimates.

In his prepared remarks, CEO Evan Spiegel admitted, "While we have incredible reach among our core population of 13 to 34 years in the United States and Europe, billions of people around the world are not using it. not yet Snapchat. " explained that the 2 million lost users were mainly on Android, where Snapchat does not work as well as on iOS. Now reduced to $ 1.4 billion in cash and securities, Snap will need to start touching some of those users or improving the monetization of those it still has to keep afloat without outside capital.

A rising battle

The third quarter was marked by Snapchat's launch of its first internal augmented reality Snappable games, while the leak of a third-party gaming platform was planned. Lens Explorer launched Lens Explorer to bring more attention to the augmented reality experiences created by developers and creators, as well as its Storyteller program for connecting social media. Stars to the brands to earn sponsorship money. He also closed his Snapcash function, similar to Venmo. But the biggest news came from its report on the results of the second quarter, which announced the loss of 3 million users. Stock prices did not rise, but competition and user contraction drove Snap's shares to new lows.

Snapchat relies on Project Mushroom's engineering redesign of its Android app to accelerate performance, and thereby accelerate user growth and retention. Snap has neglected the Android market of developing countries for years because it has focused on American teenagers who love the iPhone. Since Snapchat is all about fast videos, slow loading times have made it almost unusable, especially in markets with slower network connections and older phones.

Looking at the competitive landscape, WhatsApp's Snapchat Stories clone reached 450 million daily users, while Instagram Stories has 400 million daily newspapers, much of which in developing countries, blocking growth. from Snap abroad, as I had predicted at the launch of Insta Stories. Snap Map has not become ubiquitous, Snap's original series are still not luxurious enough to attract new users. Discover is a mess of clicks, and Instagram has already copied the best parts of its ephemeral messenger. Snap could be vulnerable in developing countries if WhatsApp similarly copies its endangered discussions.

At this rate, Snap will run out of money before it becomes profitable in 2020 or 2021. This means that Snap will likely have to sell new shares in exchange for outside investment or buy to survive.

Source link