[ad_1]

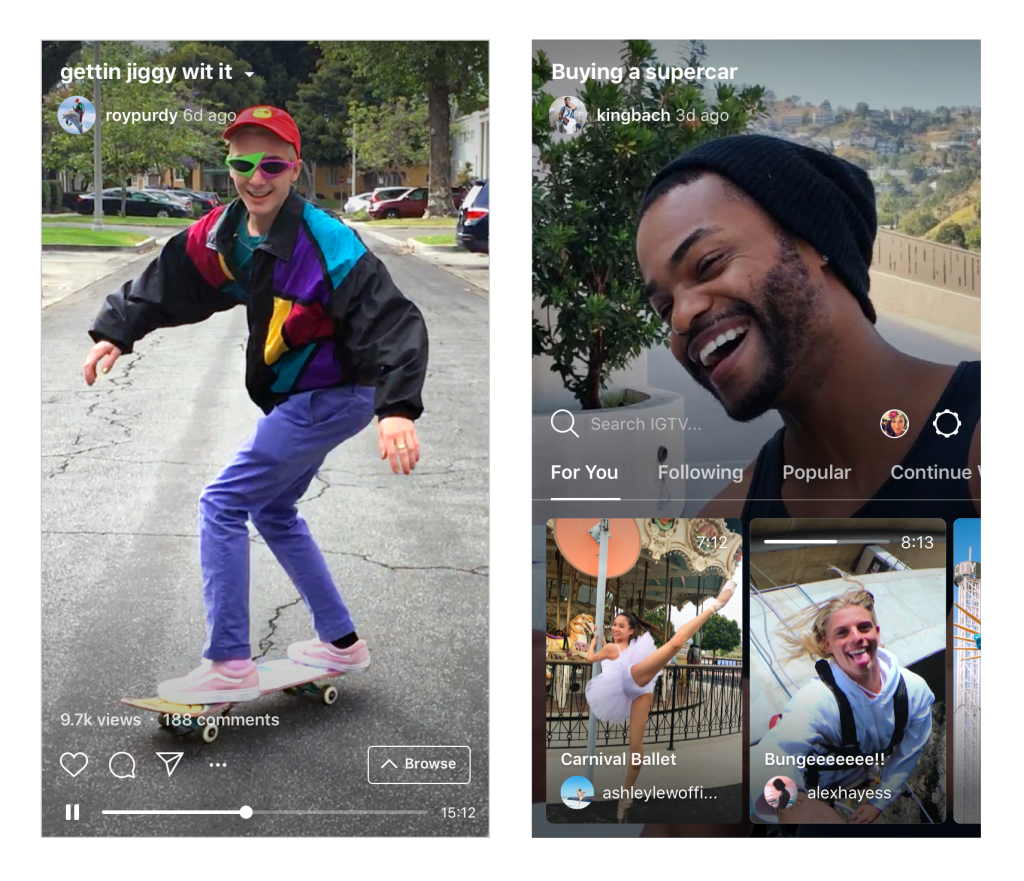

It's been four months since Facebook launched IGTV, with the goal of creating a destination for longer Instagram videos. Is it about to become a prestige flop, or could it be about the company's next multi-billion dollar company?

IGTV, which offers videos of up to 60 minutes against those of Instagram. normal limit of 60 seconds, has not made much noise yet. As there are no ads yet, it did not save a dollar either. But, it offers Facebook the opportunity to dominate a new category of premium video and develop a subscription business that aligns better with high quality content.

Facebook has collaborated with many brands and media celebrities to produce high quality vertical videos for IGTV. launch on June 20th, both as a dedicated application and a section of the main Instagram application. But IGTV has remained silent ever since. In conversations with media executives, I have often heard that almost no one is creating content specifically for IGTV and that the audience on IGTV remains low compared to distributing videos on Snapchat or Facebook. Most videos are recycled from the Snapchat account of a brand or an influencer (at best) or a YouTube channel (more common). Digiday heard the same return.

Instagram announced on June 20 that IGTV would be a way for users to post videos up to an hour in a dedicated section of the app (and the separate application).

Facebook's goal should be to make IGTV a major property in its own right, distinct from the Instagram feed. To do this, the company must follow the concept contained in the name "IGTV" and review what a TV show in the format of an Instagram user would look like.

His team should rely on the catalog of streaming TV services such as Netflix and Hulu to develop original series with the best Hollywood talent to anchor their own subscription service, but there create a new format of programs designed specifically for vertical entertainment. screen filled with a smartphone.

Mobile video goes into high gear

Of 6 hours and more a day as Americans spend on digital media, the majority on their phones (most of them on social and entertainment activities) and watching videos grew up with. In addition to the decline in linear TV viewing and the rise of over-the-top streaming services such as Netflix and Hulu, we have witnessed the creation of a whole new category of video: video native for mobile.

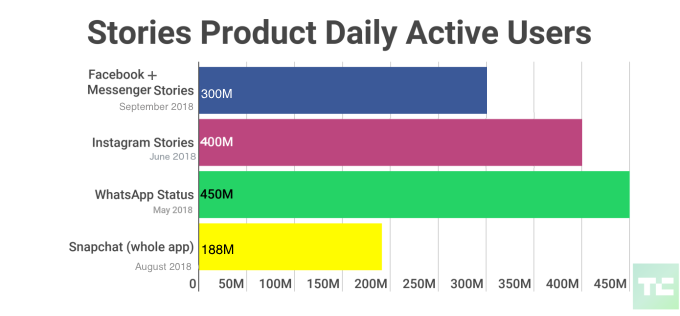

Starting with its most basic iteration with daily user records for Snapchat Stories, Instagram Stories and YouTube vlogs, mobile video is a very different viewing environment with much more competition for attention. Mobile video is watched as people go to their day. They can spend a few minutes at a time, but not in blocks of an hour. Annoying text messages and push notifications are superimposed on the screen while they are watching.

"Stories" about major social apps have developed vertically oriented mobile native videos in their own content format.

In my recent conversation with Jesús Chavez, CEO of the Vertical Networks-based mobile production company in Los Angeles, he pointed out that the success of episodic mobile videos is not just about regular TV clips with changes to the game. "Packaging" (cropped for vertical, thumbnails selected for clicks, etc.). The way episodes are written and filmed must be completely different to succeed. Chavez described the higher "density" of native mobile videos: consolidate more activity in a shorter amount of time, with faster dialogue, fewer drawings, shared screens, and more. Other tactics.

With the increasing time spent every day watching videos on their social apps – and the flood of poor quality videos after watching – it makes sense that they want top quality content. We have already seen this scenario when ad-dependent radio gave birth to subscription radio like SiriusXM and ad-dependent network television gave birth to pay-TV channels such as HBO. In this context, it is a trusted service with the same high level of tolerance for the captivating narration of popular movies and TV series – and often featuring famous talents – but originating from the vertical environment smartphones.

If IGTV continues on this path, it would compete most directly with Quibi, the new venture that Jeffrey Katzenberg and Meg Whitman raise $ 2 billion for the launch (and called NewTV temporarily until their announcement at the top of Vanity Fair's new facility last Wednesday). They develop a large library of exclusive shows made by iconic directors like Guillermo del Toro and Jason Blum, specially designed for smartphones with their next subscription application.

Quibi's funding comes from the world's largest studios (Disney, Fox, Sony, Lionsgate, MGM, NBCU, Viacom, Alibaba, etc.) whose leaders see a sufficient opportunity in such a platform – for which they could then produce content – write nine-digit checks.

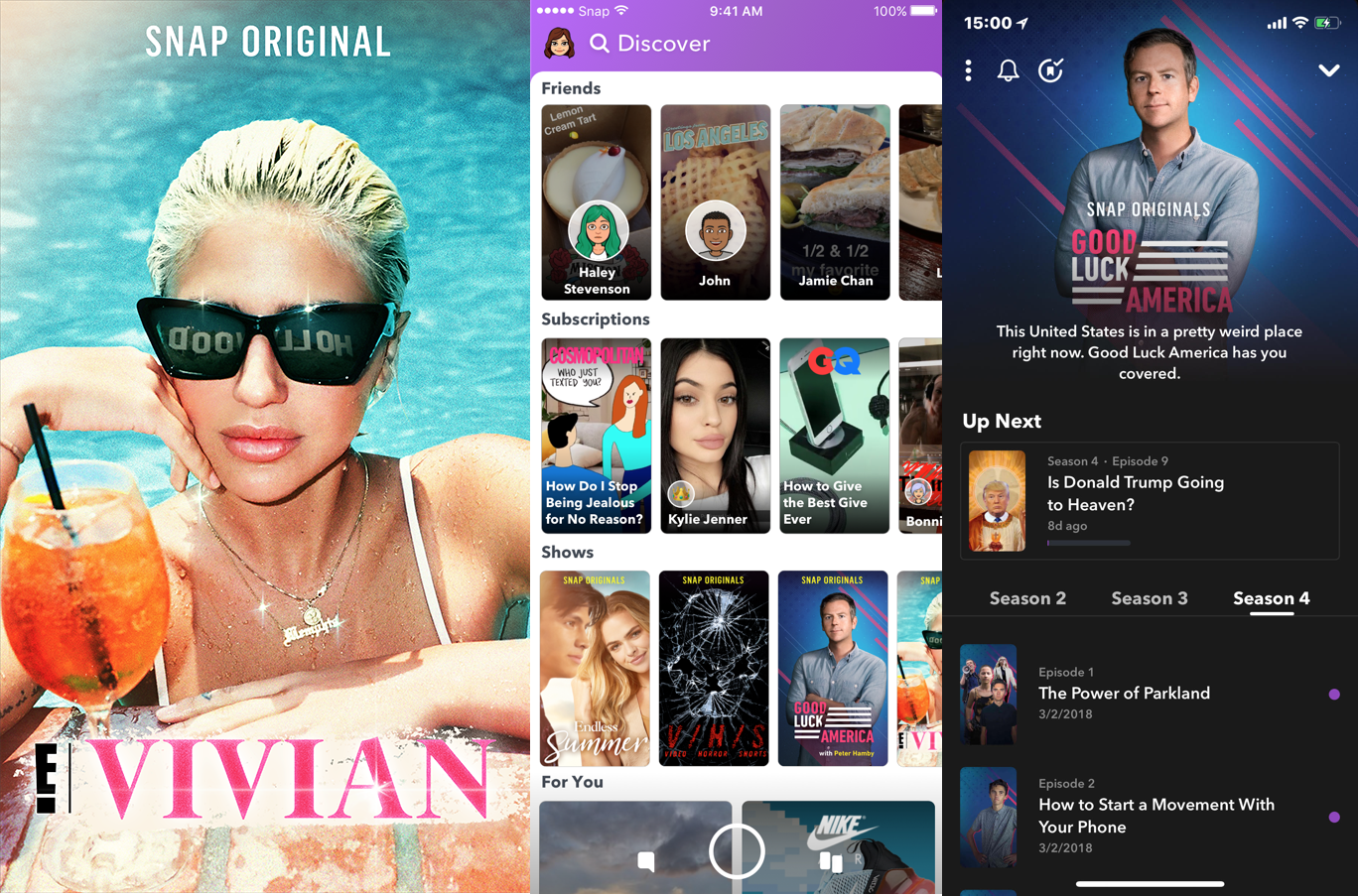

Josh Constine from TechCrunch argued last year Snapchat should also go in the same direction "mobile HBO", although funded by advertising rather than by a subscription model. The company seems indeed to go further in this direction with last week Snapchat Originals Announcement, although he announced and then canceled the original content plans before.

Snapchat announced its Snap Originals last week.

Facebook is best placed to win

Facebook is best placed to seize this opportunity and IGTV is the vehicle. Without even taking into account integrations with Facebook, Messenger or WhatsApp applications, Facebook starts with a base of over a billion active users per month on Instagram only. It's a huge audience to expose these original shows, and an audience that does not need to create or connect to a separate account to explore what is broadcast on IGTV. A wider distribution is also a selling point for creative talent: they want their shows to be seen by a wide audience.

User data that makes Facebook a single competition with Google in targeted advertising would give IGTV's recommendation algorithms an undeniable advantage in pushing users to the most relevant IGTV shows in relation to their interests and the most popular among them. friends.

The social nature of Instagram is a benefit to raise awareness and spark engagement around IGTV broadcasts: Instagram users can see when a person they follow is following or "likes" a show (while waiting for their privacy settings). An obvious feature would be to allow users to chat or review a show by sharing it in their main Instagram feed with a comment. their followers would see a clip or trailer, then would be able to click on the entire show in IGTV in one click.

Developing and acquiring a library of unmatched, high quality original productions requires a lot of capital – just ask Netflix for the $ 13 billion it spent this year. Targeting top quality mobile video will not be different. That's why Katzenberg and Whitman raise a $ 2 trillion war chest for Quibi and budget the production costs of $ 100,000 to $ 150,000 per minute tied with the best TV shows. Facebook has $ 42 billion in cash and equivalents on its balance sheet. It can easily spend more than Quibi and Snap in financing and marketing original programs by a mix of newcomers and Hollywood icons.

Snap can not afford (financially) to compete head-on and does not have the same scale of distribution. This is a 188 million daily active users and is growing faster (up 8% from last year, but the number of SADs decreased by 3 million in the last quarter). Snapchat is also a much more private interface: it does not allow users to see the activities of other users such as Facebook, Instagram, LinkedIn, YouTube, Spotify, etc. to encourage content discovery. Snap is more likely to create a center for mobile programming initially funded by advertising for teens and 20-year-olds rather than their rivals Quibi or IGTV by creating a more popular Netflix or Hulu program. native mobile broadcasts.

It's time to go freemium

It is particularly necessary to invest significant capital initially to create a subscription level: consumers must see from the start enough compelling content behind the paywall and enough new content added to find a valid subscription in progress.

There is currently no monetization of IGTV. He is sitting in experiment mode while Facebook observes how people are using it. If a company manages to generate enough advertising revenue solely from commercial short films to continue to take advantage of high-cost, high-quality episodic broadcasts on its mobile, that is Facebook. But a freemium subscription model makes more sense for IGTV. From a financial point of view, integrating IGTV into its own profitable profit and loss account while investing in substantial content will likely require more revenue than just the generated advertisements.

The alignment of incentives is just as important. Subscriptions are defined by "time well spent"Rather the time spent and the clicks made: quality on quantity. It is in this environment that the premium content of other formats has also flourished; SiriusXM for radio conference, HBO for linear TV, Netflix for OTT. The kind of content IGTV encourages, and the creative talent it will attract, will be of a much higher quality when the incentives to create must-see shows that drive new subscribers will be generated in relation to the creation of video optimized for the views.

Could there be a "Netflix for native mobile video" with programs shot in vertical format specifically designed to be viewed on a smartphone?

Optimizing views (generating advertising revenue) has been the template used by media companies creating content for Facebook over the last decade. The toxicity of this situation was one of the great successes of last year, Facebook recognizing many problems related to clickbait, sensationalism and changes of vows.

Over the years, Facebook has been driving media companies up and down with changes to its news feed algorithm that has forced them to drastically change their content strategies (often with layoffs and restructurings). This has helped build bridges with media companies. especially after last January, how to reduce dependence on Facebook platforms has become a common topic of discussion among digital content managers. If Facebook wants the best producers, directors, and production companies to invest their time and resources in developing a new high-quality video series format for IGTV, an incentive business model they can trust is essential to stay consistent.

Imagine a free advertising-funded level for influencer and media partner videos (plus a selection of "IGTV Originals") to attract Instagram users, and then a subscription level of $ 3- $ 8 / month for 39; access to all IGTV formats and an ad-free display. experience. (In comparison, Quibi plans to charge a $ 5 / month subscription with ads with the $ 8 / month option for its ad-free level.)

Given Netflix's growth in streaming traditional TV channels, a subscription-based company should be a welcome addition to Facebook's portfolio of leading content-sharing platforms. It would not be its first expansion beyond advertising revenue: Facebook's latest major division, Oculus, is generating revenues from hardware sales and 30% of cut recipes to virtual reality applications from the Oculus app store (similar to Apple's iOS app revenue reduction). Facebook is also testing a dating app that – based on the Tinder freemium business model, Bumble, Hinge and other major dating apps that have proven successful – would be natural to add a subscription level.

Facebook is facing public scrutiny (and government regulation) of data privacy and targeting of ads like never before. Incorporating subscriptions and transaction fees as sources of revenue benefits the business financially, better aligns incentives with users, and dispels public criticism of how Facebook uses people's data. Facebook is already testing Facebook group subscriptions and even considered offering a alternative subscription advertising on its main social platforms. This is unlikely to be the case, but the company's management clearly plans to generate non-ad revenue.

The path to follow

IGTV must make changes to its products if it moves in that direction. Currently, videos can not be linked together to form a series (that is, a show with multiple episodes) and the possibility of discovery is very low. In addition to seeing recent videos of those you follow, videos that tend and recommendations, you can only search for channels to follow (by name). There's no way to search for specific videos or shows, no way to browse channels or videos by subject, or see what people you watch are watching.

It would be a missed opportunity not to compete for that. The advantage is huge – owning Netflix in a new content category – while the inconvenience is pretty minimal for a company with such a large balance sheet.

Source link