[ad_1]

The decline occurred throughout the day against the main pairs on Tuesday before the Fed's central bank summit. The US Federal Reserve will release the July Federal Open Market Committee (FOMC) meeting, in which it lowered the benchmark rate by 25 basis points. The minutes will be posted on Wednesday, August 21 at 2 pm Eastern Daylight Time. The market expects the central bank to put Dovish rhetoric high.

The White House has expressed its expectations, and as more and more central banks engage in the dove, the Fed should lead them. The Fed has actually cut rates, as expected after the July meeting, but President Jerome Powell has confused the markets with a slightly hawkish tone and a lack of commitment in favor of a round robin. easing. The minutes of the FOMC July meeting could confirm that the Fed remains dovish – or can also validate Powell's reluctance to cut rates when the US economy may not justify the adjustment.

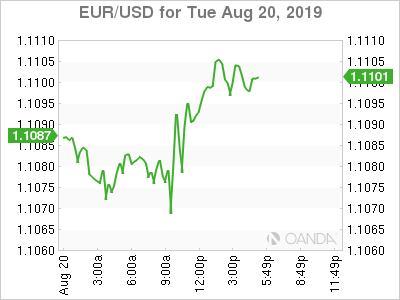

The euro rises before the minutes of the Fed, despite the Italian turbulence

The gained 0.21 percent Tuesday. The single currency is trading at 1.1101 in the pending notes of the July FOMC meeting. Investors are more focused on monetary policy than on politics, as the euro has recorded a gain despite rising tensions in Italy and England. The Italian Prime Minister resigned and in Britain, Boris Johnson maintained a dead end on the table.

EUR / USD

The elections in Italy seem to be the next step, unless a new government can be formed without them, and intervene at a time when budget negotiations need to take place. The Italian budget is a delicate issue because it is intended to put the untrained government on the road to collision with the European Union.

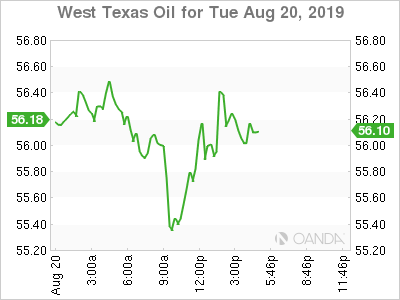

Oil

Oil prices are stable before the United States on Wednesday. is flat at 0.02 percent and earns 0.59 percent. The crude was caught in a tight range, the optimism regarding a trade deal between China and the United States being offset by an abundant supply.

American crude oil

Central banks are in place to guarantee lower rates for longer, but fears of recession have increased as there is not enough evidence of the lure that policymakers will have with limited ammunition.

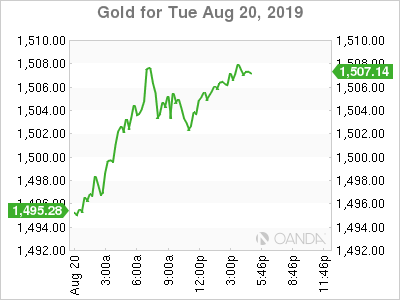

Gold

increased by 0.36% with the depreciation of the USD. The yellow metal stays above the $ 1,500 level with every eye on the Fed's minutes for advice on their holdings of metal. It will be difficult for the Fed to meet the accommodative expectations of the market, but if it does, gold could stay on the rise.

Gold

If the market is not validated, the US dollar could be strengthened and the yellow metal put on hold, despite its attractiveness as a safe haven. A neutral Fed is seen as a hawkish Fed in the current market conditions.

Original position

Fusion Media or anyone involved in Fusion Media will not accept any liability for loss or damage arising from the use of the information, including data, quotes, graphics and buy / sell signals contained in this site Web. Please be fully aware of the risks and costs associated with financial market transactions. This is one of the most risky forms of investing possible.

[ad_2]

Source link