[ad_1]

President Joe Biden is due to present his infrastructure spending plan on Wednesday, the first salvo to pass legislation through Congress to fix crumbling roads and bridges.

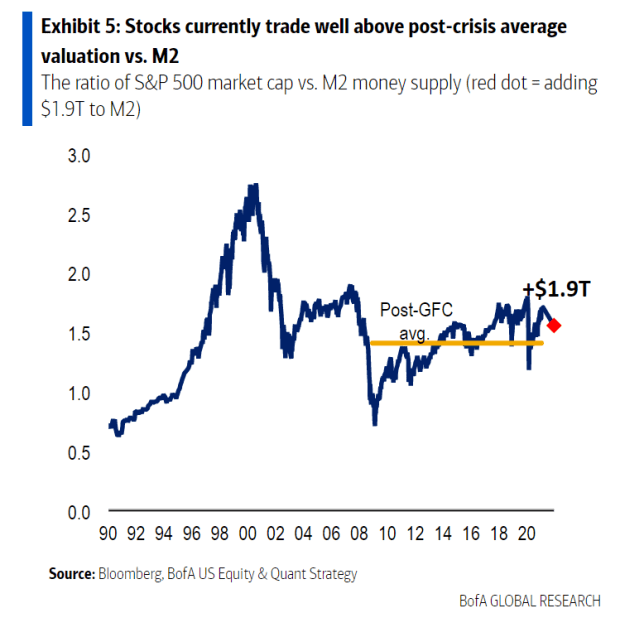

Strategists at Bank of America led by Savita Subramanian say Wall Street is already starting to cost infrastructure spending that could reach $ 4 trillion. They say the SPX ratio of the S&P 500,

Market capitalization relative to the M2 measure of money supply is exceptionally high at 1.7, compared to 1.4 on average since the 2008 financial crisis.

There is also a downside, as the market reacts to the likely hikes in corporate tax and the rise in 10-year Treasury TMUBMUSD10Y,

this raises the expenses related to corporate debt. “Infrastructure spending is spread over years, but a corporate tax hike would hit immediately,” they say.

Industrials and materials will likely be the biggest beneficiaries of an infrastructure bill, with US small caps whose sales are strongly correlated with cycles of capital spending in the United States, strategists say.

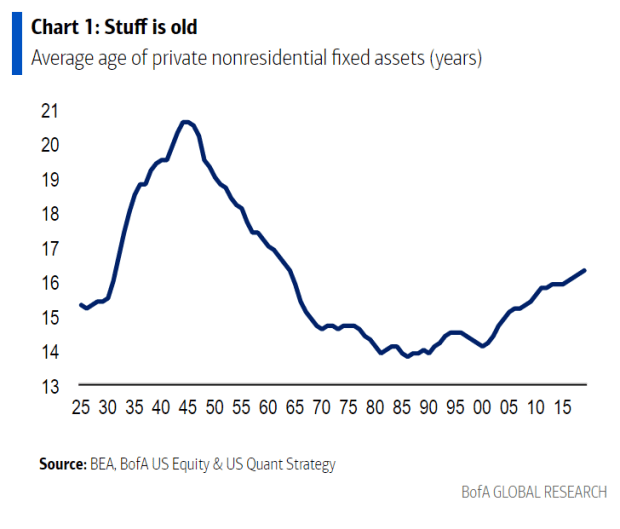

But which ones? Strategists have sifted through S&P 500 companies since 1986 for the greatest sensitivity to sales growth to components of private non-residential fixed investment in the United States.

For the highest commercial sensitivity to non-residential fixed investments in structures, this is a group led by the owner of the Kinder Morgan KMI pipeline,

Intercontinental Exchange ICE exchange operator,

oilfield equipment operator NOV NOV,

owner of the Nasdaq NDAQ scholarship,

and Ventas VTR Healthcare Real Estate Investment Trust,

For the greater sensitivity of sales to investment in technological equipment, this is Incyte INCY,

Lam Research LRCX microchip equipment manufacturer,

Electricity utility Centerpoint Energy CNP,

NetApp NTAP cloud services company,

and equipment manufacturer Applied Materials AMAT,

The highest commercial sensitivity to industrial investments includes some of the same companies: Incyte, biotech Vertex Pharmaceuticals VRTX,

manufacturer of home energy technologies Enphase Energy ENPH,

Lam Research LRCX,

and the fertilizer manufacturer CF Industries CF,

Network service provider Akamai Technologies AKAM,

travel service provider Booking Holdings BKNG,

online retailer Amazon.com AMZN,

network equipment supplier Juniper Networks JNPR,

and the network services company F5 Networks FFIV,

The strategists also looked at companies that would benefit from a relocation, including paper and packaging company WestRock WRK,

Ventas, CenterPoint Energy, high-tech lender SVB Financial SIVB,

and natural gas distributor Duke Energy DUK,

Waiting for Pittsburgh

Biden is due to make remarks in Pittsburgh on infrastructure spending shortly after negotiations end at 4:20 p.m. EST. The White House has said what is known as the U.S. Jobs Plan will include $ 2 trillion in spending over 10 years and will be fully paid for with $ 2 trillion in taxes over 15 years, including increasing the rate. corporate tax at 28%, thus increasing the global minimum. tax on US multinationals and establishing what is called a minimum tax of 15% on accounting income. Published reports indicate that the White House will make plans for about $ 2 trillion more in education and health spending within a month.

The economic calendar includes the ADP estimate of private sector employment, as well as the Chicago area purchasing managers index and pending home sales publications.

The Organization of the Petroleum Exporting Countries is meeting ahead of Thursday’s big rally which will include non-members such as Russia. OPEC lowered its estimate of oil demand on Tuesday, citing the rise in COVID-19 infections and the reimposition of lockdown measures.

Pfizer PFE,

and BioNTech BNTX,

reported that their coronavirus vaccine was 100% effective in children 12 to 15 years old.

Apple AAPL,

rose in pre-market commerce after UBS upgraded the iPhone maker to buy from neutral, citing hopes for a branded electric vehicle.

BlackBerry BB,

shares fell 6% after the security software provider reported lower-than-expected earnings, which the company blamed on a delay in selling patent licenses.

Sportswear manufacturer Lululemon Athletica LULU,

announced quarterly results better than expected. Chewy CHWY animal feed supplier,

also exceeded expectations.

Online food delivery company Deliveroo failed on its first day of trading, with the Amazon-backed company slipping up to 30% in London trading.

Rep Matt Gaetz was the main trend on Google after the New York Times reported he was under investigation into a relationship with a 17-year-old.

Want to understand the future of cryptos and NFTs? Register for MarketWatch’s Free Live Event

Nasdaq 100 gains

Futures on the S&P 500 ES00,

rose slightly while the Nasdaq 100 NQ00,

Futures posted stronger gains, after two consecutive declines for the S&P 500. The 10-year Treasury yield slipped to 1.72%.

Random readings

A Tokyo bar has a stock market theme, with drinks named “Margin Call” and “Lehman Shock” and books on value investing.

The Mars rover took a great selfie.

Need to Know starts early and is updated until the opening bell, but sign up here to receive it once in your inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern Time.

Want more for the day ahead? Sign up for Barron’s Daily, a morning investor briefing, featuring exclusive commentary from the editors at Barron’s and MarketWatch.

[ad_2]

Source link