[ad_1]

Walmart (NYSE: WMT) is one of the few consumer-driven business models that tends to thrive in times of recession, as consumers seek lower-cost solutions for the items they need. Walmart continued to expand its grocery store offering, as well as the number of stores offering online orders and in-store collections. In a world where everyone seems in a hurry, the ability to buy everything you need in a store or save time by ordering online purchases saves an hour or two a week.

Walmart has also expanded its e-commerce business, both organically and through acquisitions such as Jet.com and Flipkart. In the third quarter of 2019, online sales of the Walmart segment in the United States increased 43% sequentially. On the TTM, e-commerce revenues now represent more than $ 15 billion in revenue.

With the fourth quarter and full year results expected this week, I wanted to revisit this retail giant to see if it justified part of my investment capital.

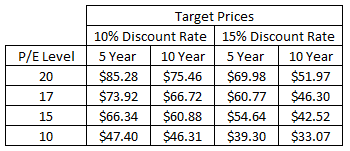

Dividend history

When I started investing, I turned to dividend growth. The premise is to focus on quality companies trading at fair or cheaper valuations and seeking to reap dividends while leaving capital gains generated over time. The idea behind this is that you can eat apples from an apple tree every year, but you can only harvest the wood one time.

Image by the author; Walmart Investor Relations data source. An interactive version of this chart can be found here.

Walmart increased its dividend payout for 45 consecutive years, earning it the David Fish Dividend Champion title. It's close to half a century of economic and geopolitical turbulence, inflation, stagflation and all the other "disasters" that would forever change the economy as we knew her. Yet each year, Walmart pays and raises its dividend.

Until 2013, Walmart had consistently forecast annual dividend growth in excess of 10%. However, as of 2014, dividend growth has slowed at a breakneck pace with increases of only $ 0.01 per share, which equates to an increase of about 2% per annum.

The growth rate of sliding dividends over one, three, five and ten years since 1993 is presented in the table below.

| Year | Annual dividend | 1 year | 3 years | 5 years | 10 years |

| 1993 | $ 0.06 | ||||

| 1994 | $ 0.09 | 49.47% | |||

| 1995 | $ 0.10 | 17.37% | |||

| 1996 | $ 0.11 | 5.20% | 22.66% | ||

| 1997 | $ 0.14 | 28.52% | 16.64% | ||

| 1998 | $ 0.16 | 14.79% | 15.78% | 22.18% | |

| 1999 | $ 0.20 | 28.87% | 23.88% | 18.61% | |

| 2000 | $ 0.24 | 20.00% | 21.08% | 19.14% | |

| 2001 | $ 0.28 | 16.67% | 21.74% | 21.63% | |

| 2002 | $ 0.30 | 7.14% | 14.47% | 17.28% | |

| 2003 | $ 0.36 | 20.00% | 14.47% | 18.33% | 20.24% |

| 2004 | $ 0.52 | 44.44% | 22.92% | 21.06% | 19.83% |

| 2005 | $ 0.60 | 15.38% | 25.99% | 20.11% | 19.62% |

| 2006 | $ 0.67 | 11.67% | 23.01% | 19.06% | 20.34% |

| 2007 | $ 0.88 | 31.34% | 19.17% | 24.01% | 20.60% |

| 2008 | $ 0.95 | 7.95% | 16.55% | 21.42% | 19.86% |

| 2009 | $ 1.09 | 14.74% | 17.61% | 15.95% | 18.48% |

| 2010 | $ 1.21 | 11.01% | 11.20% | 15.06% | 17.56% |

| 2011 | $ 1.46 | 20.66% | 15.40% | 16.86% | 17.96% |

| 2012 | $ 1.59 | 8.90% | 13.41% | 12.56% | 18.15% |

| 2013 | $ 1.88 | 18.24% | 15.82% | 14.63% | 17.97% |

| 2014 | $ 1.92 | 2.13% | 9.56% | 11.99% | 13.95% |

| 2015 | $ 1.96 | 2.08% | 7.22% | 10.13% | 12.57% |

| 2016 | $ 2.00 | 2.04% | 2.08% | 6.50% | 11.56% |

| 2017 | $ 2.04 | 2.00% | 2.04% | 5.11% | 8.77% |

| 2018 | $ 2.08 | 1.96% | 2.00% | 2.04% | 8.15% |

Table and calculations by author. Data Source Deposits from Walmart LP. An interactive chart of the table is available here.

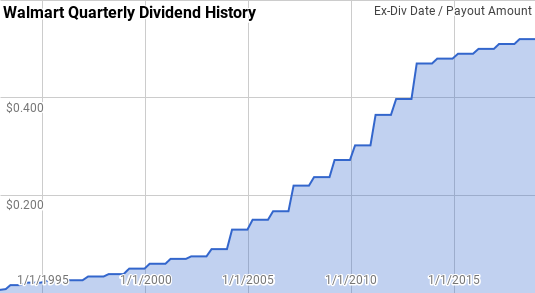

The slowdown in dividend growth has reduced the payout ratio based on free cash flow to more conservative levels. Over the past decade, the cash flow distribution ratio averaged 39.3%, while the average net income distribution ratio averaged 37.5%. For the TTM period, the net income distribution ratio is greater than 100%, although this is due to the fact that the accounting profit has been affected by the changes in tax legislation, which are not reflected in the cash flows. cash available. The dividend of Walmart is still very safe and well covered by the cash generated by the company.

Image by the author; data source Walmart SEC filings

How does Walmart earn money?

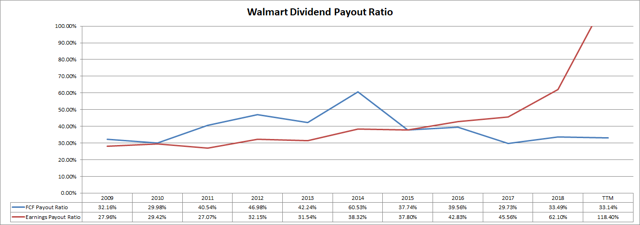

Walmart is the world's largest retailer with a variety of store formats (grocery store only, member stores and the best-known Walmart supercenter) where you can buy just about anything you can think of. Walmart is organized in 3 operational areas:

- Walmart U.S.

- Walmart International

- Sam's club

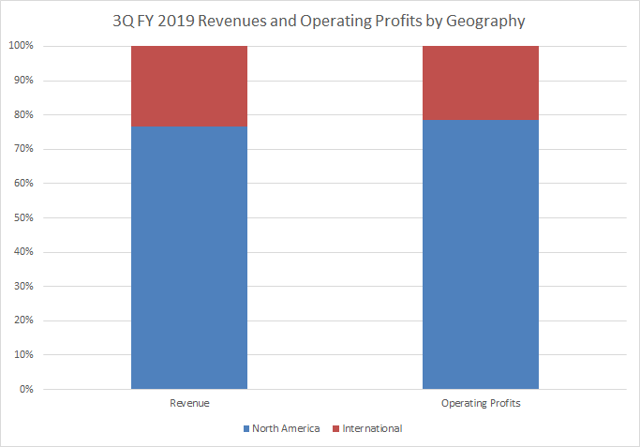

Image by the author; Data Source Walmart 2019 Third Quarter Quarterly Ranking

Walmart U.S. is by far the largest of the 3 in terms of revenue and operating profit, with approximately 65% and 71% for the third quarter of fiscal 2019, respectively. Walmart International is second in importance with 23% and 21%, respectively, Sam Club generating 12% and 7%, respectively.

Walmart U.S. also leads in terms of operating profit margin at 4.9%, Walmart International posting margins of 4.1% and Sam's Club well at the back with only 2.6%.

Image by the author; Data Source Walmart 2019 Third Quarter Quarterly Ranking

Approximately 77% of Walmart's revenues and 79% of its operating profits during the third quarter of fiscal 2019 were generated in the domestic market, with the rest coming from outside the United States. United. Although Walmart is highly exposed to the domestic market, it continues to be significantly exposed to the strength of the US dollar.

A strong US dollar is hurting international sales. Its magnitude will not change once converted to dollars for reporting purposes. However, it is also important to keep in mind that as a retailer, Walmart must purchase products to store shelves. While much of the production of consumer goods comes from outside the United States, particularly from China and other Asian countries, the strong US dollar allows Walmart to purchase cheaper products. .

Quantitative quality

The quality of an economic model will appear in his figures. That is consistent growth, improved operational efficiency and, most importantly, an accumulation of cash.

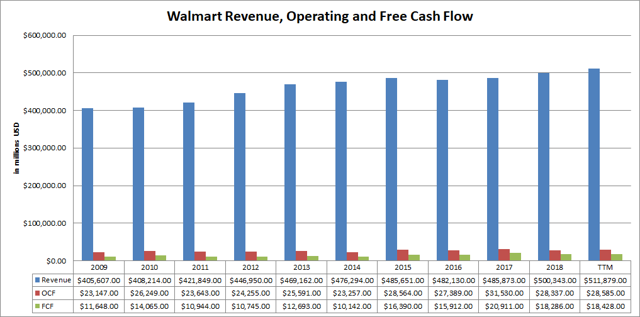

Image by the author; data source Walmart SEC filings

Despite Walmart's repeated "end of Walmart", Walmart has nevertheless managed to increase its sales by 23.4% over the last decade, or about 2.4% a year. In fact, it is quite amazing to think that a company with more than $ 400 billion in annual sales in 2009 could raise that figure to $ 500 billion in 10 years, once the business is almost fully developed. Even more impressive is the fact that turnover has also declined only year-on-year.

Over the same period, operating cash flow increased by 22.4% or 2.3% per annum, with free cash flow increasing by 57.0% in total or 5.1% per year. With operating cash flow at the same pace as revenue growth, operating cash flow stagnated over the decade, while free cash flow margins improved significantly, even though they remain stable. at very low levels.

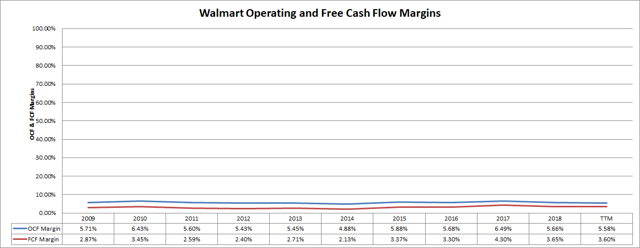

Image by the author; data source Walmart SEC filings

My preference is for companies in which I invest to have margins of 10% or more on their free cash flow. Walmart clearly fails this test with free cash flow margins averaging 3.1% over the past decade. The 10% threshold is very sector-specific and in Walmart's low-cost retail space margins are noticeably lower than in other sectors.

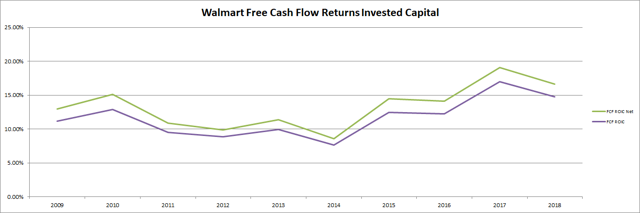

Alternatively, I like to see the profitability of a company via its free cash flow return on invested capital. CWF ROCE is the annual return that the business could generate if you owned it in full under the current capital structure. I have also included the "net" CFI value for ROI, which deducts funds held in the balance sheet from equity and debt. Again, I want to see a value greater than 10%.

Image by the author; data source Walmart SEC filings

Walmart has not exceeded the level of 10% each year over the last decade; However, they have consistently been above or slightly below 10%. The average over the last decade was 11.7%, with an average net income of CFI of 13.3%. Both are at healthy levels and since 2014, the trend is up.

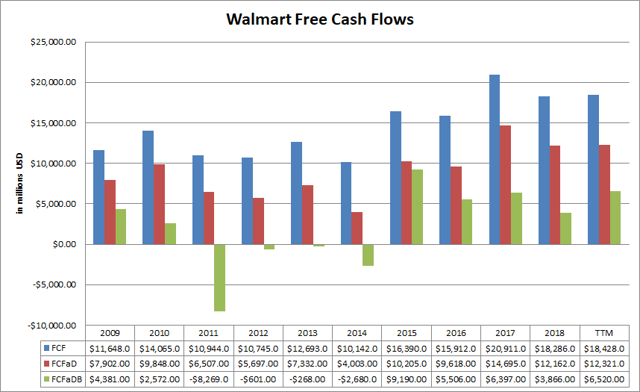

To understand how Walmart uses its free cash flow, I like to look at 3 variations of the metric, defined below:

- Free Cash Flow (FCF): a traditional calculation of free cash flow related to operating cash flow less capital expenditures.

- Free cash flow after dividends (FCFaD): FCF minus total cash dividend payments.

- Free cash flow after dividends and redemptions (FCFaDB): FCFaD less the total money spent on the share buyback.

Candidates for the ideal investment will most often show a positive image of FCFaDB. A positive FCFaDB would mean that the company generates enough cash to continue and grow its business, as well as to reward shareholders with dividends and share buybacks. If the FCFaDB trend is negative, management will be forced to use cash or balance sheet assets or seek external financing through the capital markets.

Image by the author; data source Walmart SEC filings

Over the past decade, Walmart has increased its annual FFT by more than 50% and generated an average of $ 14.17 billion annually in FCF. Cumulatively, Walmart generated $ 141.74 billion in FCF, an incredible total.

This FCF has allowed Walmart to pay $ 53.78 billion to its shareholders in dividends over the last decade and brings the FCFaD to $ 87.97 billion for the entire period with an annual average of $ 8.80 billions of dollars.

Walmart has also used $ 67.86 billion in total share buybacks over the past decade, for an average of $ 6.79 billion annually. This places FCFaDB for the last decade at $ 20.09 B.

Walmart has been truly exceptional in managing its free cash flow and not in allocating cash to dividends or redemptions. The performance of FCFaDB should allow management to continue dividend increases and continue share buybacks with internally generated cash.

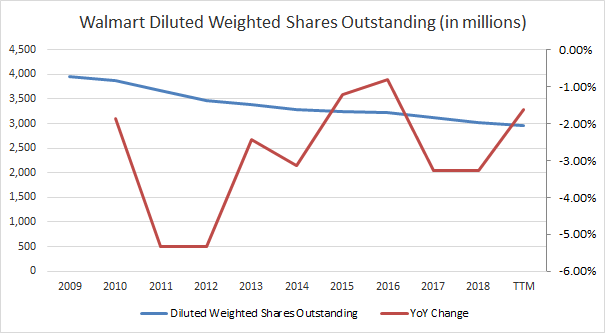

The $ 67.86 billion spent on share buybacks over the last decade has reduced the number of diluted weighted shares outstanding over the last decade by 23.8%. This is good for an annual reduction of 3.0%.

Image by the author; data source Walmart SEC filings

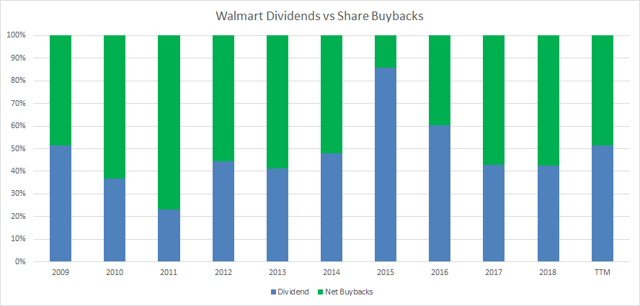

The chart below illustrates Walmart's liquidity ratio for dividends and redemptions. While I concede that share repurchases are more tax efficient, I still prefer that dividends represent a larger portion of the money given to shareholders. It takes strong leadership not to force stock repurchases of feed if the use of capital is not wise, and many directions are struggling to buy a dollar of gain for $ 0.50, not to mention of a 1: 1.

Image by the author; data source Walmart SEC filings

The ratio of cash returned to shareholders has been fairly variable over time; However, the ratio usually oscillates around 60/40 or 50/50 for dividends compared to stock repurchases.

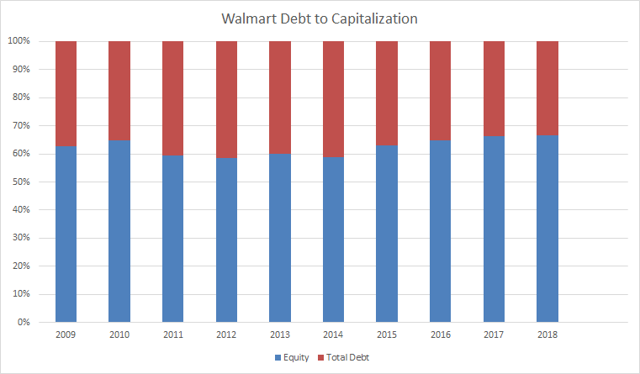

Image by the author; data source Walmart SEC filings

With plenty of cash, Walmart did not need to take on more debt. That's why total debt versus capitalization has been very consistent over the last decade, with debt representing about 40% of the capital structure and equity, about 60%. Walmart's debt is highly manageable and it would take only 2.1 years of free cash flow to fully repay free cash flow, which also covers interest at 8.3x. I would always prefer to see the debt reduced; However, Walmart's balance sheet does not raise any concerns at this time.

Risks for an investment

The elephant in the room is Amazon (AMZN). Amazon is one of the few retail companies to have the size to challenge Walmart as a low cost consumer supplier for any product they want to buy. That being said, at least until now, I think Mark Twain said it was better to say that "the rumors of my death have been greatly exaggerated".

Despite Amazon's growing presence, Walmart has further increased its sales over the last decade, with a decline of only one year. In addition, Walmart is expanding its e-commerce business and has made great strides in this department with revenues in excess of $ 11 billion last year. Much remains to be done to compete with Amazon in e-commerce, but Walmart has made progress and should continue to do so.

Walmart also offers in-store grocery collection, which I have not used yet, but that's because I preferred grocery shopping. My time is running out, I feel the need to buy time with online shopping, even if it could very well change with our second child expected in April.

The other big risk is that we keep on pushing for wages to rise. As one of the largest employers, Walmart will increase its wages. That does not worry either, because Walmart has already pushed his starting salary up to $ 11 at the hour and that employees may be at least returning part of the increase in salaries to sales at Walmart. In addition, the increase in wages will ultimately become less economical than the automation that management is already pushing.

Evaluation

One of the methods that I use to determine the value of a company is the analysis of the minimum acceptable rate of return, or "MARR". A MARR analysis involves estimating future earnings and dividends, applying a valuation to future earnings, and then determining whether the expected return meets your investment threshold.

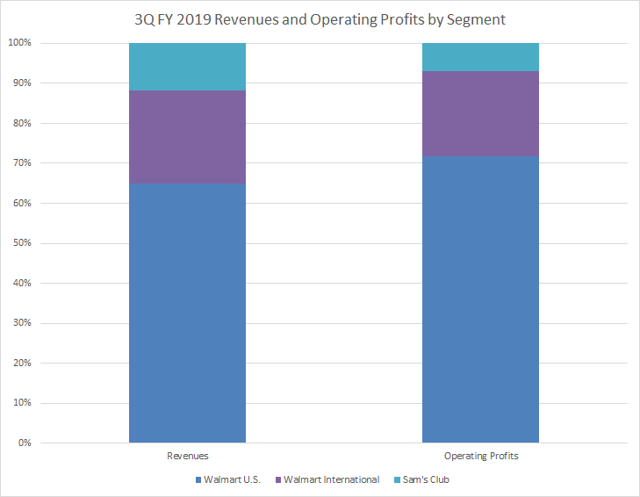

On average, analysts expect Walmart to make a profit of $ 4.72 for fiscal 2019 and grow 6.0% of its annual profits over the next five years. I then assumed that earnings growth would slow to 4.0% per year for the next 5 years. I assumed dividends would be targeted at 45% of annual earnings per share.

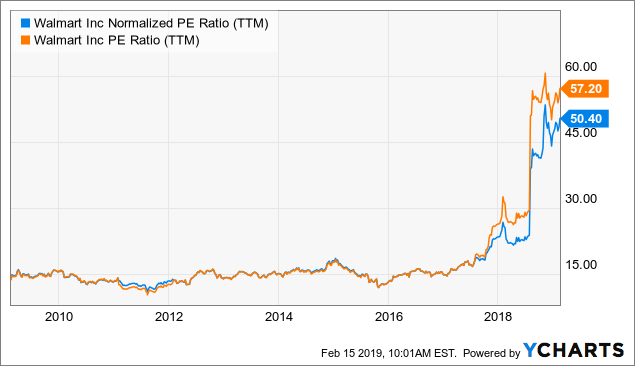

To determine a reasonable valuation, use historical multiples that investors have assessed Walmart's earnings. As you can see in the following chart, investors generally rate Walmart's profits between ~ 10x and 20x. Using a modified Graham number calculation, the fair P / E is about 17x. For the MARR analysis, I will examine the multiples in this range.

Data by YCharts

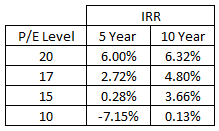

The chart below shows the potential internal rates of return that an investment in Walmart could generate if the purchase price is about $ 100 per share. The returns include estimated dividend payments and are executed until the end of the 2023 calendar year, "5 years", and the 2028 calendar year, "10 years".

Alternatively, I want to determine price targets that can generate internal rates of return of 10% and 15% depending on the different P / E ratios. The same assumptions as above apply to the following calculations.

Conclusion

Walmart's business has been successful over the past 57 years, from a single store in Arkansas to the largest retailer in the world. The retail sector is known for its very low profit margins; However, Walmart has always shown that its management is focused on its free cash flow.

The current problem with Walmart is not the commercial activity, but the price of the action. At nearly $ 100 per share, the valuation seems too high given Walmart's relatively weak growth prospects. If analysts expect EPS of $ 4.72 for fiscal year 2020, you are paying more than 21 times the term profits of a company that should only experience a growth of 6% per year. year. It's a heavy premium to pay even for a quality company.

If you do not expect much more growth than expected in this analysis, the current price performance looks meager.

Even adding the perpetuity value of the dividend stream assuming there is no future growth after 2028, we add only $ 12.80 per value share in the target price of the discount rate of 10% and $ 5.47 per share at the 15% threshold. That would still have Walmart shares quite overvalued.

I believe that there are currently better opportunities in the market and that better opportunities to buy Walmart stock will arise in the future. Unfortunately, I can not tell you when it will be. Given Walmart's current growth prospects, I would begin by considering buying shares in the middle of $ 80, about 15% below the current stock price, and I would probably not add stocks. until a price above $ 70 is found.

I am not a finance professional. Please consult an investment advisor and do your own due diligence before investing. Investing involves risks. All the thoughts / ideas presented in this article are the opinion of the author and should not be considered as investment advice.

Disclosure: I am / we are long WMT. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link