[ad_1]

The Fed currently leaves up to $ 50 billion in revenue from treasuries and mortgage-backed securities, although it does not hit that figure regularly. Beyond that, everything would be reinvested.

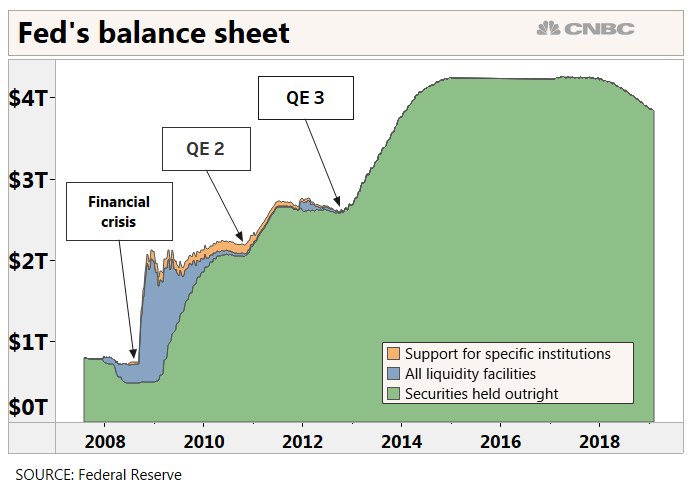

Since the beginning of the process, the bond portfolio has been reduced by more than $ 400 billion. Previously, the balance sheet had risen to $ 4.5 trillion, resulting from three rounds of bond buying – quantitative easing – that the Fed instituted to lower long-term rates and exit the US dollar. Economy of the financial crisis.

Market participants are now wondering where the Fed will go. The minutes will be closely scrutinized, especially given the stock market rally after the meeting and the perception that the Fed would take a less aggressive approach to tightening.

"The minutes of the two previous meetings – November and December – included important parts of the balance sheet," said Lewis Alexander, chief economist at Nomura, in a note. "We believe that the corresponding section of the January Minutes will confirm the Committee's intentions to end the normalization of its balance sheet by the end of 2019".

Several Fed officials have mentioned the end of the year as a likely point for the end of the process, but even this is still evolving.

Up to now, the key to the discussions is the level of reserves that the banking sector feels comfortable with. The lower balance sheet corresponds to a lower level of reserves. At present, banks hold about $ 1.64 trillion in reserves, nearly $ 1.5 trillion more than the required level.

Many Fed observers believe that the final level will reach a little over $ 1 trillion, although some see it higher.

"Once we reach $ 1.1 [trillion] Standardization is done, "writes Jabaz Mathai, head of US interest rate strategy at Citigroup.

[ad_2]

Source link