[ad_1]

Scroll through any major financial site and you will quickly see an article on "FAANG actions". If you are new to investing, it can be very confusing. Are we talking about a company dealing with vampires or snakes?

The reality is much simpler. The acronym "FAANG" represents some of the most important and important technological values in the world – the companies that turn the gears of our daily lives:

- Facebook (NASDAQ: FB) – the world leader in social media, which also has Instagram and WhatsApp.

- Apple (NASDAQ: AAPL) – the company behind the iPhone.

- Amazon (NASDAQ: AMZN) – which has marked the era of e-commerce and has also set up an extremely profitable cloud operation.

- Netflix (NASDAQ: NFLX) – the first and most successful video streamer in the world.

- Google (NASDAQ: GOOG) (NASDAQ: GOOGL) – technically, the search giant is now a subsidiary of Alphabet.

The actions FAANG – Facebook, Apple, Amazon, Netflix and Google – are now an integral part of our daily lives. Source of the image: Getty Images.

Why are FAANG stocks so important?

If you participate in modern American society, it should be easy enough to understand why these five values are so important. Many people start their day looking at their iPhone (Apple) to see what their friends and family do (Facebook) or check the latest news (Google). They finish their day by returning home to see a package waiting at their door (Amazon) and go inside to watch their favorite show streaming video (Netflix).

It may be a little dramatic, but you understand: these five companies have fundamentally reshaped our daily lives. Not that you need to convince, but consider the ubiquity of these players:

How have FAANG actions evolved?

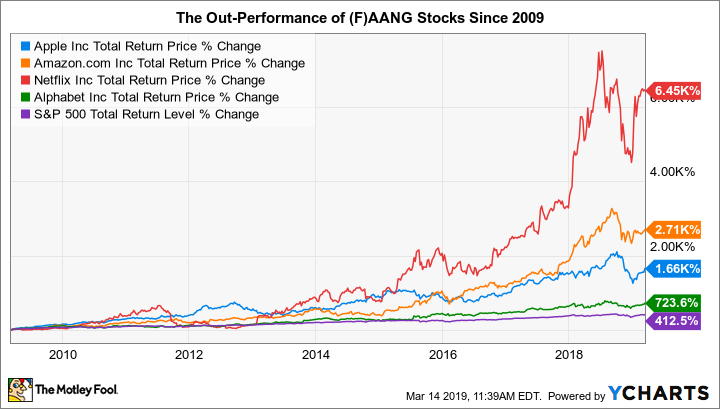

Unsurprisingly, these five stocks therefore recorded an exceptional performance. In fact, they have been the main drivers of economic growth via the stock market since the last closing of the bear market on March 9, 2009.

At that time, Facebook was not yet public. The other four were – and their returns eclipsed the S & P 500 Index. This is how they played in early 2019.

AAPL Total Return Price data by YCharts.

For those who stay home, this represents an average return of 2,900% in just ten years. An investment of $ 10,000 distributed evenly across these four centers was worth $ 300,000 10 years later. If you come to invest in the wider market (the purple line), you would have had just over $ 50,000.

Another way of looking at it is to say that these four countries have reported about 40% per year over the last 10 years. Facebook was released in 2012 and has reported about 25% per year since then.

Of course, past performance does not mean that there is a 100% chance that these types of returns will continue. But in hindsight, no matter how you cut it, these five stocks have performed exceptionally well.

Today, the total market capitalization of the five stocks is close to $ 3.2 million. trillion. That's more than the total economy of all but four countries – the United States, China, Japan and Germany – in the world.

Which stocks of FAANG should you have?

Clearly, the shareholders of these five stocks have benefited from huge returns. But the stock market is a forward-looking entity, and the important question is: how many of these five stocks should you own in the future? Since all these companies are already so big, are their best days of growth already behind them?

There is no definitive answer to these questions. For every potential investor in FAANG shares, there are a multitude of variables to consider: age, lifestyle, risk appetite and income, to name a few. only a few. Your approach will change with each new situation.

For each company, we will cover what I consider to be the most important factor: the gap of a company – its sustainable competitive advantages. There are four main varieties of moat:

- High switching costs: This occurs when leaving a company to a competitor may be costly, time-consuming, or too much of an inconvenience for the user.

- Network effects: With each additional user of a product or service, this product or service becomes more valuable.

- Low cost production: When a company can offer a good or service as good as the competition, but at a lower price.

- Intangible assets: This includes patents, government-regulated protection and the value of the brand.

We will start with the largest social media company in the world.

Facebook has a very wide gap. It is mainly in the form of network effects. In fact, no business is a better example of network effects than Facebook. Every additional user of Facebook – or its other properties: Instagram, WhatsApp or Messenger – makes the service more valuable. Who would like to join a social network without anyone else?

And although many worry about the increase in security spending, I think it's becoming a long-term benefit for Facebook. Not only must competing social media networks produce something very different, but they must also have enough money to provide the same level of security. Few have such resources.

Apple

Then we have the most successful product designer in the world … ever. What the iPhone has done in just over a decade is unprecedented.

The main gap of Apple comes in the form of the value of its brand. In Forbes & # 39; In the 2018 ranking, Apple had the most valuable brand in the world, estimated at $ 182 billion. It's pretty easy to see this in action: people line up in front of Apple stores for hours to buy the next iPhone, even if a lot cheaper Android smartphone is available.

Apple has actually done a good job creating new ditches around his business. ICloud services and device synchronization, for example, represent a slightly high switching cost. After all, it is rather embarrassing to easily lose access to all these files.

The company's App Store also benefits from network effects: As more people buy apps for their devices, third-party app developers are encouraged to build apps on Apple's platform . But in the end, it's the brand that counts. Otherwise, the other parts just do not work.

This is a very important factor to take into account. The value of a brand can be inconsistent. Apple reached its peak in the era of Steve Jobs, when the company was creating products – the iPod, the iPad and the iPhone – every few years we did not know that we needed so much.

Since the unfortunate disappearance of Jobs, Apple has not innovated in the next step. Until now, this has not stopped the company. But it must be remembered that competition is fierce and that Apple's main gap is narrower than that of other companies in this group.

Amazon

If you seem to see these Amazon boxes within everyone's reach, you can not imagine anything: it is estimated that the company possesses half of all online sales in the United States.

Personally, I am a strong advocate of actions – it's my biggest involvement, and all of this has to do with the huge gaps that surround society. Let's review:

- High switching costs: Although it's not the most powerful of the four, the contract that customers can get with Amazon Prime is simply unmatched. Between free delivery, access to digital content and a host of other benefits from Amazon Prime, it is impossible to find a better deal by giving up Prime.

- Network effects: Amazon is the # 1 destination for online shoppers. The sellers know it. They are therefore willing to list their content on the site and use Fulfillment by Amazon. Of course, this simply attracts more consumers, which attracts more sellers. It is a virtuous cycle.

- Intangible assets: The biggest intangible benefit for Amazon is the value of its brand. Forbes the class as the fifth most valuable in the world, with just under $ 71 billion.

- Low cost production: This is, in my opinion, the strongest gap. Amazon has a network of 138 multi-million dollar distribution centers and 160 others overseas. This allows the company to provide products to customers faster and at a lower internal cost than the competition.

Another important factor to remember with Amazon is the optional nature of the company. This is another way of saying that there are a multitude of ways to accomplish Amazon's ultimate mission: to be the most customer-centric company on the planet.

This is the only way to explain what Amazon has become to a person traveling nowadays from 1997. "An online bookseller has become the largest e-commerce store in the world. and the leader in IT? What in the world? "You can imagine the confusion.

But this is what happens when you aim for such a vast goal. Most ordinary Americans, for example, might not realize that the bottom line of Amazon's profits actually comes from Amazon Web Services (AWS), not e-commerce. This part of the business is protected by high switching costs (while users can switch from AWS to task, that's a problem), as well as by network effects (more people are using AWS, the more data they can collect and the more their AI efforts). .

Who knows which industry will be the next to be disturbed?

Netflix

Who does not know Netflix? It's a bit staggering that just 10 years ago, streaming was just a test project for Netflix. These red envelopes were really the main part of the business. Today, they are an afterthought.

The moats of Netflix are for the most part under the radar of investors, even if they benefit considerably. The company uses its brand to attract customers and supports sneaky switching costs that keep them going.

The most important factor for getting new subscribers is the quality of the original content. If the only place where you can watch something is on Netflix, you will have to register. And since the company's performance at the Oscars continues to turn heads, everything is going well here.

Then there are the high switching costs. No, switching costs are really not that high. But when your monthly payments are automatically billed to your credit card, you hardly notice what's going on. This means that unless there are huge price increases or terrible public relations, the current users will probably be the lifetime users.

But it is worth noting some caveats that do not relate to the gap in society. Chief among them: Netflix has hand in hand for the original content. Since the brand of the company is the way it attracts subscribers – and the brand is powered by the original content – such expenses make sense.

This is however only the case, as long as Netflix continues to produce popular broadcasts. Investors should keep an eye on the quality of the original content as well as on the balance sheet and the cash flow statement.

By the end of 2018, Netflix had $ 3.8 billion in cash but a $ 10.4 billion long-term debt. In addition, it lost $ 2.85 billion in free cash flow during the year. This is not sustainable – and the trends must finally reverse so that Netflix remains a good investment.

Google / Alphabet

Finally, we own the two most popular websites in the world: Alphabet. Not surprisingly, Google.com is the first global destination. But did you know that Alphabet also has YouTube.com – the second most popular site?

The average surfer spends 17 minutes each day on these two sites combined. This might not seem like a lot. But over an entire year, that represents 103 hours on these sites – multiplied by the time Billions Internet users.

For Alphabet, this gap is in the form of low-cost production. What does it produce? The data. And in the connected world of today, it is like a striking oil. If you remember, since the beginning of the article, Google offers eight products with more than one billion active users. Once installed, these tools do not require heavy investments, they import data at a lower cost than anyone (except perhaps Facebook) could dream.

However, owning stocks has one more advantage: Alphabet dedicates a certain amount of safe capital to high risk, high paying moonshots. Many of these projects will fail, and it does not matter. All it takes is a single lunar blow to be successful, and the company could significantly increase its income. Already, it's becoming clear that Waymo – the Alphabet Autonomous Vehicle Initiative – could be the first big hit.

But this is not the only momentum of the note. The company is attempting to provide wireless access to remote areas of the world (Project Loon), protect people from advanced cybersecurity threats (Chronicle) and expand the delivery of autonomous drones (Wing), for to name a few.

Owning Alphabet shares, as I do, gives you exposure to both the advertising industry and broad-based data, while benefiting from the positive potential of moonshots. For me, it's a good deal.

Are there any risks for the FAANG actions as a group?

You can look at these five companies and think, "These are all technology companies, I do not want too much money in the technology sector!

This point of view is both correct and short-sighted. Yes, these five companies use technologies that did not exist just 25 years ago. The same goes for almost all other public procurement companies..

If you want to invest too much money in these five actions, here is a simpler way to see what these five players really are:

- Alphabet and Facebook are advertising agencies.

- Apple is apparent to a high-end fashion company.

- Netflix is an entertainment company.

- Amazon is a bit of everything: retailer, market, shipping specialist and, more and more, advertising equipment.

The biggest risk investors should be aware of is that four of these five people have recently landed on the grids of politicians and regulators. Netflix is not considered a monopoly by those who are most concerned about the antitrust issues of FAANG shares, but the other four are. Apple may seem a strange inclusion here, but the company's practices in the Apple App Store have sparked the fury of some critics.

While it's never a good idea to make investment decisions based on what politicians can or can not do, it's good to get into any investment with your eyes wide open.

Should I buy FAANG shares now?

In total, FAANG shares are a huge part of many portfolios. Does this mean that you should run out of time and spend most of your money on these actions? Barely.

If you are interested in the actions of FAANG but do not have any yet, I suggest you take an approach that allows you to calm down over time. Let's say that Amazon is your favorite stock of the group. Next, I suggest allocating, for example, 2% of your wallet to this one now. You can add some later if you feel comfortable with this movement.

This may seem like a boring approach. It takes time to get stellar results, and no one is waiting. But it's also effective and it helps to ensure that you do not put too much behind a title before you know it.

In addition, there is no guarantee that these businesses will not be disrupted. After all, this is how they have been so successful: by disrupting market leaders. They did so well that they now have the target on the back.

All that being said, I think every investor should carefully consider spending a reasonable portion of their portfolio on FAANG shares. They are market leaders for a reason and represent some of the most beautiful businesses that America – or the world – has ever known.

[ad_2]

Source link