[ad_1]

The crypto bull market remains at full throttle. This was good news for Nvidia (NVDA). The chip giant sells the GPUs used as crypto mining platforms, providing the company with another revenue stream.

RBC’s Mitch Steves estimates that between January 31 and March 7, the company generated between $ 225 and $ 275 million in revenue from selling GPUs to mine Ethereum – the second largest cryptocurrency. by market capitalization.

There are two ways for miners to earn their money; The first is a reward for finding the new block and the second comes from the gas fees – or in Ethereum’s case, Gwei – that users pay to complete a transaction.

However, the Ethereum developer community recently decided to change the protocol.

Starting in July, Ethereum will move forward with Ethereum Improvement Proposal (EIP) 1559, which will overhaul how blockchain works and make it more user-friendly.

However, miners are not happy with this development as the changes will mean they will only receive an optional tip from transactions, instead of gas charges that will be sent to the grid and “burned”.

Steves believes that in most cases the mining fees, and not the overall reward, represent over 50% of crypto mining revenue. Therefore, starting in July, this revenue stream “may drop significantly” and the upgrade “will reduce the combined transaction fees / tips given to minors.”

Ok, so the upgrade is good for users, but bad for minors. But what does all of this mean for Nvidia?

“Put simply, if investors believe that EIP 1559 will drive the price of Ethereum up quickly and drive its adoption, NVDA could sell up to $ 700 million worth of GPUs in the second quarter,” said the 5 star analyst. “If investors believe transactions won’t change and mining fees will erode quickly, all cryptocurrency sales would come to a halt in July 2021 as used GPUs find their way into the secondary market.”

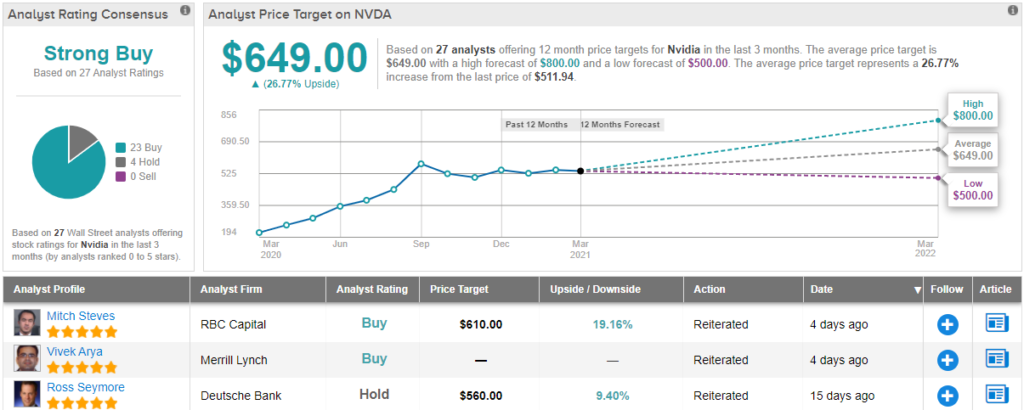

Either way, Steves remains an Nvidia bull. The analyst gives NVDA an outperformance (i.e. buy) rating with a price target of $ 610. Investors could pocket gains of around 19%, if Steves’ thesis proceeds accordingly. (To look at Steves’ record, Click here)

Looking at the breakdown of consensus, most of the RBC analyst’s colleagues agree. Based on 23 buys versus 4 takes, the stock has a Strong Buy consensus rating. There is upside potential of around 27%, given the average price target is $ 649. (See Nvidia stock market analysis on TipRanks)

To find great ideas for tech stocks that trade at attractive valuations, visit TipRanks Best Stocks to Buy, a newly launched tool that brings together all the information about TipRanks stocks.

Disclaimer: The opinions expressed in this article are solely those of the analyst presented. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

[ad_2]

Source link