[ad_1]

What happened

Actions of Break (NYSE: SNAP) climbed 11% at 11:30 am EDT after BTIG Research upgraded the company. Analyst Rich Greenfield has expressed skepticism about Snapchat's parenting prospects, but is changing the subject.

So what

BTIG had already reduced its rating on Snap to be resold in September, then passed on the sidelines with a neutral score in December. Greenfield is moving to the buy category with a price target of $ 15, despite the fact that "just about everything that could go wrong for Snapchat in the last two years since the ad went bad". However, the analyst is encouraged by the fact that emerging market-based advertisers have slightly increased spending in North America, potentially taking advantage of low prices for ads.

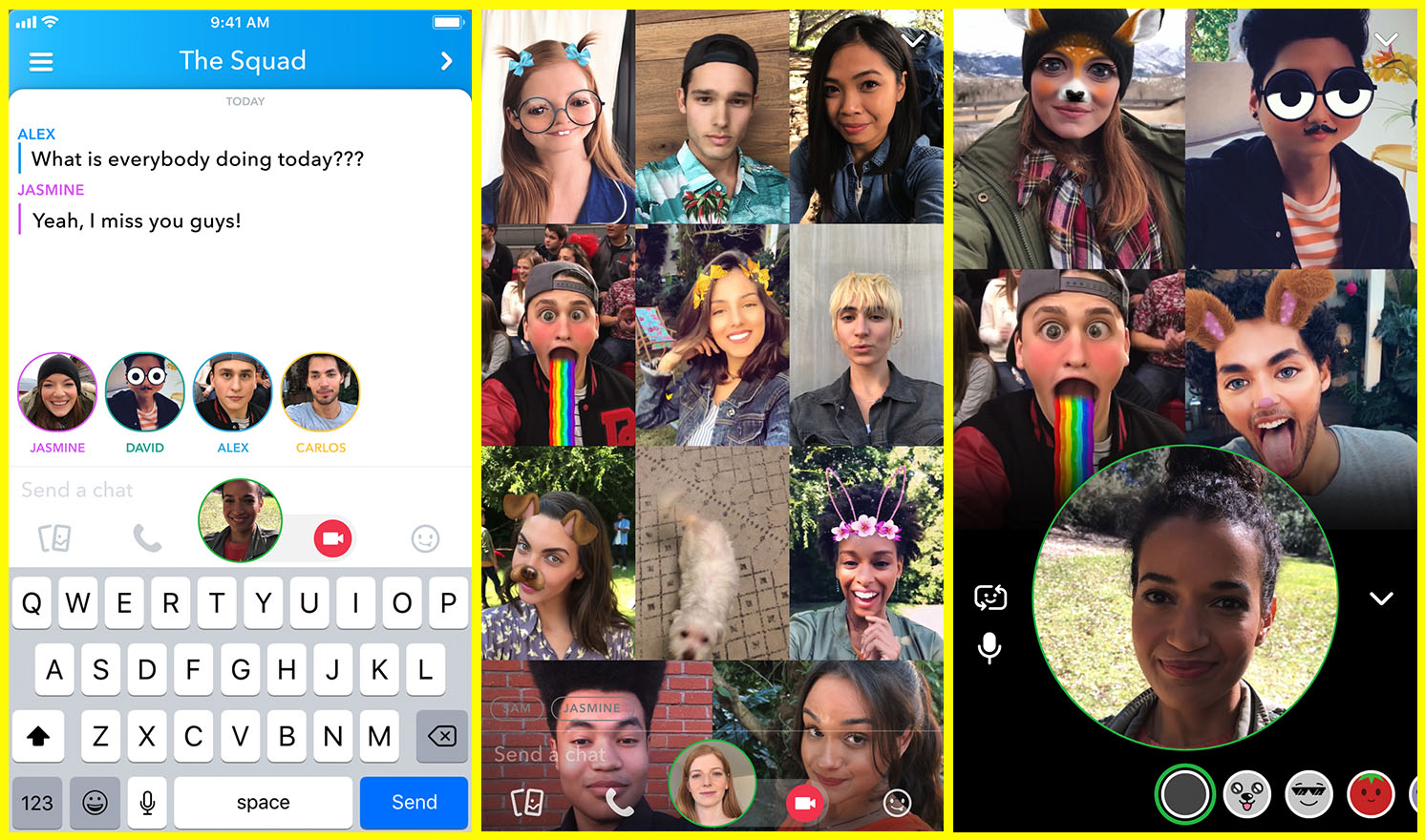

Source of the image: Snap.

According to Greenfield, the quality of ads in the Snapchat Discovery section has also been significantly improved, with a "significant reduction in clickbait content / shady influencers and an increase in premium / publisher content." Snapchat remains incredibly popular with primary users who use the platform for communications and Snapchat still has potential for international expansion. The company's progress in improving the performance of the application on Android are also a welcome sign.

Now what

BTIG still has some concerns, including US Department of Justice and SEC investigations into IPO information. The outcome of these investigations could adversely affect Snap's cash position.

Greenfield has adjusted its estimates and now expects a negative free cash flow of only $ 510 million. He no longer believes that Snap will need to raise capital by 2020. The analyst is currently modeling revenues of 2019 rising to $ 1.65 billion, compared to an earlier estimate of $ 1.4 billion. Greenfield expects a turnover of $ 3.4 billion in 2022, up from $ 2.1 billion previously.

Evan Niu, CFA does not hold any of the shares mentioned. The Motley Fool has no position in any of the actions mentioned. Motley Fool has a disclosure policy.

[ad_2]

Source link