[ad_1]

Arthur Hayes, CEO of BitMEX, the most widely used margin trading platform for cryptographic assets such as Bitcoin and Ethereum, said the bull market for bitcoins was real.

Hayes m said on Twitter:

"The bull market is real. A momentary dip below $ 7,000. A few days later, we went back over $ 8,000. [June and September] the contracts are in contango. Booyah! "

Optimism over Hayes' bitcoin price trend follows a strong recovery from last week's crypto-currency, in which assets rebounded from $ 6,400 to $ 8,000 in less than three days .

The market benefited from the $ 6,400 drop in bitcoin

As previously reported by CryptoSlate, following the sale of 5,000 BTCs on Bitstamp, many bitcoin contracts on BitMEX were liquidated on May 17, due to the strong dependence of BitMEX's power supply on Bitstamp.

As a result, the price of bitcoin fell briefly to $ 6,400, recording an 18% drop in overnight value.

In just 72 hours, the market absorbed the unexpected fall in the price of bitcoin on Friday, resulting in a sharp recovery of bitcoin.

While the price of the bitcon again exceeded the $ 8,000 mark, the main cryptographic assets, such as EthereumBitcoin Cash, XRP, Litecoin and BNB posted gains of around 10 to 20% against the US dollar.

The immediate recovery of Bitcoin after an unexpected 18% drop in less than three days indicates that the sentiment surrounding the cryptography market is currently very positive and investors are likely to overwhelm the bears.

As a cryptocurrency operator m said:

"Hell of one bullish weekly closing on bitcoin with a record volume, solidifying the strength and validity of this rally. The BTC / USD is full of bulls. "

Industry leaders, including Barry Silbert, have begun to express optimism about the current trend in cryptographic assets, saying that the recent recovery of bitcoin is fundamentally different from that of the end of 2017. .

While the rise in the cryptography market in 2017 was triggered by a growing interest in retail, Barry Silbert, CEO of the Digital Currency Group (DCG), said the recovery of 2019 had been catalyzed by the fact that there was no need for it. notable improvement in institutionalization and infrastructure supporting the asset class.

Silbert said what was missing this week on Bloomberg:

"The feeling, the techniques are superb. An 80% withdrawal took place three or four times and each time that happened [it hit] records records. So as soon as the price goes up again and the animal instinct comes back. But the difference between this price increase compared to the bubble in 2017 is that the infrastructure is very different. You have guards now. you have trading software, compliance software, people are informed about the asset class, so this time it's different.

Does the $ 1 billion increase in Bitfinex help you?

A month after its billionaire shareholder had mentioned the possibility of a billion dollars to help Bitfinex solve its relationship with Tether, the stock exchange's CTO announced that it had completed the $ 1 billion fundraiser.

Bitfinex sought to raise new capital after the New York Attorney General's Office alleged the misuse of Tether's cash reserves of more than $ 900 million in order to "conceal" its loss of 850 millions of dollars.

A $ 1 billion IEO brought together in less than a month. The bull market is there, buckaroos on the belt !! https://t.co/4DaZ0fNtXe

– Arthur Hayes (@CryptoHayes) May 13, 2019

Hayes said that the $ 1 billion increase in Bitfinex via an IEO is also an indicator of the positive sentiment with regard to the cryptography market.

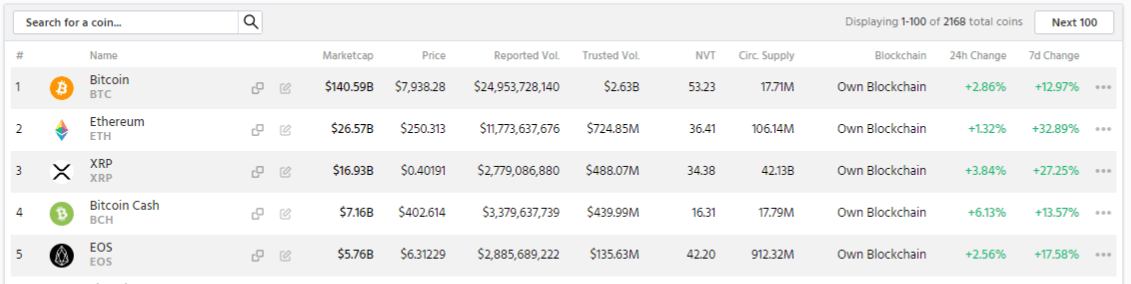

Bitcoin, currently ranked number 1 by market capitalization, is on the rise 2.68% in the last 24 hours. BTC has a market capitalization of $ 142.12 billion with a volume of $ 24.77 billion over 24 hours.

CryptoCompare's graphic

Bitcoin is up 2.68% in the last 24 hours.

Filed Under: Bitcoin, BitMEX, People of Blockchain, Price Watch

Warning: The opinions of our writers are only theirs and do not reflect the opinion of CryptoSlate. None of the information you read about CryptoSlate should be considered as investment advice. CryptoSlate does not support any project that may be mentioned or associated with this article. The purchase and trade of cryptocurrencies must be considered as a high-risk activity. Please do your own due diligence before taking any action related to the content of this article. Finally, CryptoSlate takes no responsibility if you lose money by exchanging cryptocurrencies.

[ad_2]

Source link