[ad_1]

Some mergers and acquisitions are taking place in the world of market research and analysis, highlighting how our media consumption and consumption habits revolve around digital platforms. WPP announced today the sale of 60% of Kantar – the company that provides statistics and information on how consumers buy and think about service products in areas such as technology, media, health etc. (we wrote several articles on TechCrunch citing Kantar figures) – to Bain Capital, the private equity firm. The cash transaction is expected to yield $ 3.1 billion to Kantar, net of taxes and investments it will make in Kantar after the transaction, and valuate Kantar at $ 4 billion (or £ 3.2 billion), announced WPP, based in London.

The agreement is a big success that limits the months of speculation, after WPP announced in October 2018 its intention to seek an outside investor to take a stake in Kantar, partly to generate revenue from the transaction and partly to invest in l & # 39; transaction. The plan had always been to keep participation in WPP, as there are many areas in which Kantar collaborates with other parts of WPP, one of the largest advertising agencies in the world.

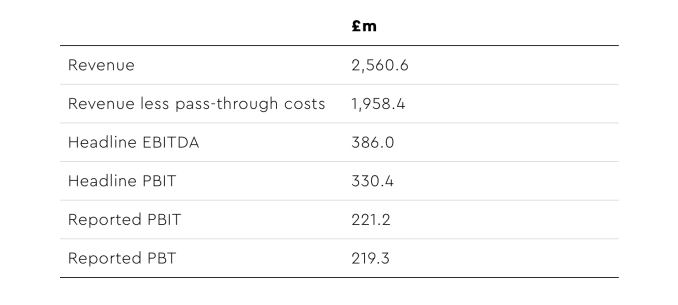

CVC, Apollo and Platinum would also have been interested in buying the stake. Kantar reported revenue of £ 2.56 billion ($ 3.2 billion) in 2018 and is profitable, according to WPP's sales announcement figures:

The partial divestment highlights how WPP reorganized and redefined after the departure of its longtime chairman and president, Martin Sorrell, who resigned last year, who resigned under a cloud of controversy.

Mark Read, who took office as CEO, has taken a different approach to mergers and acquisitions, partly to make up for sluggish growth, and it's a product of that.

"Kantar is a great company and we look forward to working with Bain Capital to realize its full potential. As a strategic partner and shareholder of Kantar, WPP will continue to benefit from future growth as our customers continue to benefit from its services and capabilities, "said Read in a statement. "I want to thank [Kantar CEO] Eric Salama, his team and all Kantar associates for their tremendous contribution to WPP – a contribution that will continue as we develop the company together. This transaction creates value for WPP shareholders and further simplifies our business. With a much stronger balance sheet and expected return of approximately 8% of our current shareholder value, we are making good progress in our transformation. "

As more and more consumers are increasingly using our media on digital platforms, companies such as Kantar, built to track this activity, have had the opportunity to strengthen their positioning and relevance to how media are used.

Nielsen and comScore are also among the competitors. The latter, however, has gone through a more difficult period, marked by many upheavals and a stock market price: he recently announced a $ 50 million fundraising for the reconstruction and recapitalization of its activity.

"Our new ownership structure provides a great opportunity for Kantar, our employees and our customers. At Bain Capital, we have a partner who shares our ambition, brings relevant expertise and, with WPP, can help us accelerate our growth and impact on customers, "said Salama. "We focus on providing a" large scale and rapid human understanding "and" Kantar best "in a more coherent way. We will do this by investing more in talent and becoming a more technology-driven solution provider. "

It is unclear whether Bain was chosen as the highest bidder, or because it seemed to be the best partner for the transaction in terms of common strategic goals, or a combination of both.

In any case, the plan will be to expand the business through more investment and acquisitions.

"Kantar is a market leader in many areas and we are excited to partner with our management team and WPP to strengthen this outstanding growth platform," said Luca Bassi, Managing Director of Bain Capital Private Equity, in a statement. "We see many opportunities for expansion and we will invest in technology to build the company's capabilities and strengthen its position as a global leader."

"We believe that we are well positioned to help Kantar, along with WPP, move the industry forward in a rapidly changing industry," said Christophe Jacobs van Merlen, another managing director. "Our in-depth knowledge of the industry, our operational expertise and our strong track record of partnering with management teams to accelerate growth gives us confidence that we can help Kantar grow organically and by acquisition.

I Heart Media and ADK, an Asian advertising agency, are also part of the Bain Capital portfolio.

[ad_2]

Source link