[ad_1]

A new bank supports Apple Pay in France since today: bunq. If its name does not tell you anything, it is normal, it is a young mobile bank of Dutch origin which is available in only a handful of European countries.

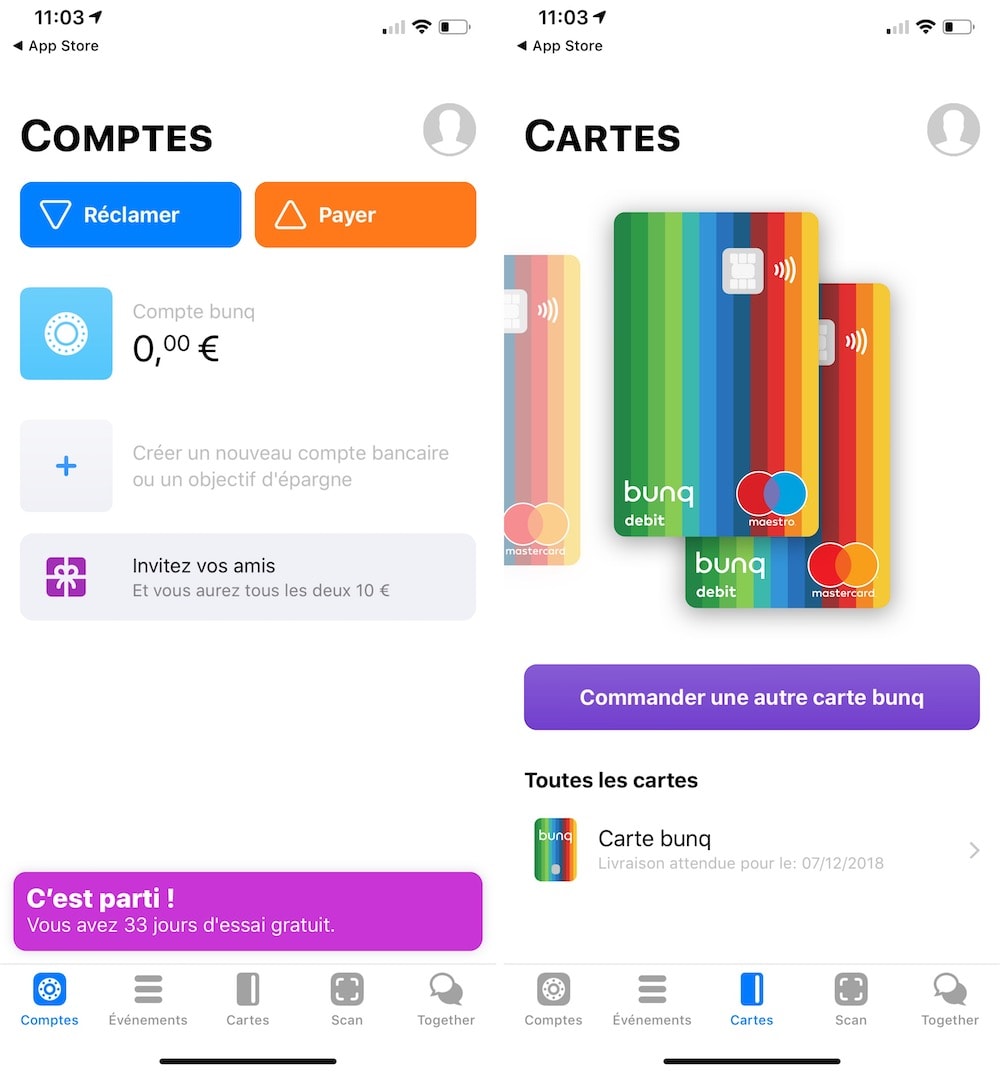

The general principle is the same as Revolut or N26; registration, very fast, and use are happening entirely in the mobile application. Without paying anything, we have a bank account – the IBAN is Dutch – and several functions, including the transfer of money, but no credit card (tariff card).

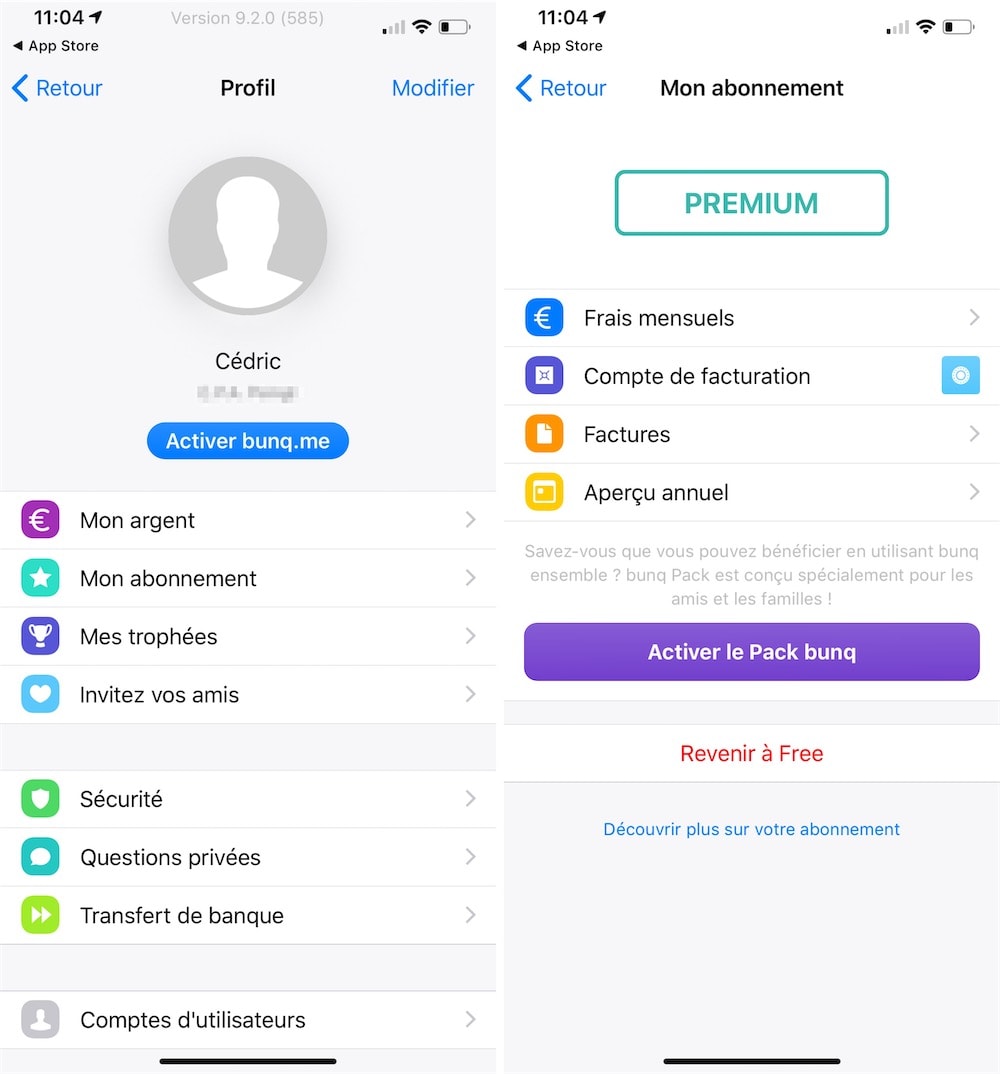

To have a card, you have to subscribe the Premium subscription at 7.99 € / month. bunq is distinguished from the competition by providing not one, but three cards (Mastercard and / or Maestro). Why three? Because the Premium account allows you to have up to 25 different bank accounts, each with its own IBAN.

These multiple accounts are supposed to facilitate the management of his money, by spreading his expenses between each one of them. In addition, they can be converted into joint accounts. And if you want as many cards as accounts, it costs 9 € + 3 € / month for each additional Mastercard.

For payments with the card outside the euro zone, bunq does not take any fees and uses the Mastercard exchange rate. Ten withdrawals per month are included, after which you have to pay € 0.99 per withdrawal, in Europe as elsewhere.

bunq also allows you to scan your bills from the app, save automatically by rounding up payments (Revolut does too), have a payment link … The first month Premium is offered.

In short, this mobile bank offers advanced services or functions that are not found elsewhere, but that will not be useful to everyone. bunq is generally more complete than N26, however its bank card is not free. Compared to Revolut, which also has original features, the newcomer can boast of being already compatible with Apple Pay.

Source link