[ad_1]

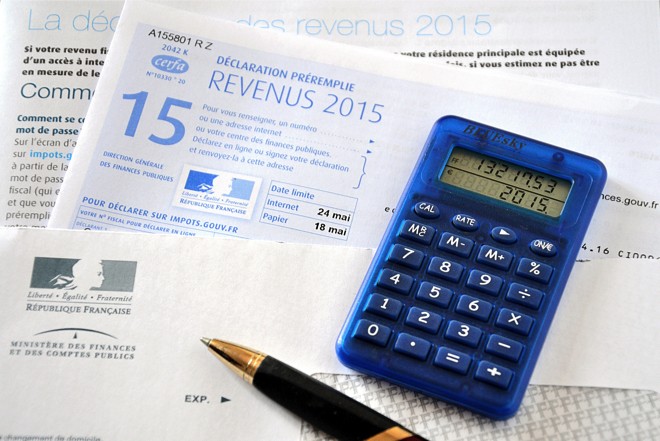

France is the European country with the highest tax revenue (taxes, taxes, social contributions), according to Eurostat. Details.

While the tax burden is denounced in all directions by the "yellow vests", this is a figure that should not fall on deaf ears. According to Eurostat – the body responsible for statistical studies within the European Commission – taxes, taxes and other social contributions alone account for 48.4% of France's GDP, making France the country of Europe where the share of tax revenue is the highest.

France is European champion of tax revenues. Photo credit: LP2 Studio / Shutterstock

France is European champion of tax revenues. Photo credit: LP2 Studio / Shutterstock

For the third consecutive year, France is therefore "European champion" of taxation. By comparison, the figure was 47.7% of GDP in 2015 and 2016. According to the figures published by Eurostat, the share of compulsory contributions has therefore increased by 0.7% in GDP. which also makes it the fifth country with the largest increase after Cyprus, Luxembourg, Slovakia and Malta.

This upward trend is true elsewhere on the continental scale and concerns a majority of countries, since "Compared to 2016, the ratio of tax revenue to GDP increased in 2017 in fifteen Member States" out of 28, says the Eurostat report. According to Le Figaro, social contributions account for 18.8% of French GDP – the European average being 13.3% – when taxes on income and wealth only represent "only" 12.8%, or 0 , 3% less than the continental average.

France is European champion of tax revenues. Photo credit: Alexandros Michailidis / Shutterstock

France is European champion of tax revenues. Photo credit: Alexandros Michailidis / Shutterstock

Behind France, we find the Belgian neighbor (46.5%) and Denmark (46.5%) who complete the "podium", ahead of Sweden (44.9%) and Finland (43.4%). ).

In contrast, at the other end of the ranking, Ireland (23.5% of GDP), Romania (25.8%) and Bulgaria (29.5%) are the three countries where tax revenue share is the lowest.

Like this article on Facebook

[ad_2]

Source link