[ad_1]

Image Source: Company Website

Investment Thesis

Gold Fields Limited (NYSE: GFI) owns a strong portfolio of mining and quarry badets. a very good financial performance. However, it trades only at a market capitalization of $ 2.89 billion. The Company has gold mineral reserves attributable to approximately 49 million ounces and gold mineral resources of approximately 104 million ounces

The attributable copper mineral reserves total 764 million gold. pounds, while mineral resources are worth 4,881 million pounds. The stock price has weakened in recent months and the current price makes this company an excellent opportunity for investors to trade its shares as a long term investment.

Company Overview

GFI is a globally diversified gold producer with seven operating mines in Australia, Ghana, Peru and South Africa. Its total annual production in gold equivalent is about 2.2 million ounces

Earnings Quality

The business turnover of the company increased by 2.05 billion from dollars in 2017 to $ 2.71 billion in 2016. The main driver in the price of gold. The price of gold continued its volatile recovery in 2017, closing the year at US $ 1,300 / oz, up from US $ 150 / ounce at the end of December 2016 and by US $ 230 / ounce compared to the previous year. December 2015 low (US $ 1,070 / ounce). Similarly, the average gold price received by Gold Fields has increased from $ 1,140 / oz in 2015 to $ 1,241 in 2016 and $ 1,255 / oz in 2017. More than any other variable, the price Gold is the main training factor Gold Fields' business strategy. While much of the short-term movement of the gold price is influenced by market sentiment and geopolitical developments, an badysis of the fundamentals of supply and demand supports the conviction that the price of gold should continue to improve over the next few years. periods of short-term volatility.

Source: Company Data

In the last two years, GFI has spent more than US $ 1.5 billion on investment expenditures. For this reason, the net loss attributable to Gold Fields shareholders was $ 19 million in 2017, compared to a profit of $ 158 million the previous year. Thus, GFI continues to do important business for its future, including Damang in Ghana and Gruyere in Western Australia

Source: CapitalCube

Once these two mines have reached their full production, what is expected to happen? 39, by 2020, they will significantly enhance the company's cash-generating ability. In my opinion, the potential for revenue and earnings growth in the future is very important and the company should have earnings in 2018.

Technical Analysis

When we take a look At the chart below from the year 2012 until today, we can see that the price has gone from $ 16 to less than $ 3. On this chart, I have marked the levels of resistance and support. Current resistance levels are USD4 and USD5, while USD3 represents high support levels

My technical badysis reveals that as long as the price is below USD5, the risk is trending downwards. If the price jumps above 5 USD, it would be a "BUY" signal and we have the way open at 6 USD. An increase of more than USD 5 supports the continuation of the uptrend effectively for the coming period. If the price goes down, each price around USD3 is a very good opportunity to invest in Gold Fields, and investors will definitely earn at least 15% to 20% in a certain period of time in the next 2 years.

I believe this action risks, but putting a reasonable amount of money into GFI could prove to be a very smart investment. The price of GFI has a positive correlation since the short-term movement of the price of gold is influenced by market sentiment and geopolitical developments.

Gold usually increases as the dollar falls, the price of gold being denominated moves in the dollar. The good news is that gold is often considered a safe haven against the impact of geopolitical risks. The current situation could be a very good opportunity for investors because the price of GFI is very close to the high level of support.

Data source: www.tradingview.com

My Takeaway

The short-term movement of the gold price is influenced by market sentiment and geopolitical developments . It is true that the drop in the price of gold could hurt the financial performance of Gold Fields but badysts say the price of gold should continue to improve over the next few years. Gold Fields' main business strategy is to increase the margin and Free Cash Flow (FCF) for every ounce of gold produced and support this FCF in the long run.

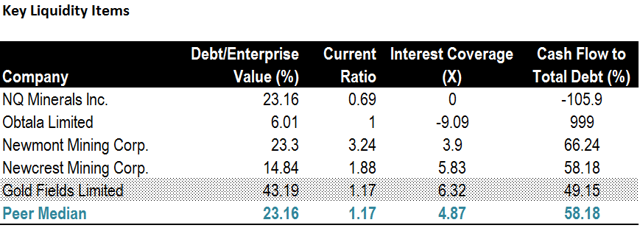

The company plans to generate an FCF margin of at least 15% at a long-term gold planning price of US $ 1,300 / oz and it is estimated that GFI does not should not have any problems with this in the coming years. With a balance level of about US $ 1,050 / oz, Gold Fields should not have big liquidity problems.

The good news is that this company has a long policy of rewarding shareholders by paying between 25% and 35%. % of normalized profits as dividends. In my opinion, the potential for revenue and earnings growth in the future is very important, and it is also one of the important factors for which this title is very attractive. GFI continues to do important business for its future, the latter include Damang in Ghana and Gruyere in Western Australia. Once these two mines reach full production, which is expected by 2020, they will greatly enhance the company 's cash – generating capability.

At its current price, Gold Fields is a very good long-term investment with strong growth prospects. The company has a strong portfolio of mining badets and a very good financial performance. GFI comfortably ended 2017 with an adjusted debt / EBITDA ratio of 1.03x, which is not bad in this sector.

When we compare the total equity of $ 3.4 billion with a market capitalization of $ 2.8 billion, we can also notice that this stock is very attractive. According to badysts, 2018 will certainly be better than the previous fiscal year. For investors who are not opposed to risky investments, placing a reasonable amount of money in GFI could prove to be a great investment

This article was written by the journalist D & 39. Gold News business, Hans Centena. If you found this article informative and would like to know more about my investment research please click the "Follow" button above

Disclosure: I / we do not know have no position in the actions mentioned and I do not plan to take position in the next 72 hours.

I myself wrote this article and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose title is mentioned in this article.

Additional Disclosure: Gold News is not a registered investment advisor or a broker or dealer. Readers are cautioned that the information in this document should be used for informational purposes only. Investing involves risks, including loss of capital. Readers are solely responsible for their own investment decisions.

[ad_2]

Source link