[ad_1]

Founded in September 2015, Pinduoduo took only 2.5 years to become the third largest electronic commerce platform in China based on GMV. PDD has achieved this by offering products at much lower prices to price-sensitive consumers. Similar to Baba, DP monetizes by charging commissions and providing online marketing services on its e-commerce platform.

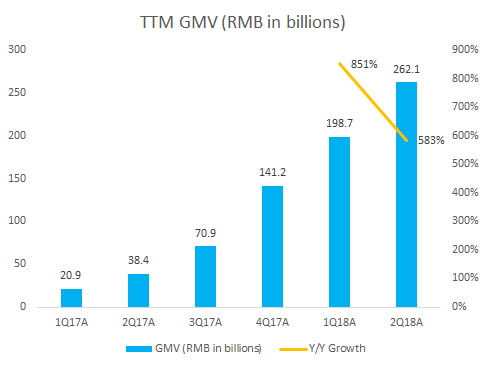

According to its IPO filings, PDD realized GMV of ¥ 141.2b in 2017, which took Taobao ~ 5 from Alibaba (NYSE: BABA) years ago (in 2008), JD.com (NASDAQ: JD) ~ 10 years (in 2013) and Vipshop Holdings (NYSE: VIPS) ~ 8 years (in 2017). True, the Internet / mobile Internet environment is much more developed now than it was 5 or 10 years ago in China, but the spectacular growth of PDD still looks amazing.

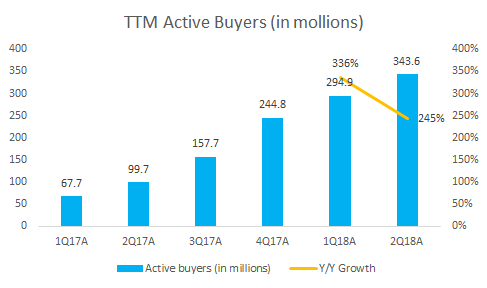

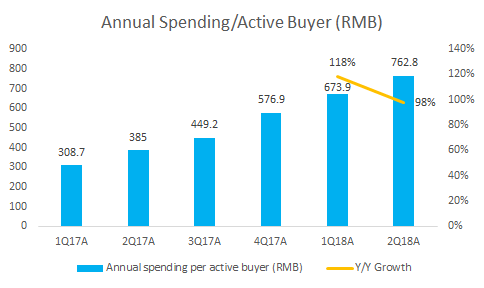

What is more surprising is that growth does not slow down. For the 12-month period ending June 2018, the company's GMV continued to climb to 262.1 billion yen, representing growth of nearly 600%, driven by active growth of 245% and expenses. per active buyer. Despite its fantastic growth, we are cautious on the stock given its valuation at 24x I / O ahead on our 2018 business estimate of ¥ 6.9b (300% year-on-year growth), and 14.7x I / O on 2019 business turnover of 11.4b yen (64% y / y), based on our base case scenario.

Key Points

GMV reached ¥ 141.2b in 2.5 years, the fastest even in China

The Pinduoduo platform began operations in September 2015, with a direct sales business model of 1P under the name "Pinhaohuo" and a 3P model similar to Taobao under the name "Pinduoduo". As the platforms evolved, the company decided to end the 1P activity and focus on the 3P Pinduoduo platform in 1Q17. Since then, the platform has entered a "crazy" expansion mode relying on the largest source of online traffic in China – WeChat, a mobile community with more than 1 billion MAU . During the 12-month period ending March 2018, the platform generated a GVW of 198.7 billion yen, nearly 10 times the same period end of March 2017 and about 1/5 of that of JD and 1 / 25 from Baba.

Source: PDD IPO Deposits.

Source: IPO DP Depositions.

Source: Depositions of PDO IPO.

The 3P market model offers similar monetization potential to that of Taobao.

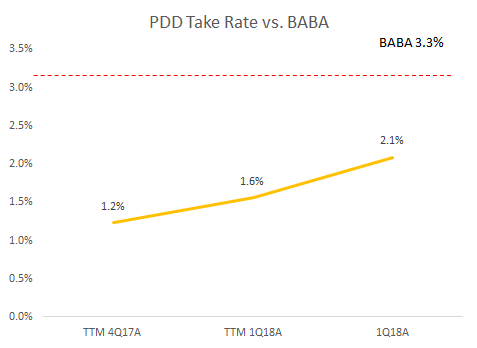

DP monetizes through a similar model to Taobao of BABA, charging commissions and selling advertising services to traders on its platform. According to its IPO filings, DP generated revenues of ¥ 141.2b GMV and ¥ 1.7b in 2017, implying a mixed absorption rate of 1.2%, and it should be noted that this percentage was up, in the 12 months ending March 2018. was ¥ 198.7 billion, with income of ¥ 3.1 billion, representing a higher mixed care rate of 1.6% . In addition, in 1Q18 (2T sales figure not yet published), with revenues of 66.2 billion GMV yen and 1.4 billion yen, the mixed care rate rose to 2, 1%. As a comparison, for the fiscal year ended March 2018, 4,820 billion yuan traded on the platforms of BABA (Taobao + Tmall) generated a turnover of advertising business + commissions of 160.8 billion yen, a weighted catch rate of 3.3%. Thus, we see the potential for the DP take rate to reach the BABA level in the next two years.

Source: IPO PDD deposits

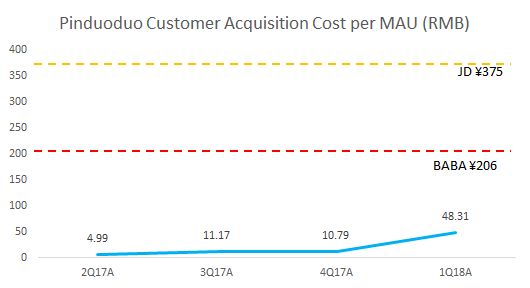

Most profitable customer acquisition model.

PDD uses a "team buying" model that offers "team purchase discounts" when multiple buyers make group purchases (they do not need to to know itself). And users are invited to share their intentions to "buy as a team" certain products and to share their information on social networks such as WeChat (more than 1 billion MAU in 1Q18) and QQ (MAU close to 700 million in 1Q18). Thus, users are motivated to promote the Pinduoduo platform on themselves in order to take advantage of the reduction of the team's purchase. Using sales and marketing expenses / net MAU adds as a proxy for the cost of acquiring customers (NASDAQ: CAC), PDD is much more profitable compared to its competitors. Even though the CAC increased from ¥ 11.79 in Q4 to ¥ 48.3 in Q118, it is still interesting against BABA at 206.5 and JD at ¥ 375.4.

Sources: IPO PDD deposits; BABA and JD Press Releases

Potential challenges include the upgrade consumer trend and competition from Baba and JD.

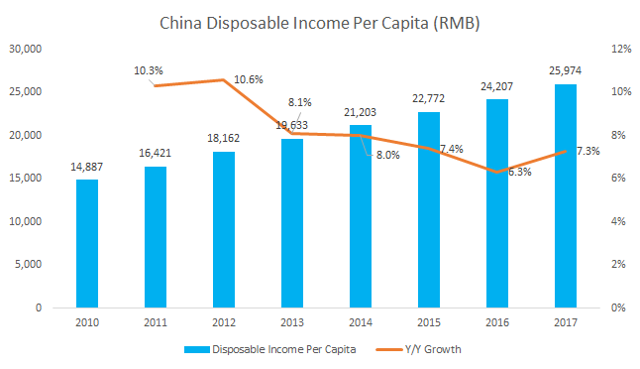

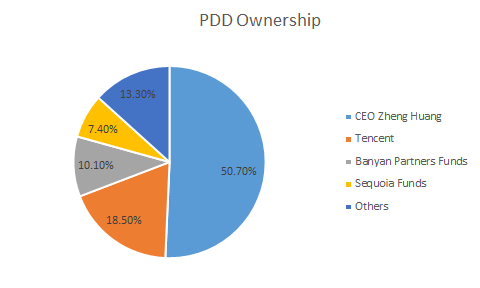

According to the Chinese National Bureau of Statistics, per capita disposable income in 2017 was 2.1x from 2010 and is still growing at ~ 8% y / y (unadjusted for inflation). With this trend, consumers are putting more weight on quality / brand than prices when making purchasing decisions. However, the Pinduoduo platform is filled with cheap products and often of poor quality. Whether the DP model succeeds in this context of upgrading consumption in China or that it evolves over time to provide more quality products at attractive prices, remains an issue to be solved. And competing with more well-funded and well-developed e-commerce companies, such as Baba and JD, could be difficult, especially if DP is trying to penetrate the high-end market. But we note that with Tencent as one of the DP investors (18.5% stake before the IPO), this risk should be mitigated to a certain extent.

Figure: Adjusted disposable income from inflation Growth per capita

Assessment

Please note that it is unreliable to forecast the financial statements for the year. a young company while it is still growing and spending more than revenue to finance future growth. However, baduming a turnover of 201.9E ¥ 6.9b (300% a / a) and a 2019E business turnover of 11.4b yen (64% y / y), the price current involves 24x EV / 2018 business turnover and 15x EV / 2019 turnover. More detailed badysis at the end of the article.

Company Overview

Pinduoduo is the largest electronic commerce platform in China based on GMV (19459045) . And it succeeded in just two and a half years. During the 12-month period ending March 2018, the company generated GMV of ¥ 198.7b GMV, about 1/5 of JD and 1/25 of BABA. The e-commerce platform is characterized by low-priced products, a team buying model and an element of social sharing. Since its launch in September 2015, the platform has quickly attracted users and raised BMV by encouraging users to share their buying intentions in other internet communities such as WeChat and QQ, both owned by to the Chinese giant of the Internet Tencent. By leveraging this huge pool of traffic, DP has been able to develop its annual active buyers and GMVs faster than any other e-commerce platform in Chinese history.

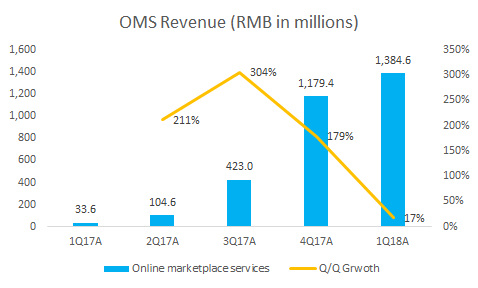

Historically, DP had a 1P model similar to JD. obligations of the products sold. However, as PDD grew so fast and was quickly unable to support all orders, in 1Q17, they decided to stop the 1P activity and switch to a similar 3P model to BABA. Today, DDP monetizes through billing fees and the provision of marketing services to merchants on the platform, which is accounted for under the online market services (OMS) revenue line. The online market services business turnover rose from 33.6 million yen in 1Q17 to 1.4 billion yuan in 1Q18, an increase of 40x

Source: PDD IPO deposits

Home Page Pinduoduo

Tencent Cooperation ” width=”640″ data-width=”640″ data-height=”1386″ data-og-image-twitter_small_card=”false” data-og-image-twitter_large_card=”false” data-og-image-twitter_image_post=”false” data-og-image-msn=”false” data-og-image-facebook=”false” data-og-image-google_news=”false” data-og-image-google_plus=”false” data-og-image-linkdin=”false”/>

In addition to being the second largest shareholder of PDD, Tencent has also entered into a strategic cooperation with Pinduoduo in February 2018. More importantly, Tencent agreed to provide Pinduoduo a traffic gateway in the WeChat, under WeChat Wallet so that WeChat users can be directed from WeChat Wallet to the Pinduoduo application. In addition, PDD and Tencent will also cooperate in areas such as payment, cloud service and user engagement, and Tencent agreed to charge DPs the payment processing fees no higher than the normal rate charged to customers. third.

Figure: Pinduoduo Traffic Gateway under WeChat Wallet

Counterfeit Products

Investors should be aware that as a 3P platform, Pinduoduo does not directly manage what is sold on the platform. form. And sometimes 3P traders to attract cheap customers, they put counterfeit products on the platform. However, DP will still be held responsible if the brands decide to sue the company for failing to carefully handle the counterfeit issue on the platform. In fact, one of the largest TV manufacturers in China, Skyworth, is already in talks with PDD regarding counterfeit Skyworth TVs sold on DP (Source). And Pinduoduo was recently sued in the United States by a diaper manufacturer called Daddy's Choice for knowingly allowing the sale of knockoffs on Pinduoduo (Source). It is not surprising to see an e-commerce platform grow so quickly by attracting price sensitive consumers, but if DP will be able to solve this problem will remain the key to its growth.

a hat soon, while under-penetrating into high-level cities.

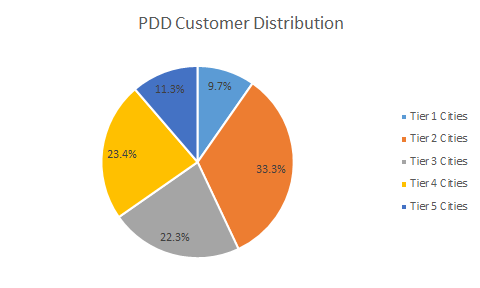

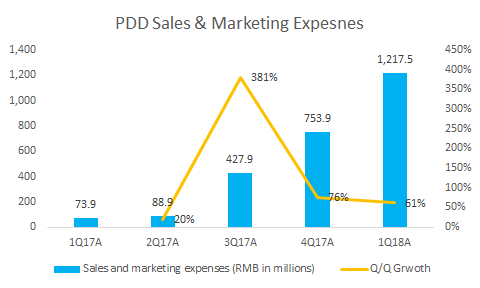

Characterized by low-priced products, DP has managed to get a large user base mainly made up of people who live in lower-tier cities and care about price rather than quality. However, to catch up with BABA and JD in terms of annual spend per active buyer, it may be necessary to increase the number of first-tier consumers. Pinduoduo is probably doing this already, and since the end of 2017, it has been buying branded advertising on major TV channels and online video platforms, which has resulted in a sharp increase in sales and marketing expenses.

Source: iSearch.

Source: PDO IPO Depositions

Estimate

Before entering the forecasts, please note that it is extremely unreliable to make estimates for a young and growing company and when its strategy is somewhat blurred. Too many factors could have a significant impact on the value of the business and this evaluation should only serve as potential results

Basic Case: Moderate Slowdown in Key Parameters and Moderate Expansion of Catch Rates

baduming 60% / 20% growth in 2018/2019, and reach 392m / 470m by the end of 2018/2019; baduming annual expenditure growth of 40% / 25% per active buyer in 2018/2019, ie ¥ 808 / ¥ 1,010 by the end of 2018/2019. We arrive at ¥ 316b / ¥ 475b GMV in 2018/2019. In addition badume 2018/2019 take a rate of 2.2% / 2.4%, implying a moderate expansion of 2.1% in 1Q18. Then we have 2018/2019 revenue of 6.9b / yr 11.4b, involving 24.0x / 14.7x 2018/2019 I / S.

Bull: If PDD is able to continue to develop users at a pace Quickly, and successfully increase per-user expenses by encouraging the user to place more orders or increase the value per order or both and is able to reach a BABA monetization level from here 2019.

Assuming an annual growth of active buyers of 70% / 30% in 2018/2019, and would reach 416m / 541m by the end of 2018/2019; baduming a growth of annual expenditure of 50% / 35% per active buyer in 2018/2019, ie ¥ 865 / ¥ 1,168 by the end of 2018/2019. We come to ¥ 360b / ¥ 632b GMV in 2018/2019. In addition, suppose 2018/2019 take a rate of 2.8% / 3.3%. Then we have 2018/2019 incomes of ¥ 10.0b / ¥ 20.8b, involving 16.5x / 8.1x 2018/2019 I / O.

Bear case: If PDD is unable to continue to develop users at a rapid pace, and increase spending per user at a slower pace and return to the level of 2017.

Assuming annual growth of active buyers by 40% / 10% in 2018/2019, and reach 342m / 377m by the end of 2018/2019; baduming a growth of annual expenditure of 30% / 15% per active buyer in 2018/2019, ie 750 yen / 862 yen by the end of 2018/2019. We arrive at ¥ 257b / ¥ 325b GMV in 2018/2019. In addition, suppose 2018/2019 take a rate of 1.9% / 1.9%. Then we have 2018/2019 revenues of ¥ 4.9b / ¥ 6.2b, which implies 33.8x / 27.0x 2018/2019 I / S.

Conclusion

When investors love the fact that PDD could quickly become the third third largest e-commerce platform in just 2.5 years, investors should be cautious about the current valuation until the company makes a profit and proves its ability to continue to develop without material slowdown.

Disclosure: I / we have no positions in all the stocks mentioned, and no plans to initiate positions in the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link