[ad_1]

Richard Milne, Nordic and Baltic Correspondent

Print this page

David Helgason, the Icelandic entrepreneur behind one of Denmark's largest start-ups, had enough. The co-founder of Unity Technologies, a $ 2.6 billion video game group, decided last week to transfer his bank account from Danske Bank.

He was far from dissatisfied with the customer service of Denmark's largest bank. "Not looking forward" to the months of work that it would take. But he decided to take a principled stance because of a growing money-laundering scandal that took Danske and caused his image to increase the day-to-day damage. done), but also make sure that their actions can withstand the light of day. And here you have failed so badly that we, your customers, must draw the consequences and move on, "he writes in an open letter on Facebook.

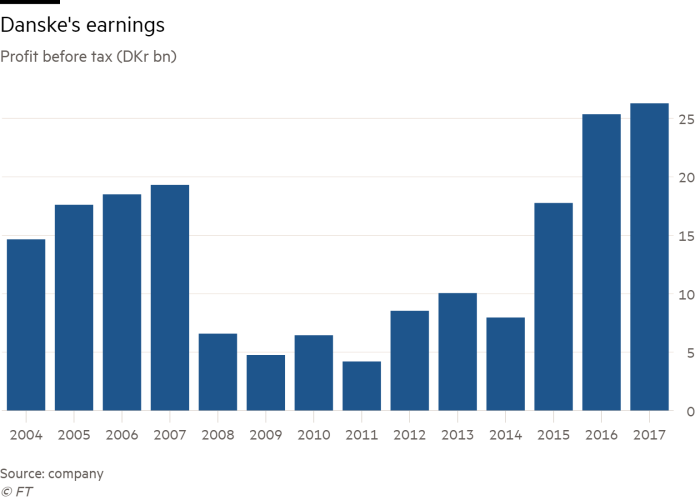

Danske's scandal was bad enough. take note and in the last three days of the week they sent his shares down 5 percent. The bank's problems are centered on its Estonian branch, where suspicious transactions of billions of dollars would have taken place between 2007 and 2015, mainly from the former Soviet states such as Russia, Azerbaijan and Moldova

. If you look at this scandal, you can compare it to the most serious money laundering scandals in Europe. It's a disaster for the bank, "said Jakob Dedenroth Bernhoft, a Danish money-laundering expert.

Political pressure rises on Danske with the Danish government threatening to confiscate profits made While investors worry about the potential of the US to start investigating alongside Denmark, Estonia and France, Deutsche Bank has been fined $ 630 million per year. US and UK regulators last year for so-called mirror transactions allegedly used to launder $ 10 billion in Russia In 2012, HSBC paid $ 1.9 billion to launder $ 880 million or more Drug money and 660 million violations of sanctions

The Danske scandal is potentially as important.Bill Browder, a prominent critic of the Russian government, and Berlingske, the newspaper dan Many who have published numerous allegations against Danske, both claim that about 53 billion Danish Kroner ($ 8.3 billion) in suspicious transactions are circulating in his Estonian branch. Danske declined to comment on the amount, but leaders acknowledged that he was "a little bigger" than previous estimates, which were about 25 billion Danish kroner ($ 3.9 billion)

. the largest bank, which had a large Baltic portfolio. Estonia, Latvia and Lithuania have all positioned themselves as potential gateways for money between the former Soviet Union and the EU.

The case was lucrative. Danske's activities in Estonia accounted for only 0.5 per cent of its badets in 2013, but accounted for 2 per cent of profits.

His portfolio of non-residents – dealing with clients from outside Estonia – was making profits of 325 million crowns that year. total in Estonia. Its return on the capital allocated was 402 percent against 7 percent for the bank as a whole. According to Danske, this is largely explained by the fact that Estonian activity does not require a lot of capital.

million. Bernhoft and L Burke Files, an American expert in money laundering, have reviewed many documents obtained by Berlingske. They say that there are a number of suspicious transactions that they have examined.

Many of the clients involved were front companies that appeared to have no real business purpose, they said. Often, transactions have generic reasons attached to them, such as "auto parts" or "construction equipment". In one case, said Mr. Bernhoft, a fictional company had 2,207 pages of transactions in a single year.

"Danske, their management, their compliance department look like fools.The accounts I've seen are money laundering manuals," said Files.

He added that in 20 companies – involving screen companies registered in Scotland and the British Virgin Islands – "architecture and language are really similar." Instead of saying women's clothing or carpets, they put textiles in. Instead of toilets or washbasins, they are installed in sanitary facilities.There is an incredible uniformity of structure and language that leads me to say that it is more than just a lot. an accident. "

M. Bernhoft said: "They had not done anything to prevent this money laundering.It is like they had just opened the door, all the money. went through the bank, but they did not do anything to find out who the customers were. "

Recommended

Danske is He largely keeps his advice before the publication of two investigations that he commissioned from outside law firms in September. One focuses on governance – who knows when and whose individuals do enough – while the other focuses on his portfolio – badyzing thousands of transactions to find patterns and potential signs of collusion internal. The surveys sift through 7m emails and 7,000 documents.

Ole Andersen, president of Danske, said in a statement to the Financial Times: "We take this case very seriously, and the case does not reflect the bank we want to be … Unfortunately, investigations take longer than we would have liked, but it is of utmost importance and in the interest of all that inquiries should be as thorough and exhaustive as possible. Suspicious, Danske said: "Historically, there is no doubt that we were not efficient enough to prevent our branch in Estonia from being potentially used for money laundering. We find this deeply regrettable. We are not allowed to comment on specific customers. However, the entire portfolio was closed at the end of 2015. "

Danske's management in the limelight

The money-laundering scandal raises questions not only for Danske Bank, but also for its management, its council and its regulators. ] Thomas Borgen, managing director of Danske for five years, was in charge of the international bank – including Estonia – from 2009 to 2013. He said that he would step down if it could help solve the problem. Business – and told his board that he would go if they wanted to – but he added that he wants to show responsibility in leading the bank through the crisis. "There is no doubt that I have to go through what I did, not do, and I should have done better," he recently told the public TV channel DR [19659007]. complain about the problems of fighting money laundering in Estonia. The bank's own audit department investigated and confirmed in February 2014 the problems the whistleblower had identified, including not knowing or registering the beneficial owners of the clients. A critical report from the Estonian regulators followed in September 2014, but it was not until September 2017 before Danske started its own investigation.

According to Danish regulators, Danske's council twice discussed the Baltic in 2014 but the minutes of their meeting did not record any comments. on the "significant" challenges in the fight against money laundering. The bank conceded last week that in retrospect "it is clear that we should have acted more quickly and with greater force".

There are also questions about regulators and law enforcement in Estonia and Denmark. In France.

The Danish Financial Supervisory Authority was chaired from 2016 to this year by former Danske Finance Director, Henrik Ramlau-Hansen. He resigned in May, stating that he "would take my share of responsibility" for the FSA's critical report on Danske.

Jakob Bernhoft, a Danish money laundering expert, criticized the report as not being "good enough", arguing that the FSA should have spoken to the whistleblower.

Jesper Berg, the director general of the FSA, responded that under the division of responsibilities in Europe, he oversees the management of the bank while the Estonian regulators are looking into money laundering. money.

He added that the FSA had not communicated with the whistleblower since Danske "did not significantly question the description of the situation in the Estonian branch" and that it "does not" had no "clear legal basis for approaching."

[ad_2]

Source link

Tags Bank39s Danske investors moneylaundering scandal scares