[ad_1]

For those of you who have not heard of Google Trends, it's a tool produced by Alphabet / Google (GOOG) that allows users to see the search volume and the geographical concentration of research for a wide range of keywords. It is most often used to see if Kim Kardashian or Taylor Swift tend more, but we believe that it has great utility for active investors and research badysts.

We badume that retail investor sentiment is correlated with Google's search volume. When more users search for keywords such as "stocks to buy," risky stocks should outperform at-risk stocks. When users search for terms such as "how to sell short", this is a sign that retail investors are becoming more worried and that risky stocks should outperform.

Measuring a bullish or bearish sentiment

market, it often starts with a Google search of "what stocks to buy" or "the best stocks". Often these investors respond to the market itself; their friend boasts of how much money they have recently made in the market and says that the new investor brings to Google. This will lead to some sources on "how to invest" and some stock tips; and, a week or two later, they will buy shares.

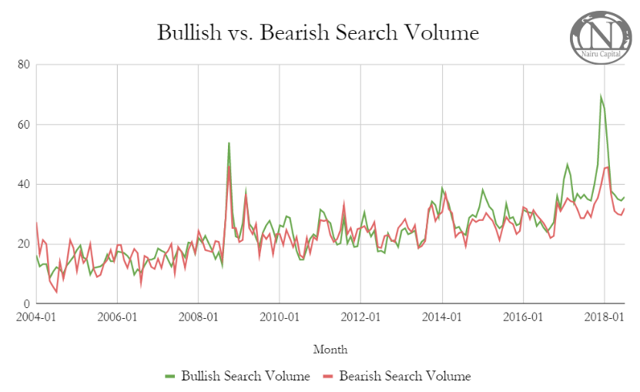

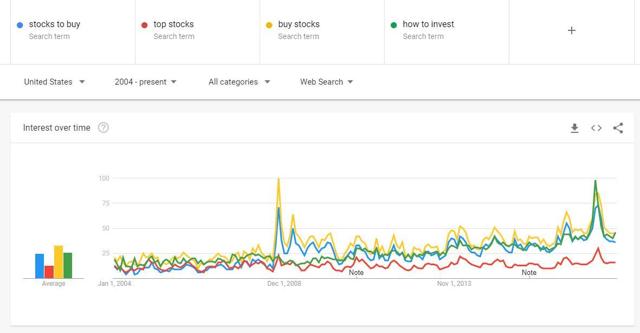

Here are the monthly data we have collected about these keywords since 2004:

Source: Google Trends

As you can see, there are significant peaks both during the sharp rallies of the market as in January of this year and at the big sales as in 2008. To create more We will collect the same data for the downside of Google's search volume.

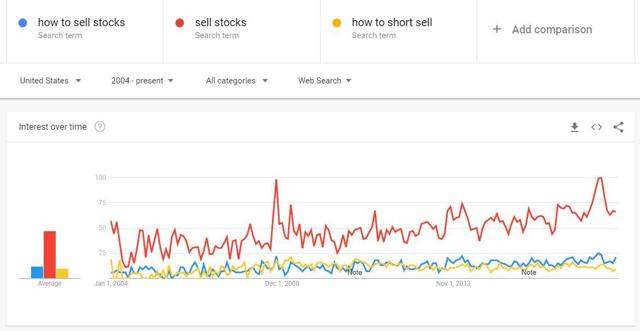

When investors worry, they will often look for "sell stocks", "how to sell short" and "how to sell stocks". Here is the same as above for these "bearish" research requests:

Source: Google Trends

Here is the volume of bullish and bearish research since 2004:

Data source: Google Trends

As you can see, the two data are very similar. There is a big spike during the most difficult months in 2008, and again in January, as the S & P 500 climbed 8% in just a few weeks.

It is clear that Google's research volume reacts to markets, the question remains whether we can use Google Trends to predict markets.

Sentiment Speaks

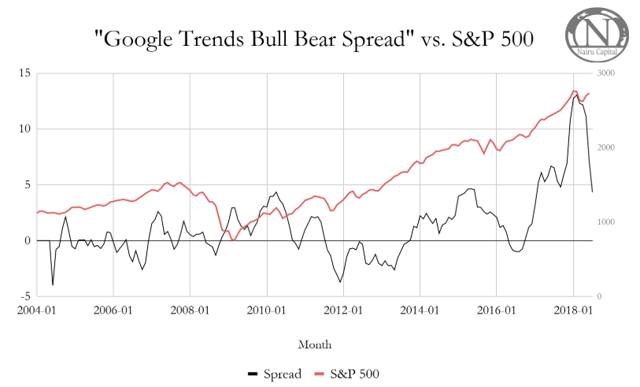

To create a sentiment index, let's take the difference between the "bull" and "bear" search and give the data a 6-month moving average to filter random noise.

Source: Google Trends, Google Finance

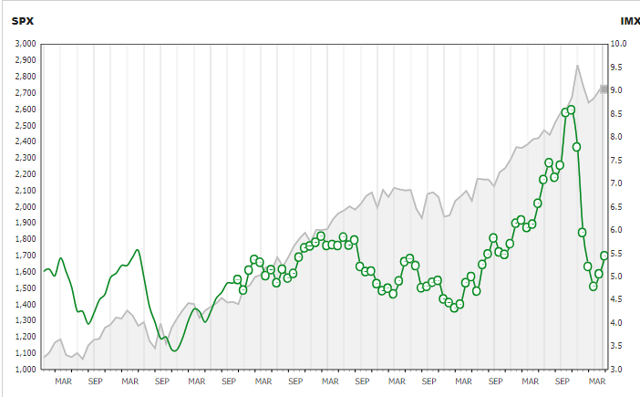

As you can see, our index was not a strong indicator that after the recession, the volume of Google search was then significantly lower. However, in this bull market, the index has become much more useful. The above index data corresponds to TD Ameritrade's newly created Investor Movement Index, which tracks the new brokerage accounts and account positioning:

Source: TD Ameritrade

As you can see see, there is a corresponding peak towards the end of 2016 which has increased in strength before falling back to its long-term average after the February correction. This tells us that our "Google Sentiment Index" measures roughly the same information as the IMX index, but in a very different way.

Google Trends Index Investment Strategy

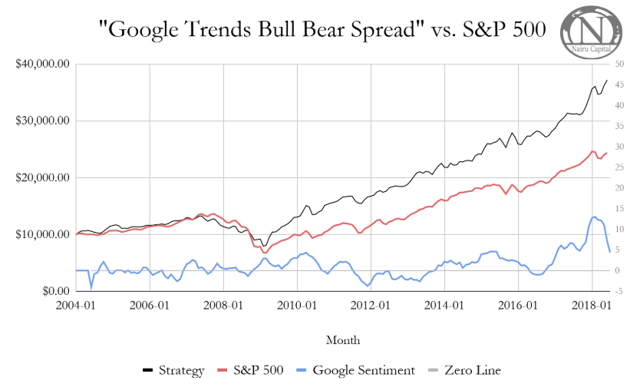

In order to show how the data can be used, we wrote a simple algorithm. If our confidence index is negative, we invest in consumer staples (XLP); if it is positive, we are investing in Consumer Discretionary (XLY).

The concept is that when the negative sentiment increases, it invests in "risky" stocks such as consumer staples in anticipation of risk avoidance. it invests in "at risk" stocks, such as consumer discretionary stocks, to take advantage of the momentum.

This is the $ 10,000 growth that results from this strategy. (Note: Dividends are excluded.)

Data Source: Google Trends, Google Finance

As noted above, this strategy beats the market with lower runs. Indeed, since 2004, it has posted an average annual performance of 10% while the market has posted an average performance of 7%. Even more, he did it with the same annualized standard deviation of 11%. Thus, the strategy had an "excellent" Sharpe ratio of 0.92 while the S & P 500 was only 0.59.

Bottom Line

Of course, no strategy is foolproof and Google Trends data is only in their infancy. to the investment industry. Measuring investor sentiment in this way can become problematic during "market events" that cause people to Google in the stock market without the intention of buying or selling stocks.

As you can see in the "Bullish vs. Bearish Search Volume", also a lot of random noise in the data that can easily lead to a bad trading strategy. To deal with this, we still have to use a moving average of the data. While this approach is beneficial for badysis, it results in a significant lag of three months in the data and limits any strategy to a long-term investor. Ideally, further research will be conducted on creating short-term trading strategies with Google Trends.

The research volume badysis is a useful tool for measuring investor sentiment. By creating a simple "Bull Bear" spread index, we get a glimpse of investors' risk appetite, which can then be used for "risk on" or "risk off" allocation. We will look more closely at the investment strategies of "Google Trends" in the future as we think it is the next frontier for investment research.

Disclosure: I / we have no position in the actions mentioned

I have written this article myself, and this expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link