[ad_1]

It doesn’t take a rocket scientist to discern that the financial markets are full of juice right now, with the S&P 500 SPX,

ending Thursday in its fourth record of the young year and up 72% from lows in March 2020. The past 12 weeks have seen the biggest stock inflows on record, according to Bank of America.

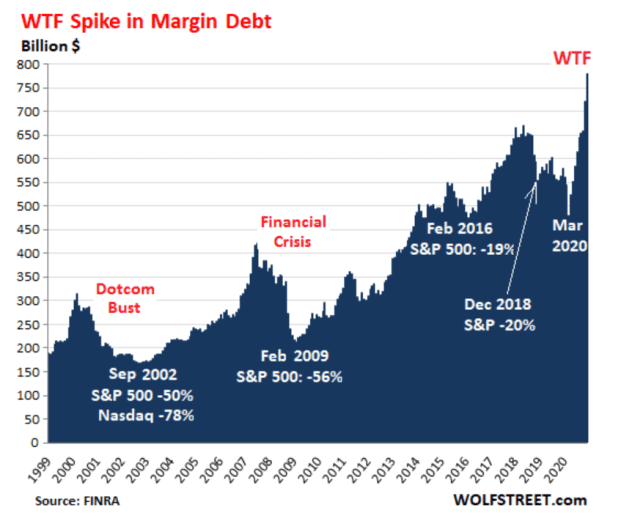

Here’s another sign. Margin debt tracked by member firms of the Financial Industry Regulatory Authority has skyrocketed over the past two months. “We don’t know what the total leverage of the stock market is, but margin lending points to trends, and we’ve had another WTF moment,” says Wolf Richter, author of the Wolf Street Blog.

“This surge in margin debt over the past few months is another sign that the markets have gone crazy, and everyone is on the hunt for everything no matter what it is, whether it’s ‘a penny stock with a name similar to something. [Tesla Chief Executive] Elon Musk mentioned in a tweet, or if it’s Tesla’s TSLA,

the stock itself, or one of the electric vehicles [electric-vehicle] suspected EV makers or makers who might never mass produce EVs, or even a legacy automaker who is now touting their EV investments, or whatever, including bitcoin BTCUSD,

– which exploded higher, before plunging 28% in two weeks.

As the chart shows, peaks in margin debt often precede major stock market meltdowns.

The good news – for those who invest in the market – is that stock market leverage is an accelerator. “When stocks are already rising and investors feel confident, they borrow money to buy more stocks, and they can borrow more against their stocks because their value has gone up. And that extra borrowed money runs after stocks and thus creates more buying pressure, and prices rise further, ”writes Richter.

And the inevitable bad news: “Stock market leverage is a downward accelerator, when stock prices are already falling and brokers issue margin calls to their clients who then have to sell stocks to stay compliant. , triggering a forced sell wave, and many leveraged investors sell before margin calls to avoid being forced to sell at the worst possible time. “

The buzz

Intel INTC,

fell 4% in pre-market trading, after rising 6% on Thursday when it posted stronger-than-expected results about 10 minutes before trade closed. New CEO Pat Gelsinger has suggested that most of its manufacturing will remain in-house, rather than relying on outside foundry services. The chipmaker said it released the report soon after discovering a hack in the results presentation.

IBM from IBM,

stocks were down 7%, after the tech services giant reported a decline in revenue for the 30th time in 34 quarters.

Alphabet GOOG,

Google has threatened to shut down its search service in Australia over a bill forcing it and the social media platform Facebook FB,

to pay publishers.

New officials in the Biden administration downplayed expectations of containing the COVID-19 pandemic with effort leader Jeff Zients saying, “What we inherit is much worse than what we would have. could imagine. ” The White House said President Joe Biden would sign executive orders expanding federal nutrition programs and clarifying that workers can collect unemployment benefits while refusing to work in unsafe conditions.

The country most advanced in its vaccination efforts, Israel, still struggles to bring cases of the coronavirus under control. Airlines listed in Europe, including Ryanair Holdings RYAAY,

fell, after UK Prime Minister Boris Johnson and Home Secretary Priti Patel failed to repeat previous assurances the UK would return to normal by April, with speculation the country will start to pay people with the virus to stay at home.

The economic calendar features existing home sales and flash readings of purchasing managers’ indices. These PMIs showed that conditions in the eurozone and the UK were deteriorating in January.

The market

ES00 US equity futures contracts,

NQ00,

pointed to a much lower start, with futures contracts on the Dow Jones Industrial Average YM00,

lose more than 200 points. Futures on crude oil CL.1,

and or GC00,

also declined, while the 10-year Treasury yield TMUBMUSD10Y,

was 1.09%.

Table

A general rule of thumb is that VIX volatility,

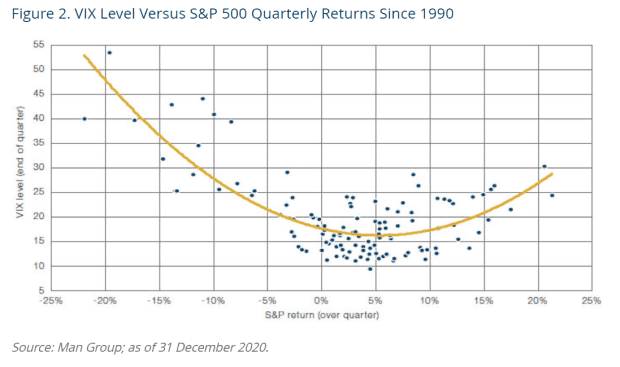

is high when stocks fall, and low when stocks rise. This is clearly not the case at present. The investment institute of hedge fund giant Man Group says there are notable exceptions to the rule. “When volatile sectors dominate the index, we have more examples of simultaneous rise in stock markets and volatility, especially during the tech bubble of the late 1990s. Indeed, today we see a similar composition. of the S&P 500, ”they said.

The tweet

Check out this “Hamilton” -esque song about Janet Yellen, candidate for the Treasury Secretary. The full lyrics are here.

Random readings

Comedian Dave Chappelle contracted coronavirus, days after being seen with talk show host Joe Rogan, singer Grimes and Musk, who had previously had the virus.

Speaking of Musk, SpaceX’s last launch is scheduled for 9:24 a.m. EST, weather permitting.

Need to Know starts early and is updated until the opening bell, but sign up here to receive it once in your inbox. The emailed version will be sent out at approximately 7:30 a.m. Eastern Time.

Want more for the day ahead? Sign up for Barron’s Daily, a morning investor briefing, featuring exclusive commentary from Barron’s and MarketWatch

[ad_2]

Source link