[ad_1]

The erectile dysfunction market is not as lucrative as it was, but it did not matter much for Pfizer.

The New York pharmaceutical giant holds a significant share of the market for erectile dysfunction drugs even as competition from generic drug companies consumes sales of its male libido treatment, blockbuster, Viagra.

The drug, originally developed for the purpose of treating high blood pressure in adults, has become a hit for men in trouble in the bedroom and Pfizer when it was introduced to the US market in 1998 In the first quarter, Viagra reported a total of $ 400 million in Pfizer's revenue and would later produce annual sales of about $ 1.8 billion.

According to the Cleveland Clinic, about 1 in 10 men have erectile dysfunction. Viagra was the first non-invasive treatment for male impotence and opened up a previously unreviewed dialogue about sexual health between men and their doctors.

Nearly 21 years later, sales of the original drug have dropped. Pfizer lost the exclusive rights to this medicine in December 2017, resulting in an avalanche of generic versions. In the United States, sales of the "little blue pill" fell by 73% in 2018, from $ 789 million to $ 217 million in 2018, Pfizer announced in its fourth quarter earnings report at the time of writing. Entry into the generic market.

A strategy

Despite the generic competition from other drug companies, Pfizer has managed to maintain a significant market share thanks, among other things, to the launch of its own generic version of the blue diamond pill.

In late 2017, Pfizer announced the production of a generic version, called sildenafil, at a cost half the brand name. The company also announced that it will offer new discount programs and increase discounts on its co-payment cards to make the brand version more accessible to patients.

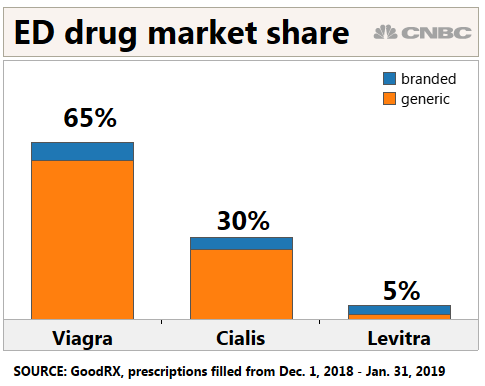

According to GoodRx, 65% of ED prescriptions executed from December 1, 2018 to January 31, 2019 were for Viagra or its generic version. Thirty percent of the prescriptions were for rival Cialis and his generic, tadalafil. Levitra and generic vardenafil ranked third with 5% of the market. A year earlier, Viagra held only 51% of the market, with Cialis ranked second with 45%.

Moreover, the gap between the requirements met for the brand name and the generics is important. According to GoodRx, 90% of the prescriptions dispensed in the same two-month period were for the generic version of Pfizer, while only 10% were prescribed for the brand name.

"The data can not explain why people take the generic rather than the brand, or vice versa," said Tori Marsh, head of data and content at GoodRx. "But as generic Viagra is more affordable than brand, cost is probably a factor here."

Marsh added that most health insurers require that a generic drug be prescribed to members when there is one and that pharmacies issue the generic.

Taking online

The increase in the number of young companies in the health technology sector, which allow patients to override their doctor and buy drugs online, could also keep patients loyal to the branded drug .

For example, Roman, the direct-to-consumer brand of men's health products, eliminates intermediaries such as pharmacies and health care providers and allows customers to purchase erectile dysfunction medications online.

Pfizer also allows customers to buy Viagra on its website.

The proliferation of virtual platforms could lead to increased online drug purchases, said Dr. Anupam B. Jena, economist and physician at Harvard Medical School. "It is worth noting that this significantly reduces the stigma of buying a prescription."

[ad_2]

Source link