[ad_1]

The Central Bank of Turkey freezes the interest rate of 17.75% on 24

"Latest rises" dive 2% after losing expectations

"Urgent intervention in monetary policy" growing concern

|

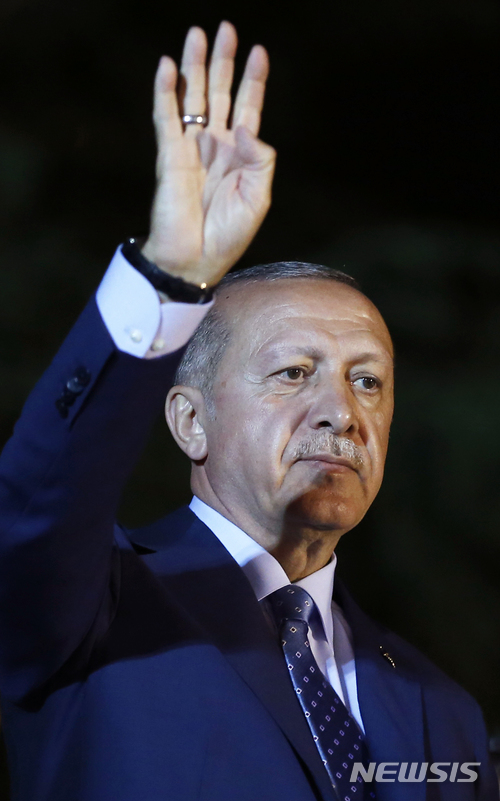

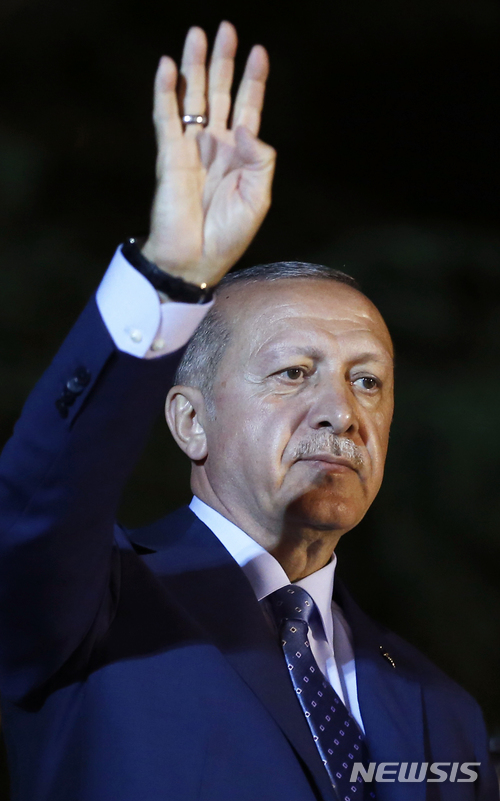

| [LePremierministreturcRecepTayyipErdoganquiestaupouvoirdepuis21ansetaréussiàréélireL'heurelocale)serrelamaindespartisansrbademblésdevantlepalaisprésidentielàIstanbulSelonlacommissionélectoraleturqueleprésidentErdoganaremporté5254%desvoixlorsdel'électionprésidentielledelaveilleavec99%desvoixcomptées[19659004] [ANSWER] New York, the news that the storm of the play continues , Turkey becomes the second emerging country to face the economic crisis this year after Argentina

According to CNN, the value of the Turkish lira has fallen by more than 2% since the central bank decided to Freeze the benchmark interest rate at 17.75%. The value of the currency has fallen more than 27% this year. Turkey is facing an outflow of capital and a sharp rise in prices. However, the expectations of economists that the central bank will raise interest rates have slid since June as inflation has exceeded 15%. In the market, it is believed that Turkish Prime Minister Recep Tayyip Erdogan, who supports low interest rates, has influenced decisions on interest rates. "As a central bank is concerned about inflation, it's an incomprehensible decision," noted an economist at Asama Blue Bay Asset Management. After beginning his second term on September 9, President Eduard strengthened his grip on the economy by changing the appointment system of the central bank president immediately after his inauguration and appointing his minister-in-law finances. But the movement creates a sense of uncertainty in the market. In a May press interview, Erdogan said he did not respond to the economic logic that "declining interest rates would reduce inflation," accelerating the pace of inflation. collapse of the read. Analysts point out that Turkey is likely to become an emerging country as a result of the economic crisis that followed Argentina, which last month received $ 50 billion from the International Monetary Fund ( IMF). In the first quarter of the year, Turkey recorded a high economic growth rate of 7.4%, but this evolution is largely due to the influx of foreign investment in the sector. construction. If foreign investment funds escape sharply due to the sudden fall of the lira, the Turkish economy could strongly tremble. Investors are concerned about Turkey's ability to repay its debt. The director of the European Union for Muta Baran Eurasia Group stressed that the Turkish government must control its spending and that if the new finance minister does not give a reliable message to the market, he may face an economic crisis. "It is possible to imagine a scenario in which the IMF intervenes," said economist Ashei. " [ad_2]Source link Tags Argentina crisis economic lira Turkish year |