[ad_1]

Alphabet (GOOG) (GOOGL) announced a profit Monday – May 29 – after the close of the market. Investors responded with pessimism and even panic, sending Alphabet down 7.5% Tuesday, before trading hours.

Revenues during the quarter were below expectations, which naturally generates some uncertainty around the Alphabet stock. Nevertheless, the fundamentals of the company remain clearly solid and Alphabet seems to be a convincing opportunity at current prices.

A fundamentally strong company

Looking at the market reaction after profits, one might think that Alphabet is suffering from lower sales and lower cash consumption. But nothing could be further from the truth.

Revenues for the quarter were $ 36.3 billion, down $ 1.02 billion from analysts' forecasts but continuing to grow 19% at constant exchange rates. Few companies in the world can generate this type of growth with such a large revenue base.

In terms of profitability, the numbers seem more than healthy:

- The operating margin excluding fines of the European Commission amounts to 28% of turnover.

- Adjusted earnings per share were $ 11.9, exceeding Wall Street's forecast of $ 1.74 per share.

- Cash flow from operations was $ 12 billion in the quarter and free cash flow was $ 7.4 billion. The company always generates huge amounts of money.

Management did not provide much detail on the causes of the deceleration in revenue growth, but the company is regularly modifying the timing and form of its ads and has experimented with different formats focused on artificial intelligence and machine learning. had a negative impact on sales in the last quarter.

Chief Executive Officer Sundar Pichai said at the teleconference that recent changes to the commercials aimed to better capitalize on the AI. He believes the company is doing the right thing by prioritizing long-term growth over quarterly performance.

We will always be a long-term, investment-oriented company that will help our businesses and our customers' businesses succeed as technology evolves. You saw this during the transition to mobile computing years ago and we are seeing it today with the move to AI.

Who missed what?

The media generally say that a given company "estimates its profits missed". However, things do not work well and the expression can create significant confusion.

The management team is responsible for managing the business and Wall Street analysts try to estimate the type of performance the company will generate in a given quarter. In other words, what happened here is that Wall Street miscalculated Alphabet's business growth numbers, without the company failing on its own. expectations.

The situation is very different when a company provides its own earnings forecast and the actual numbers are lower than these numbers. Alphabet, however, provides no indication and its purpose is to optimize long-term performance, instead of paying too much attention to quarterly figures.

In the words of CEO Sundar Pichai:

Our goal has always been to invest in the long term rather than managing the results from one quarter to the next. I am really optimistic about the future opportunities and innovations we bring to marketers, many of which are based on machine learning.

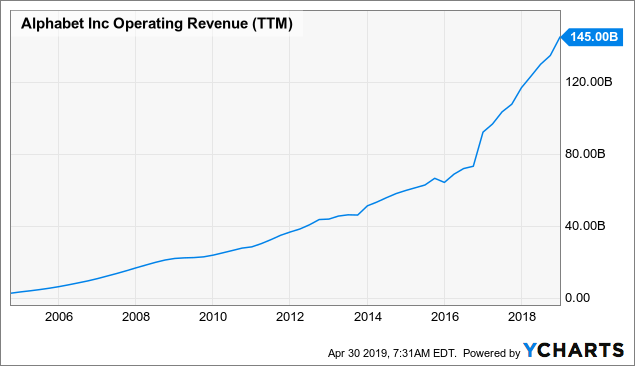

Let's be clear: a 19% increase in revenue for a company with annual sales of nearly $ 145 billion is still an impressive performance, although analysts who followed it estimated higher sales for the quarter.

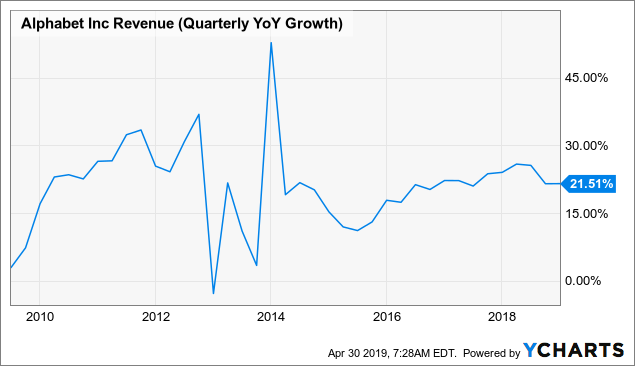

It should be noted that Alphabet has experienced different periods of accelerating and slowing revenue growth over the last decade, but that its performance has remained outstanding in the long run.

Data by YCharts

Overall, investors have little reason to worry about the continued growth of Alphabet's operating revenues over the years.

Data by YCharts

As long as the fundamentals of the company remain strong, the company is in a position to sustainably support the growth of its turnover, and there is no reason to say that these fundamentals have deteriorated.

Google has 8 different services with over one billion users each: Google Search, YouTube, Android, Gmail, Google Maps, Chrome, Google Play and Drive. This does not even take into account the growth opportunities of other services and other betting companies in areas such as health care, connectivity and autonomous cars. The company also invests a lot in artificial intelligence and machine learning, which could pave the way for interesting prospects.

From a broad perspective, Alphabet benefits from several growth drivers and the prospects for sustained growth in sales are as healthy as ever.

Attractive rating

Alphabet is expected to generate earnings per share of $ 54.79 next year. At current prices, the stock trades at a price / earnings ratio of 21.6. This is clearly a compelling assessment for a company that has just announced a 19% growth in its constant currency revenues and an operating profit margin of 23%.

The company closed the quarter with cash and marketable securities of approximately $ 113 billion on its balance sheet. This means that almost 13% of the market capitalization of Alphabet is justified by cash and cash investments alone.

In addition, the segment of the other bets generates big losses at this stage. Google generated operating profit of $ 9.3 billion, while other bets generated an operating loss of $ 868 million during the quarter.

If you value Alphabet by looking only at the overall figures, the other bets division will have a negative impact on the value of the company. While it's hard to say what the value of the other bets segment will be over the years, it certainly can not have a negative value in the long run.

The bottom line is that Alphabet has already been attractively valued when looking at the earnings figures as reported, and we could easily adjust earnings by 25-30% up if money and other bets were taken into account. This would make the stock an even more convincing market in terms of valuation.

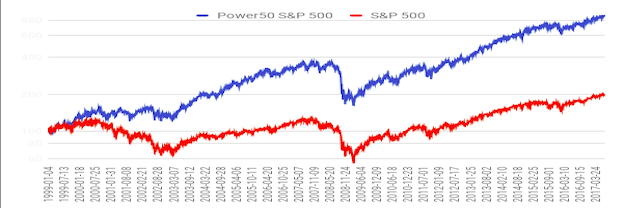

The PowerFactors system is a quantitative algorithm available to members in "The Data Driven Investor". This algorithm classifies firms in a particular universe based on quantitative performance factors such as financial quality, valuation, fundamental dynamics, and relative strength.

S & P Global Data via Portfolio123

Alphabet is the first quintile, with a PowerFactors ranking of 97.35. According to pre-verified performance data, companies with the strongest quantitative rankings tend to generate superior long-term performance.

Figures alone are not enough to build a complete investment thesis for a stock. The algorithm says that a group of companies with high numbers tend to outperform the market over the years. However, that does not tell us much about the kind of performance that a company like Alphabet will produce in a specific year such as 2019.

In other words, the company has to prove to the market that it can continue to generate strong growth for the stock to be healthy. This being fully recognized, the hard and cold numbers seem rather optimistic for the Alphabet action at current prices.

The final result

The stock market does not like the uncertainty and the fact that the turnover growth has slowed down during the last quarter may naturally cause some concern among investors. In the future, if we observe signs of further downturn due to a decline in demand or increasing competitive pressure, then the investment thesis that underlies Alphabet should be reconsidered.

Nevertheless, Alphabet is an exceptionally strong company with healthy growth prospects and attractive valuation levels. The recent short-term decline in the Alphabet title seems rather a buying opportunity for long-term investors.

Statistical research has shown that equities and ETFs with certain quantitative attributes tend to outperform the market in the long run. A subscription to The Data Driven Investor gives you access to powerful filters and dynamic portfolios based on these proven and effective performance factors. Forget the opinions and speculation, investment decisions based on tough quantitative data can provide you with higher returns with lower risk. Click here to get your free trial now.

Disclosure: I am / we have been GOOG for a long time. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link