[ad_1]

In fact, the man had won well. He worked as a pharmacist at a salary of over 6500 francs and was still paying for his retirement. But in old age, he now receives only a pension of 4230 francs – as much as someone who works for a low salary. And this, although the man – fictitious – worker receives the highest possible AVS pension. This was calculated by the Swiss Confederation of Trade Unions with federal figures.

For the first time since the introduction of compulsory old-age pensions, pensions in Switzerland have fallen in those years for people who are retiring, notably. This is shown by the latest Swisscanto study: Only between 2013 and 2017, the average pension of the first and second pillars of AHV and the pension fund, fell by 600 francs, from 5357 to 4741 francs. because of the pensions of the pension fund. And according to René Raths, member of the Board of Directors of Swisscanto-Vorsorge, these will continue to fall. "An end is not predictable for the moment," he says on request.

The fact that retirements are falling not only makes people feel like they have broken down their career or that they earn little: "Reducing pensions is above all a problem of the middle class. , notes Felix Wolffers, co-director of the Swiss Conference on Social Assistance (Skos). "Even people with an average income now have only low-retirement retirement pensions after retirement."

No car, no vacation

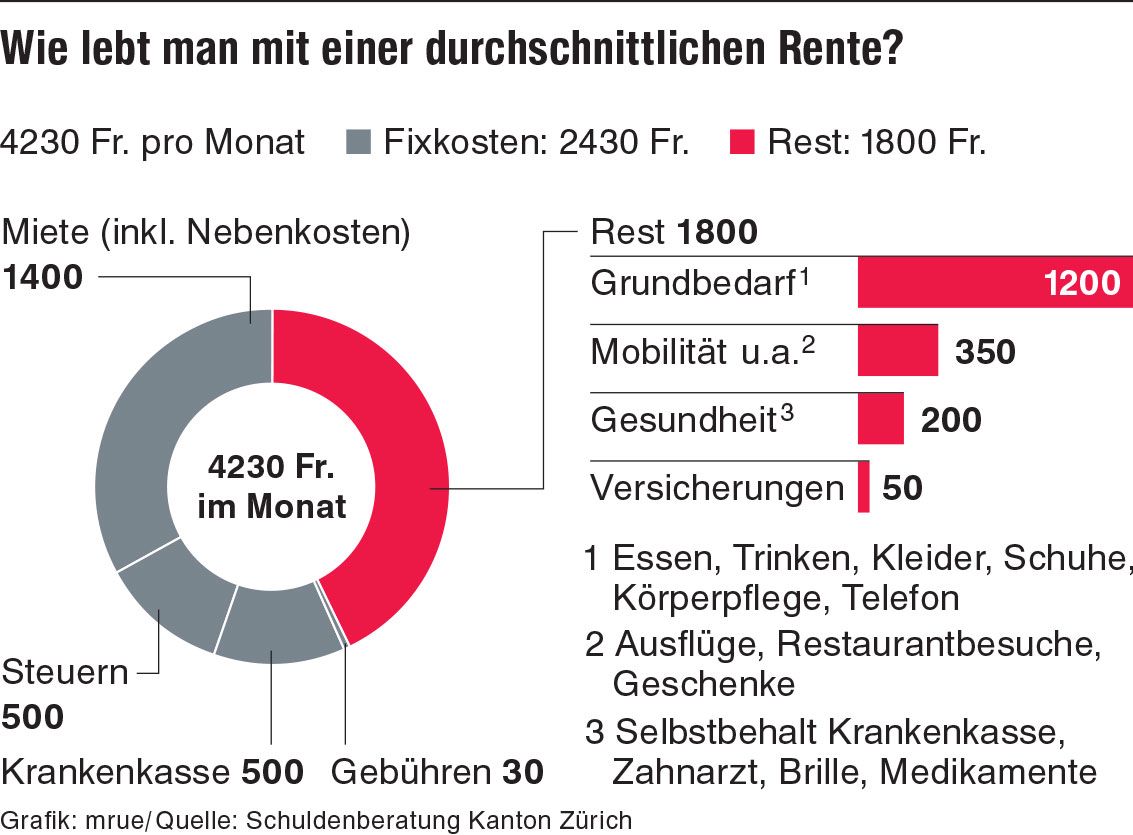

A pensioner who receives 4230 francs a month, must live very modestly today, as Max Klemenz, co-head of the council of debt for the Canton of Zurich. He calculates: If we subtract from the 4230 francs the obligatory expenses – taxes, rent, health insurance, expenses -, it remains 1800 francs. This money must be enough for food, drinks, clothes, shoes, insurance, telephone, internet, transportation and health, glasses or medicine. The money you could put aside is not left out (see chart).

Not including cars, vacations and excursions. Max Klemenz says: "You get with 4230 francs a month.But someone who does not have the habit of living modestly must first learn." Until now, the counseling center has no more registered retirees among its clients, and their number has remained stable at 6 %.However, the consequences of the fall in pensions may not have resulted in the council of the debt, says Klemenz.

Save on everything – this is not the Swiss social security system. The insured should rather be able to maintain his standard of living even after his retirement. It is in the constitution – the AVS is to ensure the existence, pension of the pension fund the previous standard of living. This should be possible if the pension amounts to 60% of the previous salary. According to the Swisscanto study, pensions were still so high in 2013 that this figure was on average 80% and in 2017 it had fallen to 71%. But many pensions do not even approach this value today – especially among those who are well remunerated.

Little Poverty among the Elderly

Will there be more seniors in poverty? Felix Wolffers denies: "Retirees do not have to go that far to the welfare office." Wolffers, who also runs the social welfare office of the City of Bern, says it's not going to be that far. There are virtually no cases of retirees pending at the authority. If the AVS does not come to life, retirees can claim additional benefits, so that age poverty is not widespread in Switzerland. However, as pensions continue to decline, the number of those dependent on supplementation is increasing. "Then the political pressure on additional benefits increases, and there will be other demands for cuts," says Wolffers

Thomas Gächter, professor of social security law at the University of Zurich, in an interview at Bernerzeitung.ch/Newsnet argues: "If nothing happens, we will become a nation of complementary contributors." Already today, 12% of all seniors, or 204,800 people, depend on additional benefits.

René Raths of the Swisscanto pension scheme states: "Insured persons will have to retire earlier in order to compensate for the fall in second pillar benefits." And above all, "start saving sooner". If it is calculated only at the age of 55, how much the pension should be high, it is already already too late. (Tages-Anzeiger)

created: 25.07.2018, 21:00

Source link