[ad_1]

Wädenswiler's Farmer Ernst Stocker is not only familiar with tractors, cows and cereals, but he also manages huge sums of money every day. For more than three years, the SVP-Regierungsrat has been financial director of the Canton of Zurich and master of a budget of 15 billion, the second largest public household in Switzerland outside the federal government.

The traditional summer walk of Dietikon, the rising city of Limmattal, Stocker used yesterday to give a glimpse of his work with money. A job that is fun now, because taxes are bubbling and cheap money circulates on the financial markets. But the many funds also pose challenges to Stocker because who has too much money, currently has to pay negative interest. That is why Cantonal Treasury experts ensure that there is never too much money in the accounts

Motto: "Fast"

In March for example, the township usually receives more money, would be required to pay bills and for wages. These are the federal taxes that the canton collects for the federal government. In the past, you have left the money for an interest income for a week or two on your own accounts. Today it is different. As of March 31, 2018, this year received about 500 million francs. As of April 4, 800 million francs were disbursed, a large part of the federal taxes, which the canton transmitted to the federal government. "For us, the currency right now, fast with the money," said Stocker, "we always try to stay below the limits, which attract negative interest rates." Store admits that the rapid advance of money to the federal government is not very good happen, because also the federal government is considered to account balances down.

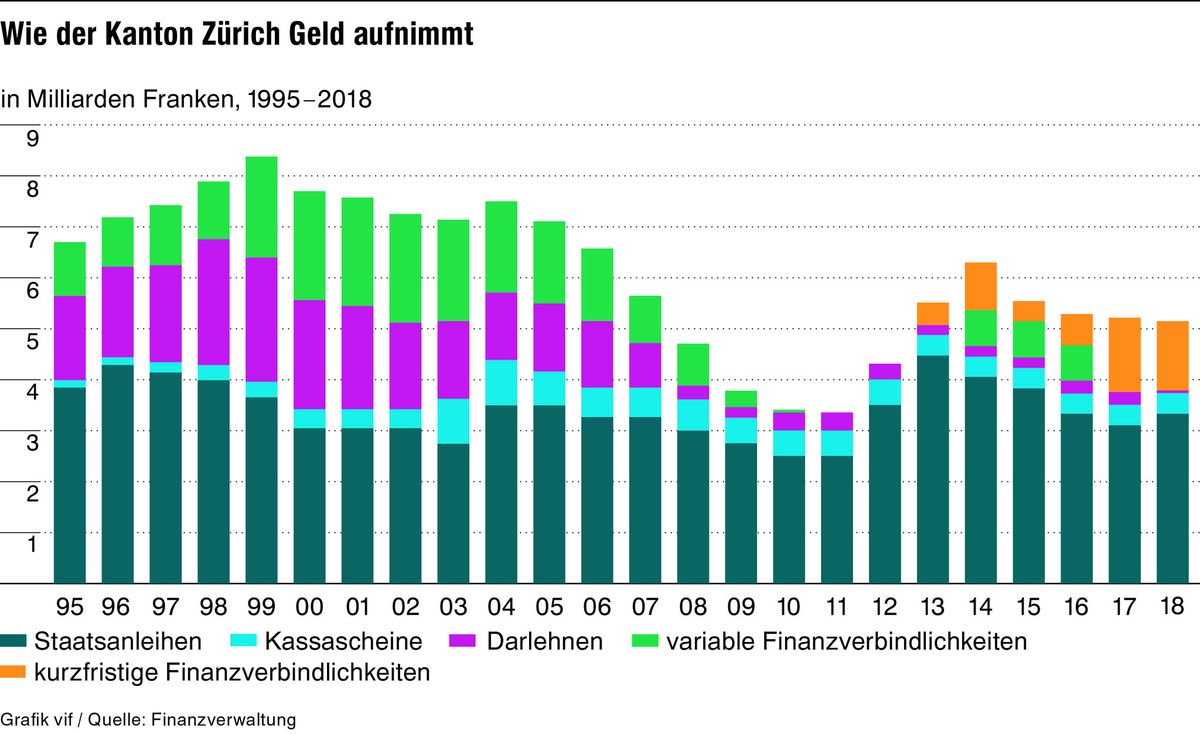

Cash management also requires having enough money in the fund if you need it, for example if the 42,000 salaries need to be paid. That's why Stocker financial professionals need to raise funds at the end of the month. They do this through government bonds, cash deposits, loans and money, which they support day to day in the financial market. According to Stocker, the short-term financial liabilities of a few months are currently the most attractive because they are even currently profitable because at the end of the term, the total amount should not be repaid. The canton collects almost negative interests. With this method of borrowing, he "earned" nearly four million francs last year

Free Money

The Township is an almost sure debtor of its creditors So it's not just short-term loans on fantastic terms. On June 27, Stocker issued a seven-year government bond at an interest rate of 0.0%. In the space of two hours, 240 million francs were collected, money with which the canton can now work for free for 7 years

. It is also interesting for the township at the present time, though it can repay long-term state loans. For example, in January 2020, a bond of 400 million Swiss francs is due, for which the canton pays an interest of 3.15%. With repayment, the canton saves annual interest costs of 9 to 12 million francs

The reversal of the trend costs millions more

The reverse effect would have a turnaround. According to Stocker, the canton should pay about 51 million francs more, which is almost a tax percentage

The current low interest rate environment could lead the canton to borrow money on favorable terms and to transfer to profit. According to Stocker, there are communities that already do it. Therefore, for the construction of a retirement home, a municipality of Zurich was offered by another money. "We do not do that," said Stocker. Reason: In the canton of Zurich, there is no parliamentary mandate or legal basis.

(Tages-Anzeiger)

Created: 20.07.2018, 23:11

Source link