[ad_1]

Since the US Securities and Exchange Commission (SEC) began to show aggressiveness with digital asset offerings, particularly for their occasional security features, cryptographic service providers have remained vigilant. List the bad asset, invest in a misaligned project and participate in a certain blockchain could be disastrous for some hopes in this space. While much of this ambivalence concerns smaller projects, such as the hundreds of initial (unregistered) offers that raised their ugly heads in 2017, Ripple Labs attended a speech about the nature of its digital asset, the XRP.

For example, US stock markets seeking to stay on the safe side of the SEC and similar entities have ruled out XRP, the third-largest market-capitalized cryptocurrency. But that changed on Monday, when San Francisco-based Coinbase plunged after months or even years of internal deliberation.

XRP registered at Coinbase Pro

Around the world, ripple proponents have sighed for a long-awaited sigh of satisfaction on Monday, when Coinbase Pro, the company's trading platform for the uncommon Joes and Jills, revealed its intention to register XRP. This quickly translated into the value of the asset, which rose 11% after the announcement of Pro on Twitter.

Related Reading: Crypto markets rise after a volatile weekend, the XRP rate increases by more than 11% due to the Coinbase list

When XRP ?? Now! The XRP / USD, XRP / EUR and XRP / BTC order books will soon be in transfer mode only, accepting incoming XRP transfers in the supported regions. Orders can not be placed or filled. Order books will be in transfer mode only for at least 12 hours. https://t.co/MWUtUm4wRh

– Coinbase Pro (@CoinbasePro) February 25, 2019

Depending on the version, crypto-currency support, which should be exchanged for USD, EUR and BTC, will initially be available for Coinbase customers based in the United States, the United Kingdom, the European Union, the United States, Canada, Singapore and Australia. At the time of writing this document, full trading of the aforementioned pairs has not yet been activated as Coinbase expects a sufficient supply of order books and supplies.

Why The About-Face, Coinbase?

Although the sudden listing probably took a lot of industry insiders with the pants down, their status being slightly skewed by the regulatory status of XRP, this decision may be perfectly logical. According to previous reports, Dan Romero, the current vice president of the institutional division of Coinbase, had already approached CNBC to explain the sudden change in his company's business strategy, which had gone from the Bitcoin-centric technology has a multi-asset-centric strategy.

Addressing CNBC's "Fast Money" segment on the topic, Romero pointed out that Coinbase is simply meeting the needs of its customers. Specifically, he said that the majority of Coinbase's customers have consistently called for additional digital resources, as there are hundreds, if not thousands, of projects that the US parvenu has not yet supported. Anecdotally, we know that the XRP is one of the most sought-after cryptocurrencies in the entire ecosystem, making the recent listing more meaningful.

In an interview with Linda Shin's crypto-centric "Unchained" podcast, Romero explained the purpose of her business. The executive noted that in order to protect customers in the secure community of Coinbase, the multi-faceted company has embarked on a mission to support as many assets as legally viable.

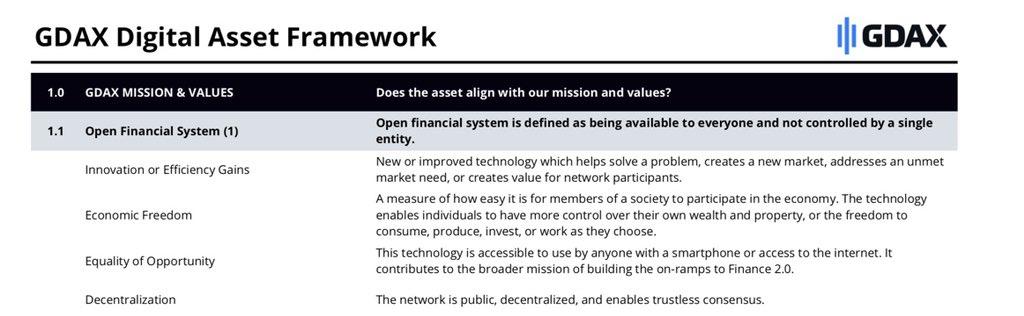

Romero may be telling the truth, but cynics argue that the XRP enumeration is not in line with the GDAX digital asset framework, a system created to evaluate cryptographic assets and their viability as part of the already existing list. range of Coinbase products. Although it is reasonable to say that the XRP protocol fits perfectly in the "Innovation" and "Equal Opportunities" departments, some project skeptics have argued that reason to be is far from creating a free world supported by decentralization.

However, Ripple's key informants insisted that the XRP registry is decentralized, citing the mass of institution-owned validation nodes / servers and the ecosystem accessibility of consumers.

Regulatory issues related to crypto

Even if what is done is done, some fear that Coinbase has too much enumerated the digital good, especially with regard to the uncertainty concerning the nature of the XRP in the eyes of the regulators, local and foreign.

Jack Chervinsky, a lawyer with the Kobre & Kim group, based in Washington, DC, said that although the community sentiment is raising the suspicion that the recent attempt by Coinbase to appease its pro-Ripple customers is confirming -security, this might not be the case. Chervinsky pointed out that there were "too many variables at play" to draw solid conclusions about the asset, making it an increasingly important part of Pro's list of marketable assets.

It is tempting to speculate on the legal implications of Coinbase's decision to list the XRP, but too many variables are at play to draw solid conclusions.

The only reasonable conclusion is that Coinbase believes that the benefits outweigh the costs (including the legal risks).

– Jake Chervinsky (@jchervinsky) February 25, 2019

Thus, the representative of Kobre & Kim concluded that the only logical inference from this debacle is that "Coinbase believes that the benefits outweigh the costs". hard to tell if cryptocurrency is safer than it is.

Featured image of Shutterstock

[ad_2]

Source link