[ad_1]

Last week, the financial results of the third quarter of 2019 Apple caused a hubbub because the income of the iPhone accounted for the first time in seven years, less than half of total revenues of Apple. The cause is a slowdown in iPhone sales combined with spectacular growth in two other areas: portable equipment and services.

But it is hardly the first time that Apple undergoes a major change in the structure of its activities. In fact, Apple is a company that has rarely evolved.

Let's prove this point, let's review Apple's 20 years of business, five years at a time.

1999: the return of the Mac

Jason Snell

Jason SnellSteve Jobs came back to Apple in 1997 and we all know what happened next. But this transformation took a while. Look at an example of a quarter of twenty years ago – the fourth quarter of 1999 – and you will see a company very different from that of Apple.

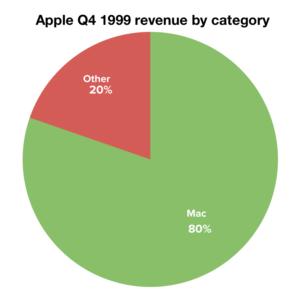

First of all, there was only one Apple product: the Mac. Apple's revenue comes 80% from the Mac and 20% from other products, mainly Mac accessories. In the fourth quarter of 1999, Apple's total revenue was $ 1.34 billion, generating a profit of $ 111 million. To put this in perspective, Apple has generated as much revenue every two days or so in the third quarter of 2019.

In the fourth quarter of 1999, Apple sold 772,000 Macs. We do not know how many Macs have been sold by Apple for a quarter, because they stopped publishing last year's unit sales figures, but that figure is probably around four million. Do not forget this when you consider that the Mac only accounts for about 10% of Apple 's global commerce: at the time when the Mac accounted for 80% of the trade in the world. Apple, Apple was selling less than a fifth of the number of Macs per quarter compared with 2019.

2004: rise of the iPod

Jason Snell

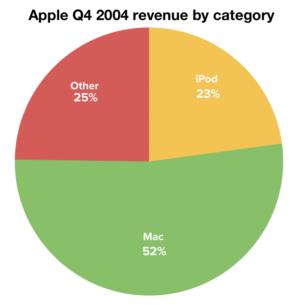

Jason SnellThe year 2004 was an inflection point for Apple. After the introduction of the iPod at the end of 2001, sales grew slowly … until the end of 2004, when they exploded like a rocket. The fourth quarter of 2004 is actually the moment that preceded the explosion of the iPod rocket. This is actually the last quarter in which the Mac accounted for the majority of Apple's business. (That's right, the Mac has been a minority component of Apple's sales for 15 years.)

The revenue mix at the end of 2004 was 63% for Mac, 12% for iPod and 25% for other products. In the fourth quarter of 2002, Apple sold 836,000 Macs, more than it had sold five years earlier. But he also sold two million iPods, a figure that is expected to double next year.

Apple was growing overall. The growth of iPod sales has enabled Apple to generate $ 2.35 billion in revenue, but only a profit of $ 106 million. Apple's earnings growth boom was likely to lag behind its earnings, at least a bit.

2009: the iPhone takes off

Jason Snell

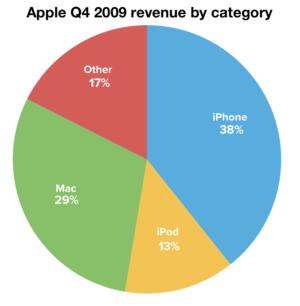

Jason SnellIn 2009, the Mac was doing better than five years earlier and many – Apple sold 2.6 million Mac in the fourth quarter of 2009, three times more than in this last quarter. And yet, despite Mac's success, it accounted for only 29% of Apple's overall revenue.

This period was marked by the explosion of iPhone growth and by the ever-high sales of the iPod. Apple has sold 6.9 million iPhones during this period and 11 million iPods. Overall, the iPhone represents 38% of Apple's business and the iPod 13%.

Apple's business was also much larger overall. The fourth quarter of 2009 generated revenues of $ 11.5 billion, four times higher than the quarter five years earlier. And as for profit? The profits began to flow in torrents. In the fourth quarter of 2009, Apple generated a profit of $ 2.2 billion. Money finally arrived.

2014: the iPods erase, the iPads replace

Jason Snell

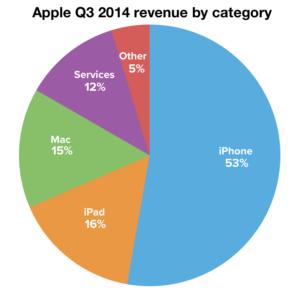

Jason SnellIn 2014, Apple looks more like the company we see today. The iPhone dominates the business figure with 53% of the total. The iPod has disappeared – its sales are so low ($ 2.9 million) that Apple has hidden its revenue in the "other products" category, which in itself accounts for only 5% of the total pie. The iPad replaces 16% of the total. The Mac, which now sells 4.4 million units (170% more than five years ago), accounts for 15% of the total.

Apple's business has exploded between 2004 and 2009, but it's nothing compared to inflation from 2009 to 2014. In the third quarter of 2014, Apple generated a turnover of $ 37.4 billion – three times what she had done five years ago!

2019: the rise of the rest

Jason Snell

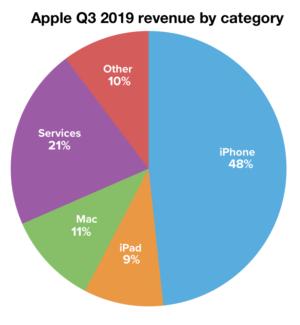

Jason SnellThis brings us to the last quarter during which Apple generated a turnover of $ 53.8 billion and a profit of $ 10 billion. It is true that iPhone sales are in free fall, but the overall trajectory of earnings and earnings of Apple continues to rise, albeit very randomly. The fall of the iPhone to 48% of Apple's total revenues is due in part to the rapid growth of the Wearables category (formerly Other) and the continued growth of the Services line.

Meanwhile, do not sleep on the Mac and the iPad. The 11% and 9% of revenue they generate may seem modest, but Apple's overall revenue has exploded. Together, they generated more than $ 10 billion in revenue.

Seeing Apple's business progressively evolve over the quarters makes it sometimes difficult to view larger images. Its product lines come and go, but so far, the overall trajectory of society in this century has been quite dramatic. One of the main reasons for this is the regular addition of new products and services that can fuel growth and compensate for products that have stopped growing or that, in the case of the iPod, have completely gone.

Apple has come a long way since the early 2000s when it could not even make a profit. According to my calculations, Apple has generated a profit of $ 450 billion since 2000, including $ 429 billion over the last ten years and $ 277 billion over the past five years.

Source link