[ad_1]

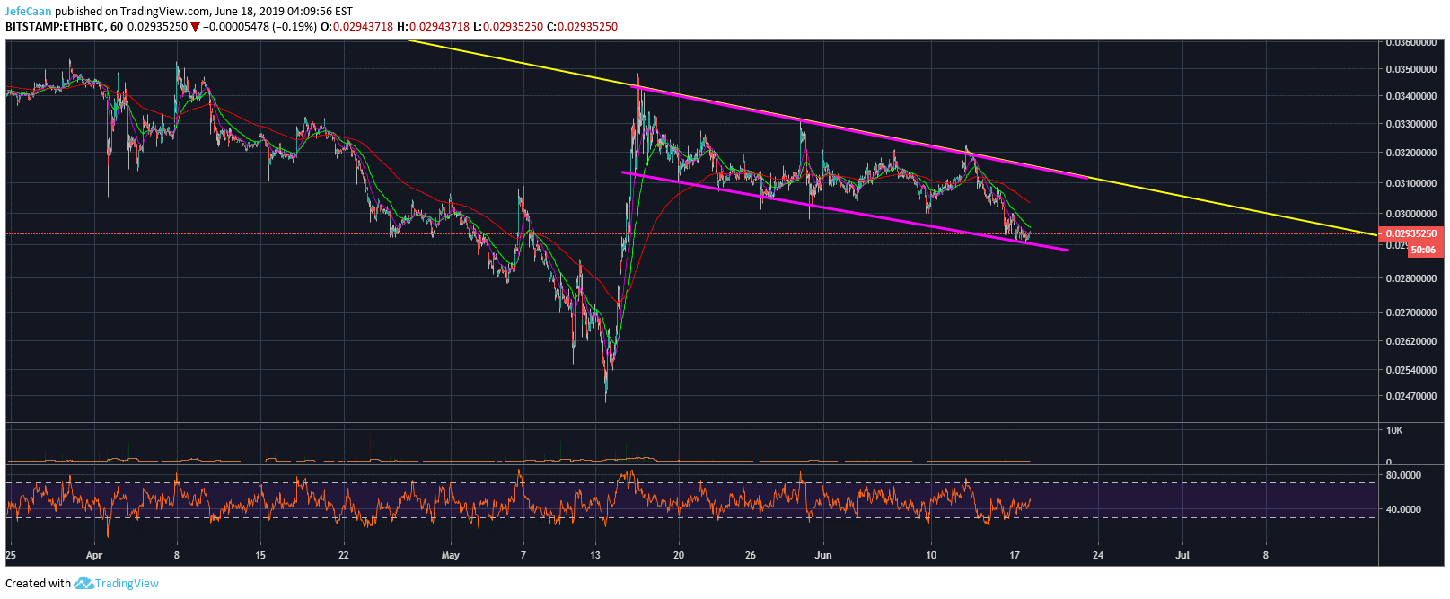

Ethereum (ETH) is likely to start a new uptrend in the short term against Bitcoin (BTC) as the price has just hit the bottom of a descending channel that is also part of a bullish flag. This formation has a real advantage to break a long-term downtrend against Bitcoin (BTC) in the short term in order to launch a mini altcoin season. Although we do not expect this to last long, we believe that the price will be in a position where it has become easier to press for such an escape. Even if the price fails to break the resistance down, the upward movement could still prove to be very profitable and investors already present in the market could consider trading some of their Bitcoins ( BTC) against Ethereum (ETH) and other short-term altcoins. .

Many good traders agree that most pairs of altcoins are just an opportunity to increase your holdings in terms of Bitcoin (BTC). The ETH / BTC pair is a good example and many traders allow traders to trade this pair without having to convert their Bitcoin (BTC) to Ethereum (ETH). It is important to note that Ethereum (ETH) remains overbought against Bitcoin (BTC) at higher maturities, but there is still much room for maneuver to rally the short term. The price could end up exceeding the resistance of the long term trend line, even if it 's a fake or a trap to attract more buyers so that the whales can throw them systematically. On the contrary, we have seen in recent days that some big players are really eager to sell and they are not afraid to drop everything at times. There is no reason to think that this could not happen on a larger scale when the price approaches levels of $ 300 or more.

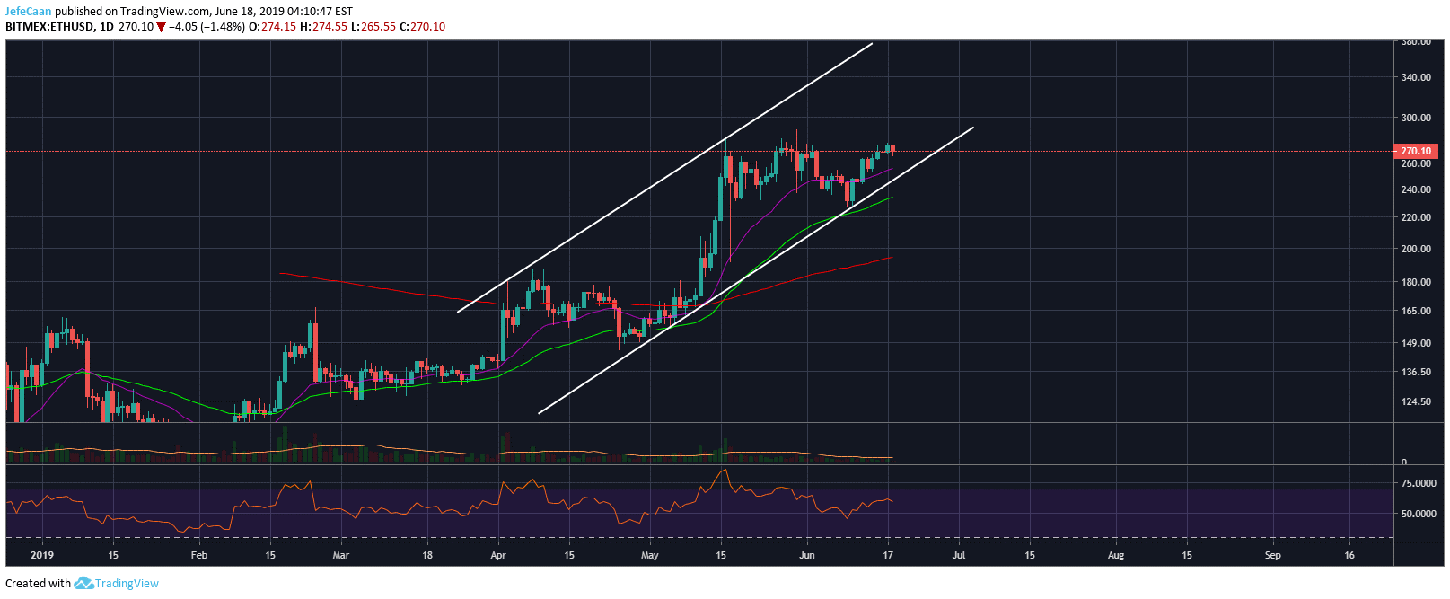

If we look at the daily chart for the ETH / USD, we see an asset that has just tested the bottom bound of the uptrend channel and is now planning to go higher toward a higher goal. However, if we examine the situation in this way without taking into account another, more important vision, we would be blindly optimistic. Indeed, what we, traders and investors, should be able to see is the price that exceeds expectations. As can be seen, the ETH / USD could form a double peak with long wicks on the rise.

It is very tempting to believe in bull that the price could continue to mount this channel in perpetuity. However, history tells us that this is never the case. Sooner or later, we will see ETH / USD collapse under this channel to begin its long-awaited downtrend. When that happens, the decline could be much faster than expected, as the exchanges would not want to give the shorts the opportunity to cumulate. Unless you are a good trader, setting stop-losses at such crucial moments in this market often results in you finding yourself without a position. So being bullish at this point could be very risky and we could see the price crash hard, especially if it ended up stopping at the bottom.

Source link