[ad_1]

Various types of fraud meet us almost daily, either by email, SMS or telephone. Some of these forms of fraud have known cases of years, while others have appeared recently, as recently mentioned Dinside pornographic fraud.

At the same time, Norwegians are often exposed to fraud – and unfortunately many people are deceived, with financial consequences.

Dinside has spoken with Terje Aleksander Fjeldvær, head of the financial cybercrime center at the DNB. Their job is to prevent fraud against DNB, including customers.

So far this year, the number of customers scammed has increased by 28% over last year, and the numbers are steadily rising. And here there is a sharp rise in two types of fraud: love fraud and investment fraud.

Humiliating and expensive

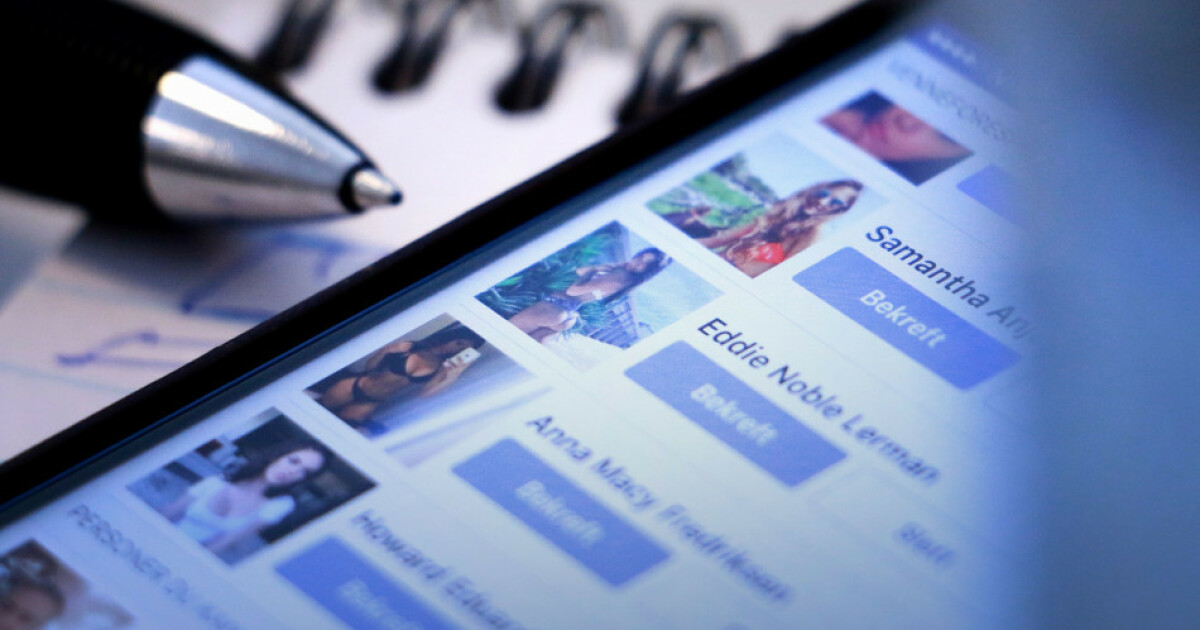

Being fooled by what appears to be a girlfriend you met on the Internet is not a new phenomenon: Økokrim has already spoken of this type of dating fraud where Norwegians are cheated for millions of dollars a year. What remains is that the contact has appeared and is via social media, mainly Facebook, but also Instagram, Linkedin and Tinder.

– Fraudsters come into contact with their victims via social media and start a relationship. After a while, the victims start sending them money, Fjeldvær explains.

He adds that these love scams, in addition to being very humiliating, often have significant financial consequences.

"Many took out loans to send money to their" boyfriend "and ended up having to sell their home to cover what they owed, he said.

And these scams are for everyone, regardless of their finances.

"There are examples of people going to social security who give all their money to such fraudsters," he says.

Investing money in counterfeit businesses

According to Fjeldvær, investment fraud is another area in which highly skilled crooks attract Norwegians for larger sums, which is becoming more common.

– Internet users see advertisements for fake investment sites on Facebook, invest a smaller amount and make profits. Then they invest more and get fooled, says Fjeldvær.

He says those who are behind this type of fraud are very professional, they have websites with a login that seem serious and their own advisers who call the customers. The fact is that those who invest are not going to get money, but it only looks like that on the web portal they are in to convince people. In addition, we are contacted by phone by a very convincing seller.

– They are fraud experts who do not want you well. They want to take all your money, he says.

False bills that look for small businesses, teams and associations are another trend that erupts in the summer.

– These come regularly and the trend is that they are sent to teams and associations that have less control over what needs to be paid for, says Fjeldvær.

Increased social media fraud

In January of this year, Consumer Europe could signal that it is looking into the evolution of the number of social media fraud complaints and that 2018 has become a record year for these complaints, which have gone from a few rare to almost five hundred. in Norway.

In social media, it's often via Facebook, Snapchat and Instagram that people are fooled, and a classic scam involves offering competitions, tests or popular brands at a very low price.

For many, phishing is a trick

Another classic among scams is phishing, which is also widespread, according to DNB.

Here, it is usually Netflix and the tax administration that are mistreated. This is done mainly by email, according to Fjeldvær, and fraudsters will be happy to ask you for information on the card.

"It's very easy to simulate an email," he adds.

– How much are going on this type of scam?

– For many, the answer comes from Fjeldvær.

He thinks people are generally not too skeptical about the information they receive on the Internet.

– People lock the door at night and have an alarm installed, even if the number of burglaries is down. At the same time, it is easy to falsify digital information. Fjeldvær nevertheless believes that few people worry about the veracity of the information.

And false information is enough. A few weeks ago, for example, DNB's own online bank was copied, so that it looks like the real online bank, but only with a different URL.

– The company with which we cooperate has taken more than 63 million fake pages, tells the fraudster.

Here's how the bank stops fraudsters

According to Fjeldvær, DNB has tools to search for special patterns in transactions that the system will stop.

At the same time, it's up to them to analyze whether to add something else to the filter, for example, so that the system records what they are supposed to do.

In many cases, however, money is lost if one wants to be fooled. After all, it is the customer himself who makes the transaction in the cases mentioned.

– In some cases it is possible to advertise at the foreign bank, but it is not easy to recover the money. One must generally consider money as lost, and one is lucky if one has to recover it, says Fjeldvær.

[ad_2]

Source link