[ad_1]

As of this Sunday (1st), the new rules of use will verify the entry into force. The measures, prepared by the self-regulatory council of the Brazilian Federation of Banks (Febraban), determine the offer of alternatives for the payment of the debit balance with smaller interests and more advantageous conditions, in addition to increase the transparency and detail of credit type information. The overdraft is a revolving credit facility, directly linked to the current account of the user, without the need for a guarantee.

Banks recommend that the service be used only in exceptional situations and for a short time, by far the highest of the economy. In May, according to the Central Bank (BC), the average interest rate on the overdraft was 311.9% per annum. It is almost 48 times higher than the basic interest rate, the Selic, which currently stands at 6.5% per annum and which serves as a benchmark for other rates prevailing on the market.

Modifications

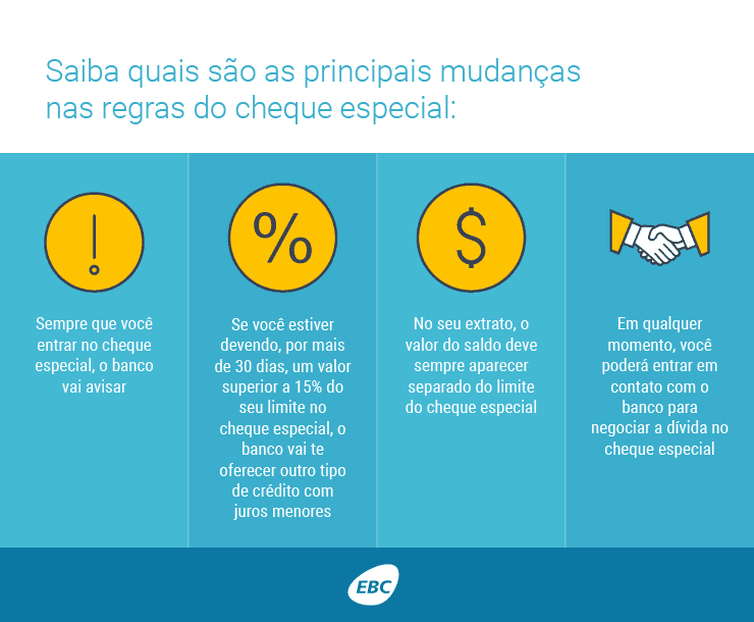

One of the key measures that come into effect is the cheaper automatic deposit offer for consumers who have used more than 15% of the limit available for 30 consecutive days. The offer will be made in the relational channels and the client decides to adhere to the proposal.

If the consumer chooses to install the debit balance in installments, the banks can maintain the credit limits contracted, taking into account the credit terms of the customer, or establish new terms and conditions of use. payment of the amount corresponding to the limit which has not yet been used and which has not been subject to the installment payment, informed Febraban

Banks will also use customer relationship channels such as the internet and phone, alert the consumer every time he enters the overdraft. In the alert, banks must inform that this credit should be used in emergency and temporary situations.

In client bank statements, the balance of the account will be reported separately from the balance and the overdraft limit so that

Under the new rules, financial institutions will always have at their disposal a cheaper alternative to the installment payment of the debit balance of the overdraft

. made by the banks themselves, is exactly one month after the entry into force of the National Monetary Council (NMC) resolution, which has limited and normalized the interest rate on the revolving credit card, which is also one of the highest of the market

Numbers [1 9459005]

The bank overdraft represents only 1.4% of all personal lending operations in the country, with a loan balance of R $ 24.3 billion in May. This is a more expensive and less used mode than other credit options. The balance of the payroll loan last month reached R $ 321.4 billion, with rates of 25.4% per annum, or 1.90% per month. Real estate financing for individuals reached R $ 573.3 billion in May, with rates of 8% per year (0.64% per month).

Of the 155.8 million active customers in the banking sector in May this year 25 million used a special check, according to Febraban. Of these 25 million customers, about 4 million correspond to the new overdraft rules, according to the calculations of the federation. They represent 16% of the total number of people using this type of credit and 2.6% of total active banking customers.

Edition: Wellton Maximum

Source link