[ad_1]

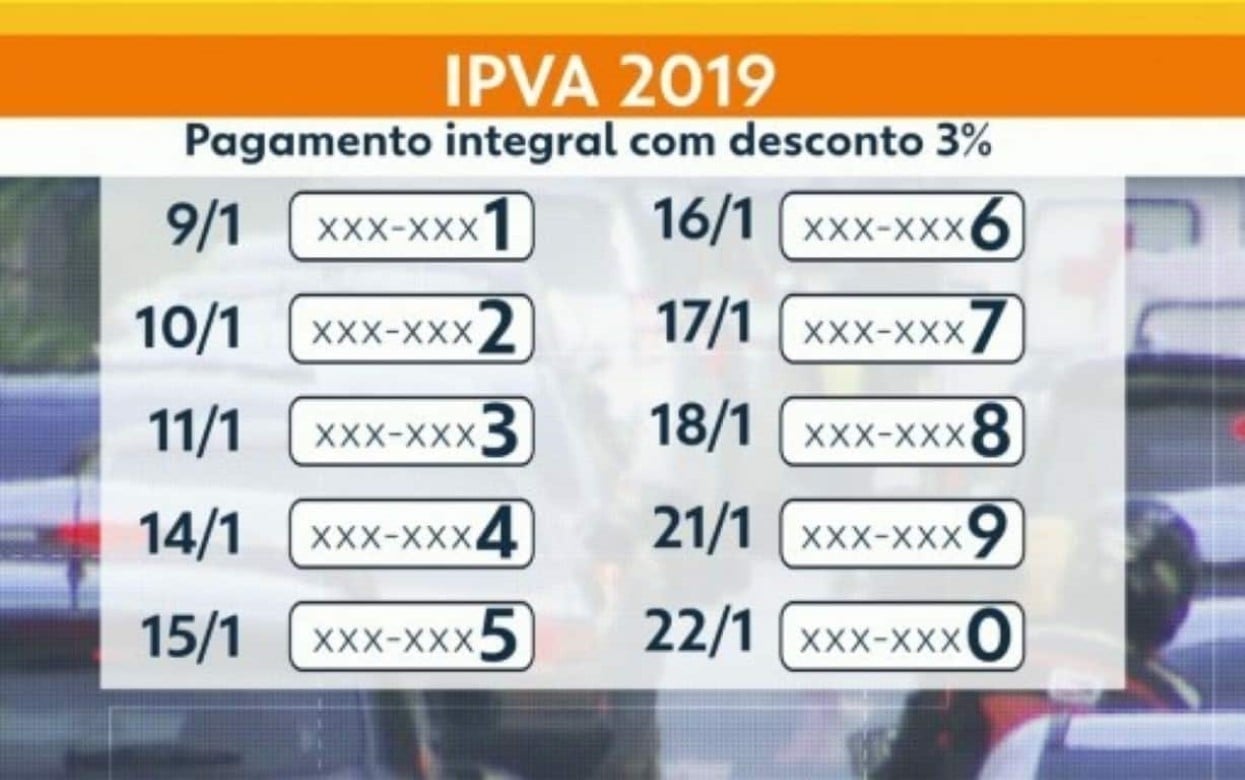

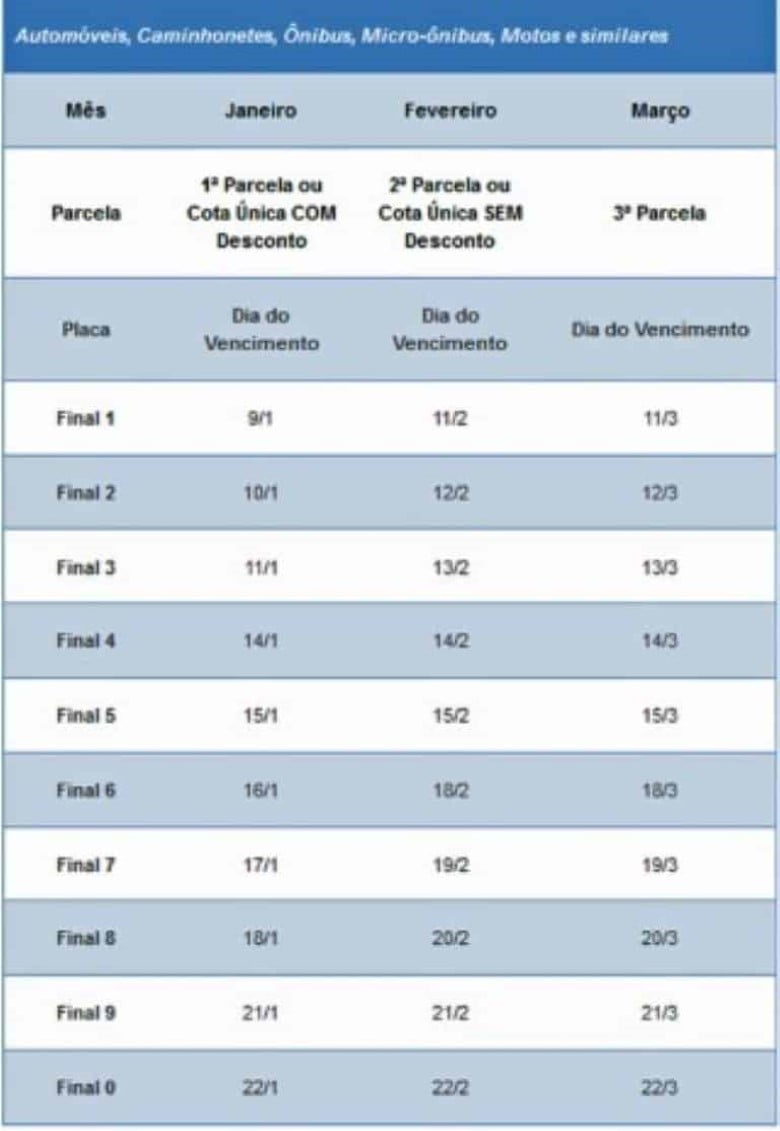

The IPVA in São Paulo will average 3.34% less in 2019, according to the Treasury Department. Taxpayers can pay the IPVA 2019 as a single quota in January, with a 3% discount, or pay the tax three times (during the months of January, February and March), depending on the end of the plate registration of the vehicle. It is also possible to pay the tax in February, without reduction.

Whoever ceases to collect it is liable to a fine of 0.33% per day of delay and default interest based on the Selic rate.

First of all, you first have to locate the IPVA in São Paulo – Photo: TV Globo / Reproduction

How to calculate

First of all, you have to locate the model and year of your vehicle in the table to find the market value. Then, to calculate the value of the tax, it is necessary to apply the rate on the market value, as in the example below:

- Value of the vehicle: (example: 20 050 R $)

- Rate tax: 4%

- Calculation: 20,050 x 0,04 (R $ 802 is the amount charged to IPVA)

Tax rates remain unchanged until the end of the year. in 2018. Gasoline vehicles and biofuels will collect 4% of the market value. Vehicles that use exclusively alcohol, electricity or gas, although combined, have a rate of 3%. Double cab pickups pay 4%. Utilities (single cabin), buses, minibuses, motorcycles, scooters, ATVs and the like receive 2% of the market value.

The reduction in the average value is due to the devaluation of vehicles, many consumers remaining with old vehicles because of the impossibility of changing to a new car.

Payment

Owners must adhere to the expiration schedule before the end of the stay (see below). In order to be able to pay IPVA 2019, it is sufficient for the taxpayer to present himself at an authorized bank branch, with the national motor vehicle registry number (Renavam), and make the payment at the counter, at the self-service terminals, by Internet or by programmed rate. or other channels offered by the bank.

See the IPVA payment calendar – Photo: Reproduction

Source link