[ad_1]

Rio – The Ministry of Finance released Friday resolution 363/18 presenting the table of vehicle values used to calculate the value of IPVA 2019. Based on Fipe's calculated market prices (Foundation Institute for Economic Research), the tax will, on average, be 3.23% less expensive than in 2018.

In the case of automobiles, the average reduction will be 3.13%. Already on motorcycles, the tribute will fall by 3.19% on average. The change in the market measured by Fipe from September to October 2017 and from September to October 2018 was taken into account.

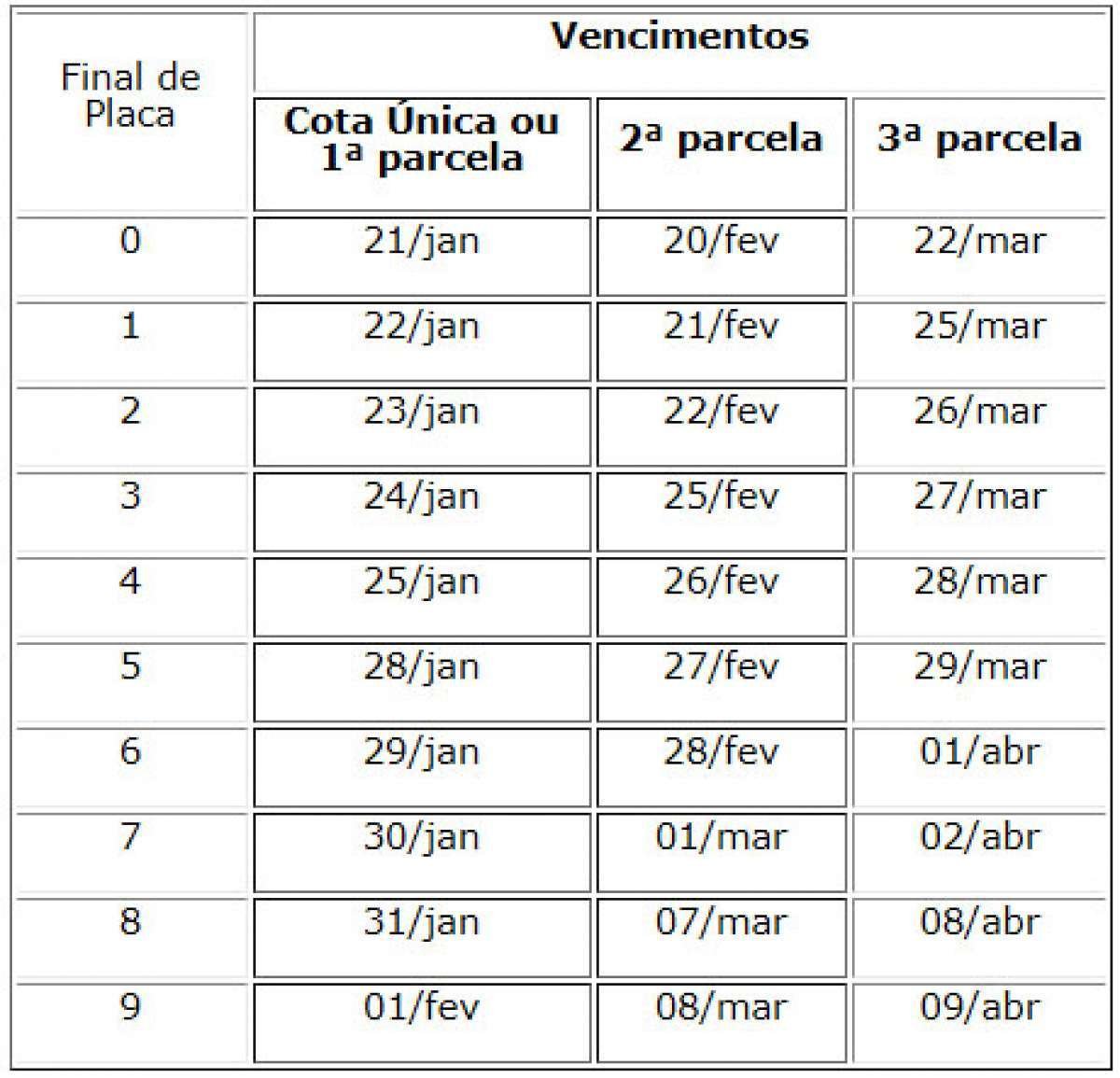

The IPVA is calculated by applying the rates (4% for flexible cars, 2% for motorcycles and 1.5% for cars running on NGV) to the values of the vehicle of the vehicle. The tax may be paid in a single quota, with a 3% discount, or the total amount can be divided into three times, by means of bank statements that can be issued on the Banco Bradesco websites (www.bradesco.com. br) or Secretary of State for Finance (www.fazenda.rj.gov.br).

The first expiry date of the table, for vehicles with the end of plate number 0, will be January 21. both for the payment of the first installment and for the complete discharge of the tax. For vehicles with the end of plate 9, the initial maturity will be 1 February.

[ad_2]

Source link