[ad_1]

Do you want to know if you are entitled to PIS and PASEP? Where is the calculation?

In this article, we will explain how the

calculation, the amount of the salary premium and the table of values according to the

months worked!

So stay tuned to this information!

The best advice

receive the PIS ? HERE

This is a benefit of up to 1

minimum wage paid to eligible workers. More,

to qualify for the pay premium, it is necessary for the worker to fit into

certain requirements.

Requirements

receive the PIS

To be entitled to the benefit, the

The requirements are as follows:

- It is necessary that the

the worker has been registered with PIS for at least 5 years. Registration in PIS is

done on the first job with registration and is done by your employer.

- It is necessary that the

person worked for at least 30 days during the base year, these being

consecutive or not.

- The worker must

have had an average salary in the base year of up to 2 salaries

minimum. If you consider the minimum wage of R $ 954.00, the worker must

receive a maximum of R $ 1908.00 per month.

- The employee must

be declared and with the data properly informed in RAIS – Annual report

social information. It is the responsibility of the employer to inform the employee.

in RAIS every year.

What is the value of

Salary premium?

According to the new rules of PIS,

according to the law 13.134 / 15, the amount currently paid is a maximum of 1 salary

minimum, if the worker worked throughout the base year. S & # 39; he

worked only a few months, the value is lower and proportional.

How much will I receive

of PIS? How is the calculation done?

The calculation of the PIS value for those who have

based on the time worked in the base year, being a

proportional to the time worked.

The rule for this

The calculation consists of multiplying the number of months worked by 1/12 of the

minimum wage.

So, if you consider the minimum wage

Of R $ 954.00:

The persons who

only 1 month (30 days) will receive R $ 79.50 (or R $ 80.00).

$ 159.00 and so on will be worked for 2 months.

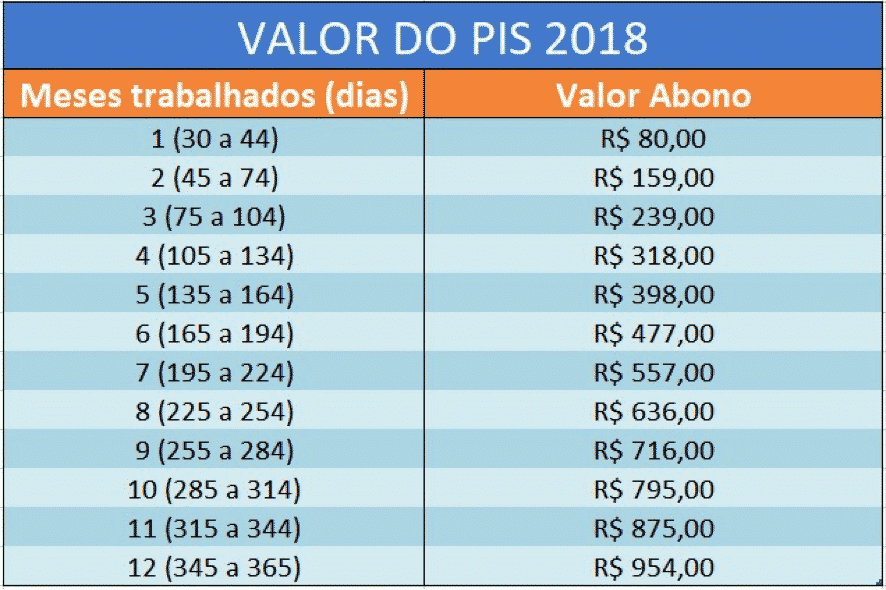

The painting remains

like this:

(example with a minimum wage of R $ 954.00)

You have to remember

as shown in the table, from the first 30 days

and each closed month, if the person worked 15 days or more, it is counted as months

complete.

Thus, a person

having worked 4 months and 20 days (about 150 days), we consider 5 months of work

job. And she will receive $ 398.00

Comment on Facebook

Comment on Facebook

Facebook Comments Plugin Powered byVivacity Infotech Pvt. Ltd.

[ad_2]

Source link