[ad_1]

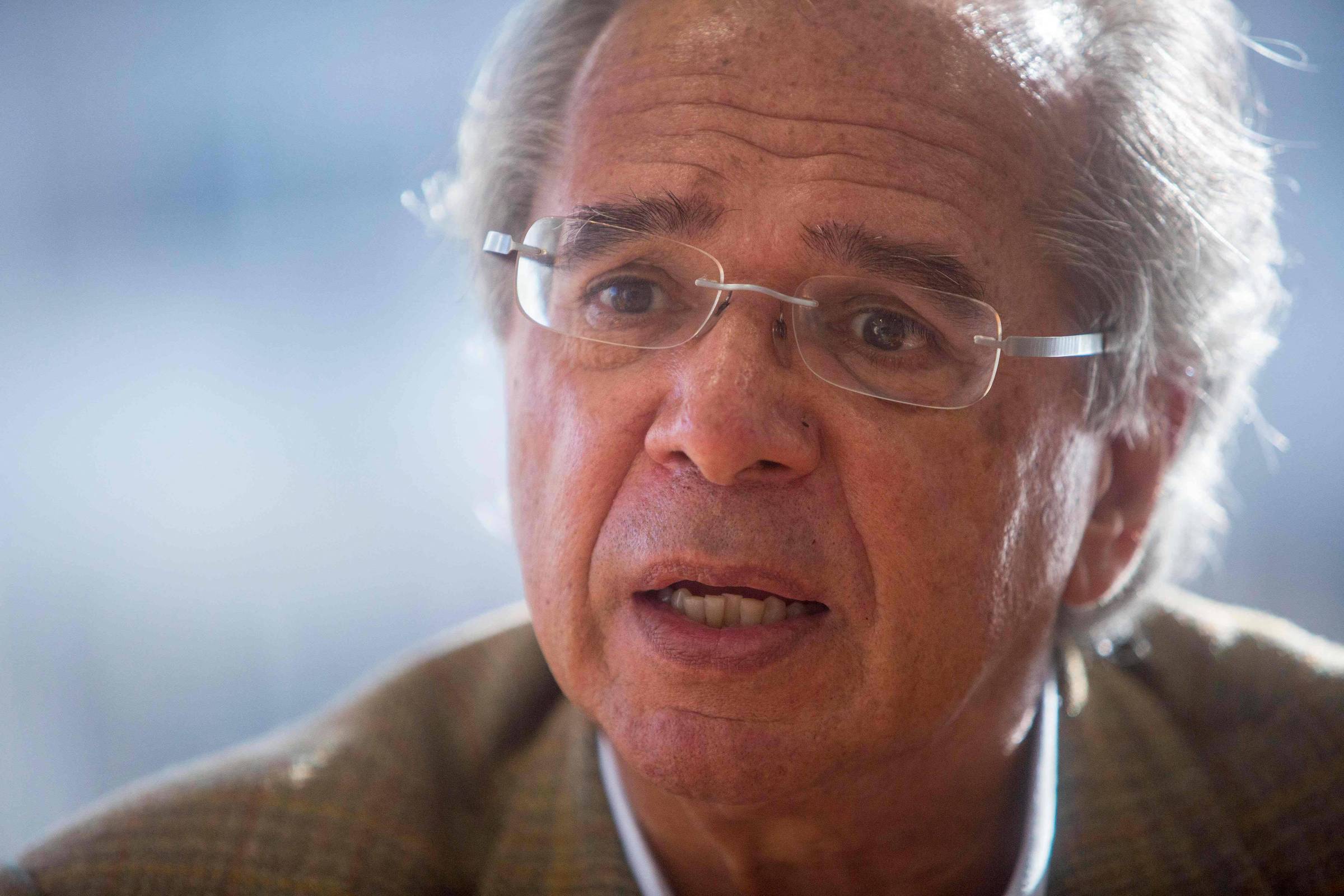

Pension fund documents, badyzed by the MPF in Brasilia, show that the Minister of the Economy, Paulo Guedes, played the role of guarantor of the companies suspected of fraud, constituted by one of his companies with state funded pension funds.

According to reports from Funcef, Caixa's employee retirement foundation, Guedes' experience would compensate for the lack of security and investment guarantees.

The minister is described as a key person. in the control of the allocation of resources. According to the documents, it would be up to him "to participate actively in the investment and divestment strategies".

Guedes is the subject of three investigations, in the Federal Police and the District Attorney's Office, to detect fraudulent or reckless management. seize and enforce, starting in 2009, $ 1 billion of seven pension funds.

In addition to Funcef. (19659002) The money was invested in the investment funds for corporate governance (FIP) created by BR Educacional and Brasil of Corporate Governance, and used in projects

as indicated in Folha in October, it is suspected that transactions with them resulted in excessive earnings for Guedes, to the detriment of the entities that were injecting money, responsible for the additional retirement of thousands of 39, employees of the state

In order to manage resources, Guedes created the BR Educational Asset Manager

According to surveys, despite the high number of people captured, the company does not have any money. had no professional experience and had recently obtained the operating license of the CVM (Comissão de Valores Mobiliários).

The first company to receive investments, BR Educação

It was created in April 2009 by a firm of lawyers specializing in the sale of CNPJ

Two employees of the bank, responsible for several other , were members of the bank,

As a result of ongoing investigations, the company received $ 62.5 million from FIP BR Educacional. He had no net worth, billing history or other guarantee.

Executive Education BR has been renamed HSM. Guedes acted at both ends of the business. He was chairman of the board of directors of the company, which received funds from pension funds.

For investigators, this dual role may constitute a conflict of interest.

Guedes was summoned to testify twice before the Office of the Prosecutor, but the activists were released by the investigators at the first opportunity and by the minister on Monday. He pleaded health problems.

In a petition sent to the Greenfield Task Force, the group of prosecutors responsible for the case, Guedes' defense stated that he "had no involvement in the daily operation of investment,

The investment plan of $ 62.5 million R, started in 2009 and completed in 2015, resulted in a loss of $ 22 million for pension funds (amounts adjusted by the Selic, the base interest rate According to the working group

the amount originally paid was used to buy the company HSM do Brasil, focused on courses and conferences for the managers. made to a Delaware group, tax haven located in the United States.

Of the total invested, $ 50.2 million was paid as a share purchase gap for the company. 39, purchase of a brand.In 2011, two years after disbursement, a company document stated that the same badet, the brand, was worth about 10% of what had been paid (R $ 5.1 million).

For the technicians who help the force. – Devaluation is a fundamental element.

From 2012 to 2013, some of HSM's shares were sold and partly exchanged for a stake in Gaec Educação. According to documents, the company had a high risk of debt and insolvency.

The researchers say that the fund managed by Guedes paid a much higher value than other shareholders for Gaec shares. They were sold from 2013 to 2015, resulting in an estimated loss of R $ 22 million.

The prosecutor is also investigating the FIP's corporate government, which had applied in 2010 R $ 112.5 million to an infrastructure group, Enesa.

In early 2018, an award revealed that Enesa had lost market value and that the FIP Guedes had sold for $ 100,000 symbolic shares he had acquired. for R $ 112.5 million.

Paulo Guedes' defense reaffirmed "the legality and correction of all public and private sector investments".

funds that, by the way, have been profitable for shareholders, including pension funds. "

In a statement, the lawyers of the minister, Ticiano Figueiredo and Pedro Ivo Velloso, indicated that the federal prosecutor's office documentation and petition proving the diligence, the regularity and the profitability of the investments". "

Gaec stated that" only from March 23, 2013 "he took control of HSM," a Brazilian institution of business education that promotes HSM. "Expo, the largest business education event in Latin America". Wanted, the Enesa has not pronounced.

Source link