[ad_1]

Disclosure

The remittance complies with the provisions of the Brazilian Code of Corporate Tax (IPCC) and can be reduced up to 10% of the value of the tax. 10% for vehicles with any plate termination, provided payment is made in full until February 28, 2019 and there is no tax debit for previous years .

The Executive Director of Economic Studies and Research of the National Association of Directors of Finance, Administration and Accounting (Anefac) is one, Miguel José Ribeiro de Oliveira, explains that the cash payment rebates correspond in reality to the withdrawal of the interest rates incorporated in the payment of the tax, in most cases

"For those who have the money to pay in cash, penalty because the discount is greater than the income savings or an investment fund.The ones who do not have the money are better paid than to borrow from banks applying higher interest rates, "he said.

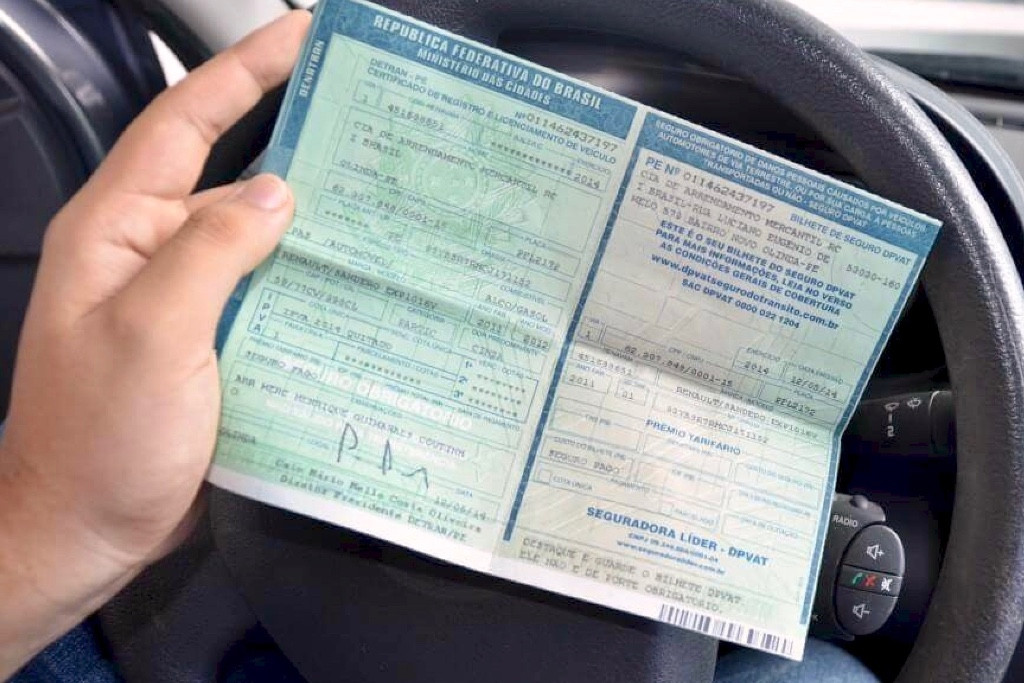

In addition to IPVA, taxpayers should be aware of payment deadlines for licenses and compulsory insurance. If one of the three is not paid, the taxpayer can be fined and even seized the car.

[ad_2]

Source link