[ad_1]

Nubank announced today (08) a new financial service for its clients. Starting Monday, customers will be able to borrow money from the institution through the new personal loan service offered by NuConta, Nubank's digital account.

The institution explained that it wanted to "redefine". the way personal credit is marketed. For this, the company will propose interest rates between 2.1% and 5%, which is lower than the national average, which was 6.3% in December 2018 for a credit without a discount sheet.

![] nubnak](https://img1.ibxk.com.br/2019/02/08/nubnak-08155713133088.jpg?w=700)

It should be noted that each client will have his story reviewed and will be able to lend money with it. custom interest rate. The idea is to make sure that good payers get better deals. "We want to start redefining what is lending money to Brazil," said David Vélez, founder and CEO of Nubank.

The institution believes that this personalized way to offer credit is important because, in the market in general, the good payer ends up paying

Customers will also be able to advance the payment of installments

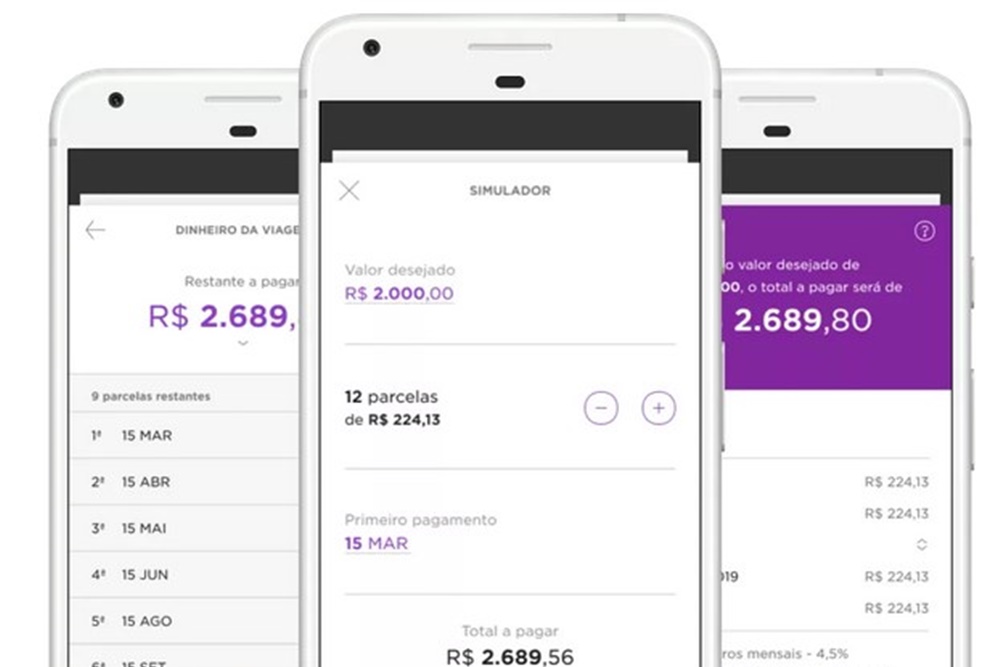

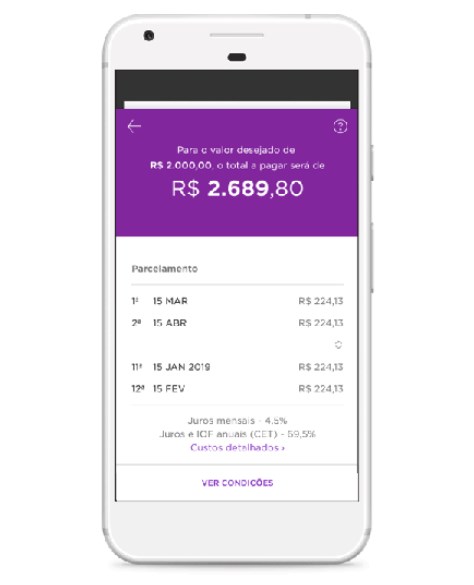

O The process of lending money should also be different. The institution wants to offer more transparency by displaying important information at any time. For this, the value of down payments, the fees and the total amount to be paid will always be displayed at the time of hiring. will also be able to advance payment of down payments, which will be automatically debited from NuConta's balance.

"We have created a product that offers security and autonomy, with the way of being at the Nubank: simple, transparent and fair.We give the customer total control over his loan, without any fees or hidden conditions. .

The entire operation will be performed by the application, as well as a new option that should enter. from the NuConta section

The entire operation will be performed by the application, as well as a new option that should enter. from the NuConta section

During the first months of operation, NuConta's personal loan is to be made available to 600,000 existing Nubank customers. There will be a pre-approved maximum credit for these people, who will be able to define the amount they wish to borrow and the frequency with which they will pay (24x maximum). The minimum amount should start at R $ 30.

Source link