[ad_1]

Table of IPVA values to be calculated in 2019. The Ministry of Finance has published the table with vehicle values, which constitutes a reference in the calculation of the IPVA 2019.

These rates are subject to rates ranging from 1.5% to 4%, depending on the type of vehicle and fuel.

In addition to vehicles older than 15 years of manufacture, the other cases provided for by law are exempt from tax, such as vehicles adapted for disabled persons.

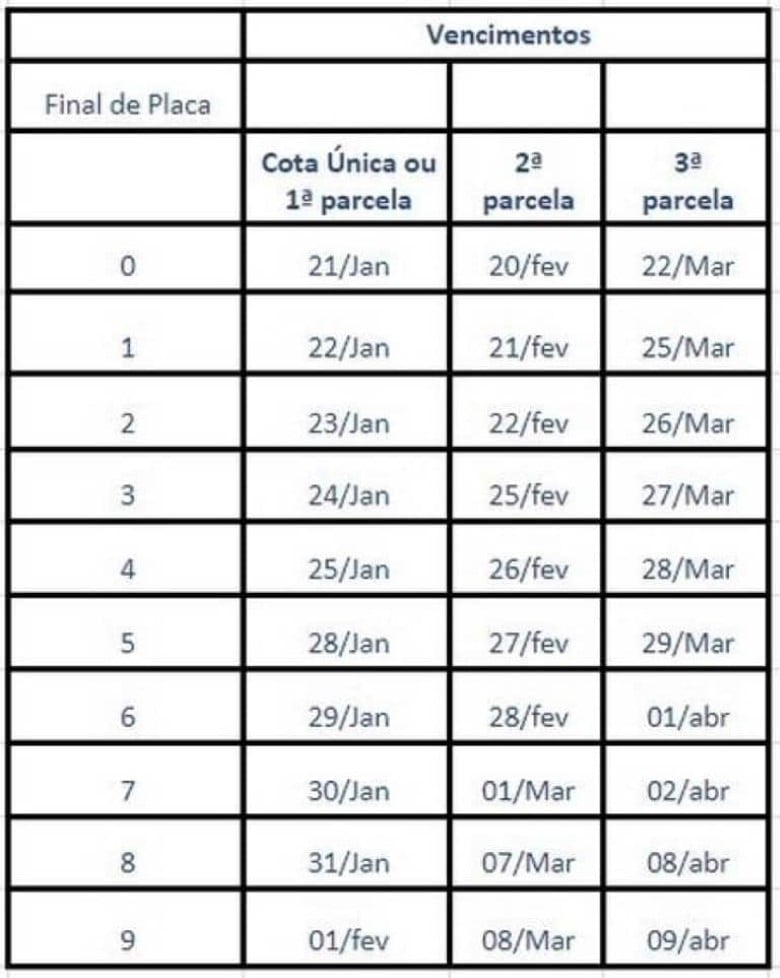

Those who choose to pay the tax in a single quota will benefit from a 3% discount. But there is the option to accept the total amount up to three times. The first installment and the single quota must be paid on January 21st.

The Debt Relief Guide can be published on the websites of the Treasury Secretariat (www.rj.gov.br/web/sefaz) or Bradesco (www.bradesco.com.br).

To calculate the amount of tax, it is necessary to find the value of the vehicle in the table (referring to the exact model and the year of manufacture). Then, multiply this value by the rate due, which is 4% for flexible cars; 2% for motorcycles and 1.5% for cars running on NGV

Source link