[ad_1]

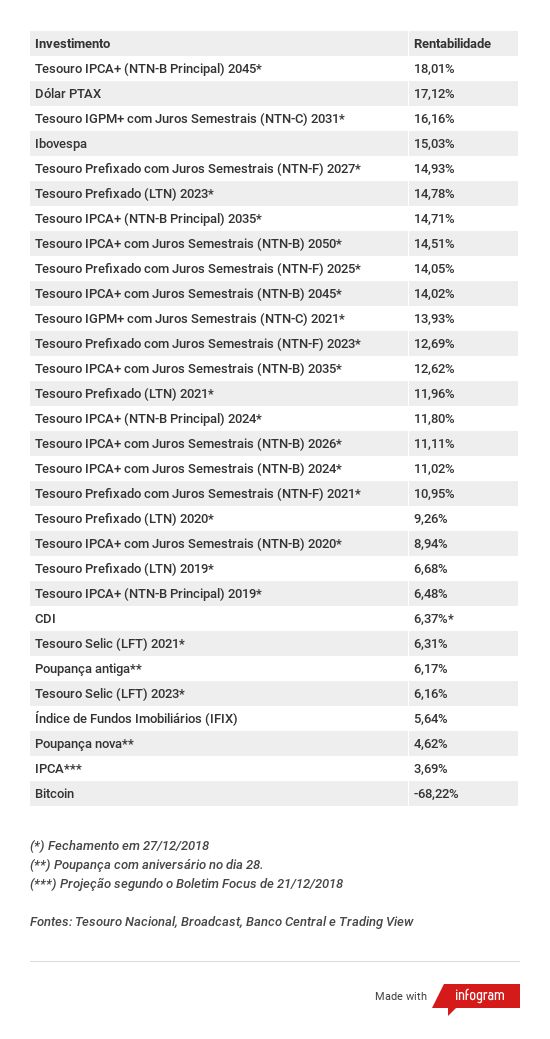

After a year full of emotions, anyone who bet on riskier investments had been successful in 2018. Long-term government bonds – indexed and indexed to inflation – were the highlights of the year. l & # 39; year. dollar, which climbed 17.12%. The best investment of the year was a long-term public index indexed to the IPCA of no less than 18%

. Those who migrated to the stock market also performed well, with Ibovespa's appreciation of 15.03%. It was well below 26% last year, but remains quite relevant after this year's roller coaster. In addition, the Brazilian stock market has stood out in the world, outperforming the stock markets of emerging and developed countries.

On the other hand, those who were too conservative saw their incomes decrease. The Selic and CDI applications had a very modest return. And the savings account was the most traditional lender of investment.

But the one who dived even in 2018 was bitcoin, which had dropped by almost 70%. Crypto suffered a sharp price correction after a strong appreciation last year.

Fortunately, with the low inflation we should have in 2018, none of the major investments have been lost in the IPCA. This, of course, if the investor has not sacrificed his profitability by paying very high rates in his applications.

The Best and Worst Investments of 2018

In this context, the investment funds that have the most conservative fixed income investments, such as the CBD, LCI and LCA, which closely follow the CDI and the Selic, were the least profitable.

There has been so much going on in 2018 that it does not even seem like the World Cup has been held this year. The feeling is that it was two years in one.

We had a truckers' strike and the World Cup itself to weaken GDP, a very strong electoral race to increase country risk and throw the dollar and future interests into it. top, and then a very talented bag with the resignation of the PT of the presidency and the victory of a candidate with a pro-market platform.

With all this, the volatility was violent. The champions of the ranking of public securities have experienced moments of strong devaluation; the dollar, which started the year at R $ 3.30, amounted to a maximum of R $ 4.20, to close much wiser, at R $ 3.87; and the Ibovespa was expected to fall by nearly 9% at the bottom of the year before ending up in the house of 87,000 points.

But if there was optimism here at the end, even without end-of-year gathering, abroad It's raining a knife. US growth is pushing the Fed to raise interest rates, which tends to have a negative impact on risky badets, while Trump criticizes its own central bank.

Add to that fears of a slowdown in global growth, especially in China. largely because of the effects that the trade war between the Asian giant and the United States may have.

Swear words and optimism favored the champions

But despite all the shots, bombs and bombs, our inflation remained controlled and the interest rate could remain silent on the ground during the greatest part of the year, trying to revive our depressed economy.

After a downward cycle over the past year, the Selic parked in March at its lowest level. history, 6.50%, where it will end in 2018.

The low interest rate and optimism that followed the election of Bolsonaro, faced with prospects for reforms and the return economic growth, paved the way for the fall in future interest, ac the decline of the dollar, the appreciation of inflation-indexed fixed rate government bonds and the rise in equities and shares. real estate funds

Do not forget that variable income becomes more attractive when interest rates are low and with prospects and inflation-indexed securities are valued when their wages fall, what happens when there is a reduction in country risk and a decrease in future interest rates

. This appreciation, however, is pocketed only by those who sell the bond before maturity. The person who receives the paper until the end of the term badumes exactly the profitability contracted.

But in the case of the dollar, even with the withdrawal after the elections, the currency closed at a high level. Reflection on the increase in overall risk aversion and the migration of investors to US government bonds in a context of high interest rates in the United States

L & D Foreign engagement vis-à-vis optimism vis-à-vis the Brazilian economy is also lacking. 19659006] The most conservative have suffered

Conservative investments never fail in the portfolio, but those who were too scared this year earned an income. Selic and CDI-related applications were the least profitable of the year, due to low interest rates.

It was again proven that the savings account was a bad investment. The so-called new savings – deposits made from May 4, 2012 – had a low yield of 4.62%. Fortunately, inflation should close the year below 4%.

Would you like our best investment advice in your email for free? Subscribe to our newsletter

Source link