[ad_1]

Payment of the Motor Property Tax (IPVA) of 2019 Begins January 24, 2019. The tax can be paid in three installments or in cash with a discount of 3%. The bulk of the fleet will have a rate of 3.5%, the same percentage being applied in 2018. Buses, minibuses, trucks, pbadenger vehicles, rental cars or NGV gas will pay 1%

D & # 39; here 2019, it is necessary to be aware of the change of payment method. This time, taxpayers will only receive home correspondence with the Fundraising Guide. If you prefer to pay IPVA, you must go to the website of the Department of Finance and print the parcel collection guides.

Payment can also be made only with the Renavam number in the approved bank branches: Banco do Brasil, Bancoob, Bradesco, Itaú, Rendimento, Santander and Sicredi. The Paraná government is expecting to collect 3.4 million rand from IPVA in 2019, 6.25% more than the forecast for this year .

In 2019, Paraná will have 4, 3 million taxed vehicles and 2.6 million additional untaxed. Taxes, Union vehicles, municipal and state, taxis, urban transit buses for the disabled, intended for school transportation and manufactured before 1999.

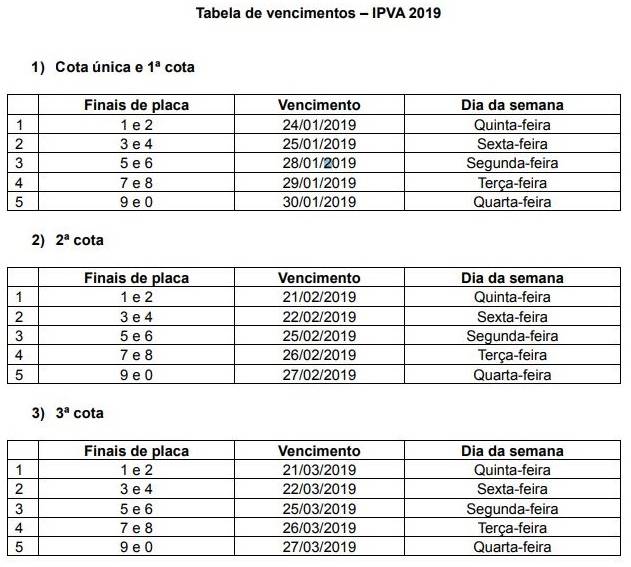

The due date of payment in cash or The first quota will be between 24 and 30 January, depending on the final figures of the plate. The second quota will be due between February 21st and 27th and the third and final quota will be paid between March 21st and 27th, according to the plate.

Owners who do not pay the tax on time will be liable to a fine. 10% and the amounts will increase interest. Taxpayers with IPVA debts are registered in the Cadin information system (Cadin) and do not have the right to transfer ownership of the vehicle. The landlord is also included as a tax debtor, which prevents the obtaining of the negative certificate of tax debts.

Detran agents do not apprehend the vehicles because of the delay of the IPVA, but by the absence of the vehicle registration certificate and license, issued only if the vehicle does not have a charge with IPVA or DPVAT insurance.

Check the expiration of the IPVA 2019 in Paraná

See how to calculate the IPVA 2019 in Paraná

according to Pesquisa's (Fipe), vehicle owners opportunity will pay an average of 3.8% less during the IPVA of 2019. To calculate the value of the IPVA, the owner must apply the rate, which is: 3.5% on the sale value of the vehicle described in the table Fip and

according to the National Automobile Distribution Federation, one of the best-selling vehicles in the first half of this year (Fenabrave) was the Chevrolet Onix. According to the Fipe table, the Onix Hatch Activ 1.4, 8V, Flex, 5-door and automatic model, year 2019, costs R $ 61,248.

Calculation: 61 248 X 0.035 = 2 143 R $,

Calculation: 59.286 X 0.035 = R (19459012) Calculation: 59.286 X 0.035 = R More than 127,000 people will use the Parana Nota

For the 2019 IPVA, 127,664 vehicle owners will use Paraná's Nota credits to reduce or reduce the value of the tax. According to the press service of the Treasury Department, the taxpayers who used the credits must have a saving of 15.5 million R. 519,000

(F, b, e, v, n, t, s), which is the same as that of "

{if (f.fbq) return; n = f.fbq = function () {n.callMethod?

n.callMethod.apply (n, arguments): n.queue.push (arguments)};

if (! f._fbq) f._fbq = n; n.push = n; n.loaded =! 0; n.version = 2.0 & # 39 ;;

n.queue = []; t = b.createElement (e); t.async =! 0;

t.src = v; s = b.getElementsByTagName (e) [0];

s.parentNode.insertBefore (t, s)} (window, document, & quot; script & # 39;

& # 39; https: //connect.facebook.net/en_US/fbevents.js');

fbq (& # 39 ;, & # 39; 609499149204589 & # 39;);

fbq ("track", "Pageview");

[ad_2]

Source link